Over the last couple of days, the crypto market derailed from its recovery track. With Bitcoin stagnated around $30k, most other cryptos were also seen consolidating. However, on Friday, June 30, the market seemed back on track. The aggregate valuation of all assets re-claimed $1.2 trillion, thanks to the 2% pump over registered over the past 24-hours.

ETC pumps double digits: What lies ahead?

Several Altcoins had registered double digit rallies, and Ethereum Classic was one among them. In just a matter of six hours, this Ethereum forked crypto asset rallied from $17.96 to $20.04 today. The same translated to an approximate 12% appreciation. From the said high, a slight retracement has been registered. ETC was seen exchanging hands at $19.71 at press time.

On the weekly timeframe, Ethereum Classic is currently being tested by the 78.6% Fib level. As illustrated below, this level has acted like a strong resistance for the asset so far in Q2. If the bullish momentum further intensifies, then ETC’s rally could renew. If the asset manages to successfully break-above the said level and convert it to support, then a gradual inclination to its next test level 27.7% higher, i.e. $25.17, can be anticipated over the next few weeks in July.

However, if bears slowly start dominating, then a consolidation around current levels can be expected. Thereon, if the sell pressure intensifies, then the asset could drop down to its next support around $15.

Also Read: Bitcoin Cash Rallies 111% in 5 Days: Back From the Dead?

Beware of the ‘spoilsport’

The latest rise has helped change the fate of investors. In the second week of June, Ethereum Classic’s sharpe ratio was at a level as low as -4.69. However now, it is already back to the positive territory. At press time, it flashed a value of 1.42, indicating that investors are slowly being compensated adequately for the risk borne by them by holding the asset.

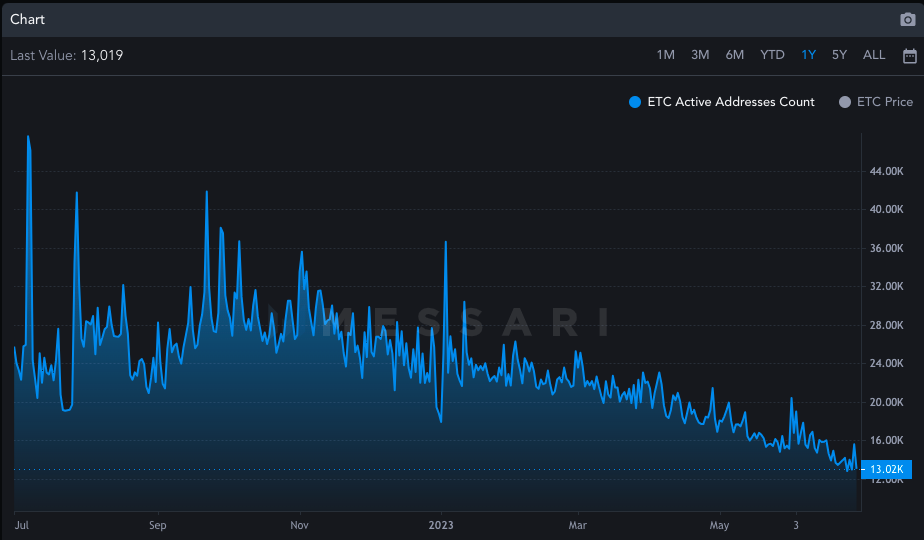

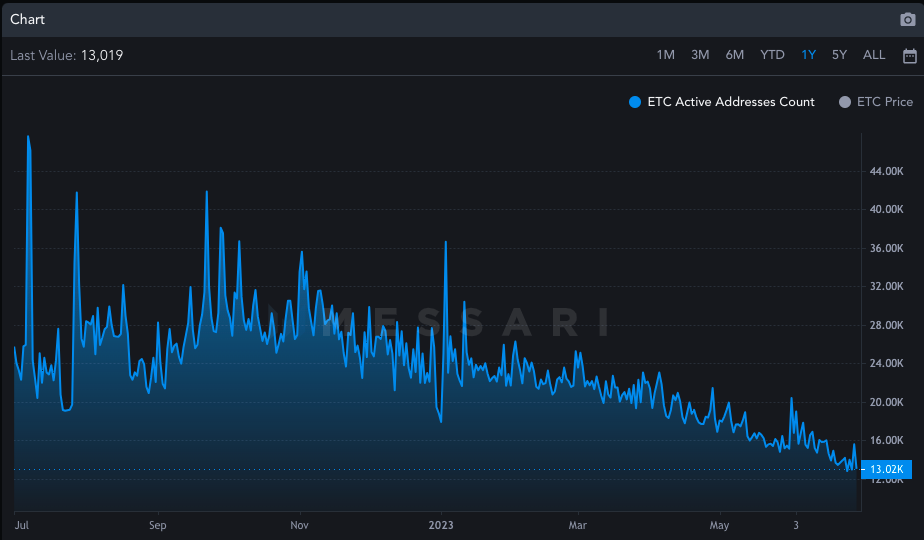

However, there might be a fundamental cause of concern. Ethereum Classic active addresses continue to be on a downtrend. In the beginning of this year, this metric peaked at 36.6k. Currently, only 1/3rd of the said participants are active. Conventionally, the higher the number, the better, for it hints towards refining participation by traders/investors. Effectively, the ongoing trend ain’t encouraging, and could hinder the ETC’s potential rally going forward.

Also Read: $7.4 Million Asset Managing Stellar Lumens Fund Shares Pump 430%