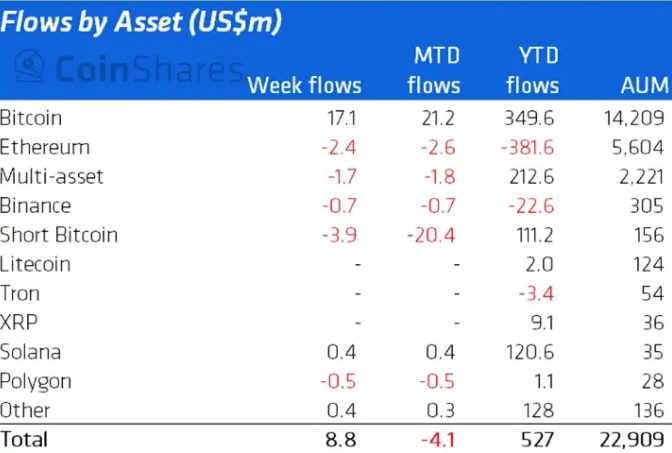

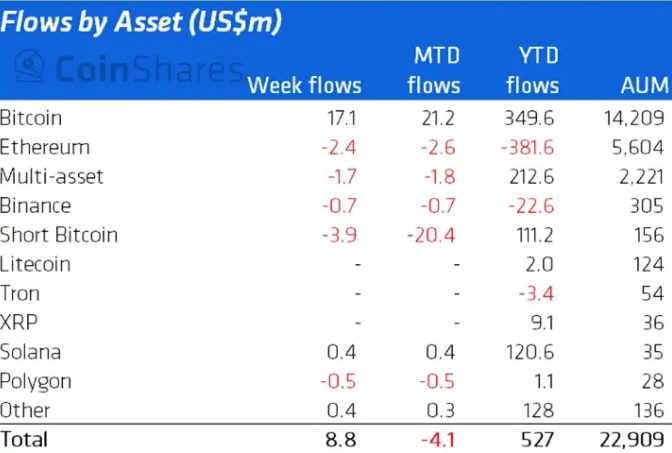

Crypto and digital asset investment products saw minor inflows summing up to $8.8 million last week. Trading volumes, however, reached a new 2-year low of $677 million for the week.

The market’s largest crypto, Bitcoin, saw inflows totaling $17 million. CoinShares’ latest weekly report outlined that sentiment has been “steadily improving” since mid-November, with inflows since then reaching $108 million in aggregate.

Also Read: Will Bitcoin, Ethereum Turn a Bullish Page in 2023?

That has, however, not been the case with Ethereum and other Altcoins. Chalking out the diverging sentiment when compared to Bitcoin, CoinShares noted,

“Ethereum saw a 4th consecutive week of minor outflows totaling US$2.4m, and since mid-November has seen outflows totaling US$22m, highlighting continued diverging sentiment relative to Bitcoin.”

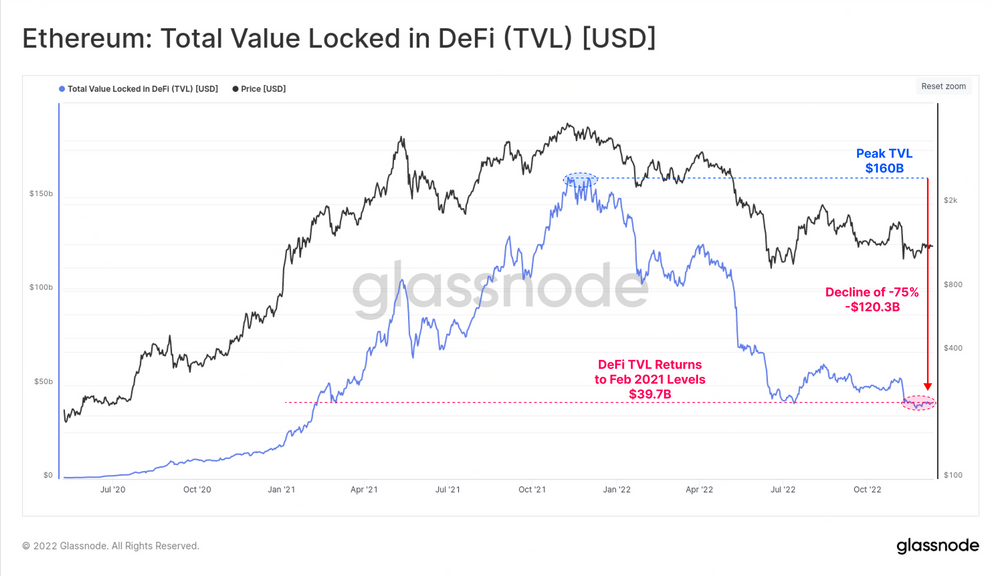

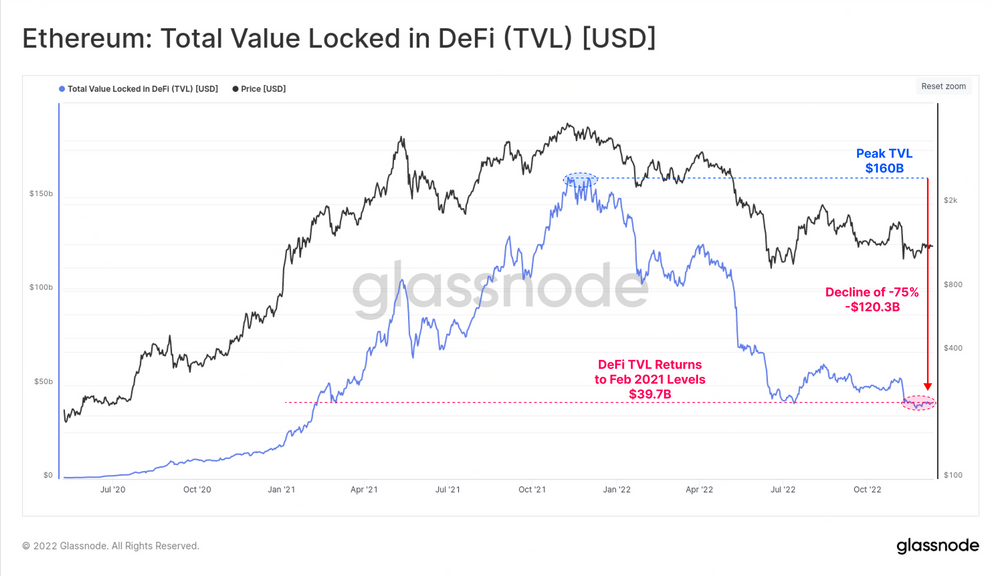

Alongside the macro price dip and the weak institutional sentiment, a severe contraction of liquidity, has also been noted by Ethereum. As illustrated below, the total value locked in DeFi has fallen dramatically.

Post attaining a peak of $160B at the market ATH in Nov 2021, Ethereum DeFi Total Value Locked [TVL] has dropped by over $120.3B [-75%]. This same brought DeFi collateral values down to $39.7B, re-visiting February 2021 levels.

Also Read: Here’s how Ethereum has fared since September Merge

State Of Altcoins Like SOL, MATIC, BNB

Like Ethereum, similar disinterest or “little activity” by institutions was noted in regard to Altcoins as well. Binance’s native BNB token noted outflows, and so did Polygon [MATIC]. The former’s figure stood at -$0.7 million, while the latter’s reflected a value of -$0.5.

Solana, on the other hand, was the only Alt that managed to register positive flows up to $0.4 million last week, making it institutions’ favorite bear market pet.

Also Read: Ethereum: Total Value in ETH 2.0 Claims New ATH of 15.6M Tokens