Expedia stock surged 7% after rumors of a potential Uber acquisition. This jump has sparked interest in travel stocks. The online travel agency’s shares rose in after-hours trading following a Financial Times report about Uber’s interest.

Also Read: This Cryptocurrency Could Experience a ‘Monster Breakout’: Analyst

Expedia’s Surge and Uber’s Interest: Investment Opportunity?

Uber’s Potential Bid

Uber has reportedly approached advisers about buying Expedia. These talks are still in early stages. When asked about the rumor, an Expedia spokesperson said:

“We are not commenting on rumors or speculation.”

Uber has not responded to requests for comment.

Expedia’s Turnaround Efforts

Expedia is working to improve under new CEO Ariane Gorin. The company aims to boost market share for its brands. These include Expedia, Hotels.com, and VRBO. Analyst Naveen Jayasundaram notes:

“Expedia is a business in the midst of a turnaround. There are early signs of progress.”

Also Read: Netflix Stock Price Revisited: Analysts Weigh In Before Earnings

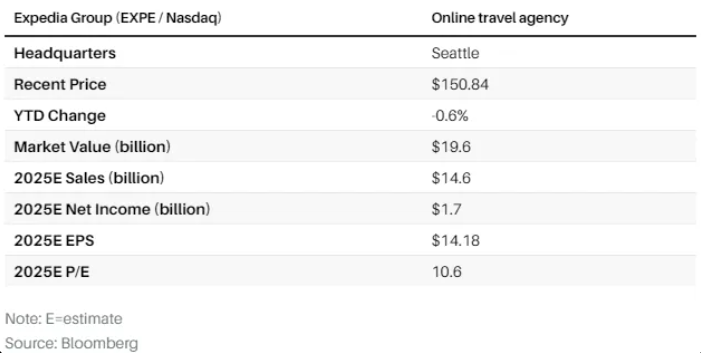

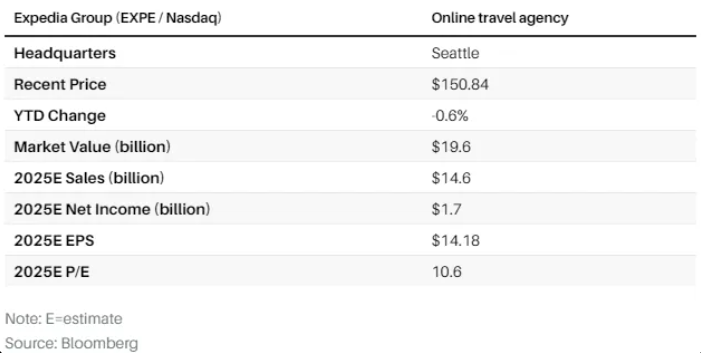

Valuation Comparison

Expedia’s stock is much cheaper than its rival, Booking Holdings. It trades at just 11 times forward earnings. This is half of Booking’s 22 times. Jay Aston Jr., a portfolio manager, argues:

“A more unified platform will allow Expedia to generate significantly more meaningful cash flow, and there’s a lot more operating leverage to come. If you look at free cash flow, it’s wildly undervalued.”

Growth Prospects

Experts predict strong growth for Expedia. They expect earnings per share to rise 21.5% this year and another 20% in 2025. Randy Hare of Huntington National Bank states:

“Expedia is probably interesting here, relative to Booking, since the valuation is more attractive—we like that. Their estimates seem doable…we could see decent growth and upward movement.”

The travel industry remains strong. Air traffic has returned to pre-pandemic levels. Cruise bookings are up. This trend could benefit Expedia’s business. The company’s recent changes, including its One Key loyalty program, show promise.

Also Read: Ethereum’s Buterin Explains ‘The Surge’: Will ETH Reach 100K TPS?

Expedia will report its third-quarter results on November 7. This report will show if the company’s new strategies are working. For investors looking at travel stocks, Expedia’s current position and potential Uber deal make it an intriguing option.