Despite its status as a forerunner in distributed ledger technology, Bitcoin (BTC) has struggled to meet the demands of payment networks. Scalability has always plagued Bitcoin’s potential for a wider audience. The Bitcoin network can handle only 7 transactions per second (TPS), compared to Visa’s 65,000. The numbers clearly indicate the significant barrier to BTC’s adoption. To even get close to Visa’s TPS, Bitcoin would have to handle eight terabytes of transactions per block, which is far beyond the existing blockchain’s capabilities.

This is where the Lightning Network comes into play. Originally proposed in 2015, the Lightning Network may be BTC’s shot at mass adoption.

Before getting into how the Lightning Network can push BTC’s use, let’s first take a look at what the Lightning Network really is.

What is Bitcoin’s Lightning Network?

The Lightning Network is a secondary layer that is added to the Bitcoin (BTC) blockchain that facilitates off-chain transactions, or transactions that do not happen on the blockchain network. The second layer is made up of many payment channels between parties or Bitcoin users. It allows for rapid and low-cost BTC transfers.

A Lightning Network channel is a two-party transaction method that allows parties to send and receive Bitcoin (BTC). By managing transactions outside of the blockchain mainnet (layer one), layer two improves the scalability of blockchain applications while still benefiting from the mainnet’s powerful decentralized security model.

The Lightning Network was first suggested by Thaddeus Dryja and Joseph Poon in 2015. Their paper was based on earlier suggestions by Bitcoin’s mysterious creator, Satoshi Nakamoto. Nakamoto had described these channels to Mike Hearn, a fellow developer. Hearn published the conversations in 2013.

The Lightning Network testnet launched in May 2016, with alpha being the first step of execution. In December 2017, the Lightning Network saw its first transaction.

Lightning Lab released the Beta version in 2018 and integrated it into the Bitcoin mainnet. A pseudonymous personality known as Hodlonaut paid 0.001 BTC to a Lightning Network wallet later in 2019.

The lack of scalability is a major impediment to the broad adoption of cryptocurrencies. A blockchain network, when appropriately scaled, can process millions to billions of transactions per second (TPS). The Lightning Network, in this context, charges low costs by transacting and settling off-chain, enabling novel use cases such as quick micropayments, for example purchasing a cup of coffee.

How does the Lighting Network function?

To use the Lightning Network, the payer must deposit a particular quantity of Bitcoin into the network to establish a payment channel. The recipient can then invoice any amount of the Bitcoin once it has been locked in. If a consumer wants to keep the channel active, they can add Bitcoin on a regular basis.

A smart contract is formed between two parties using the Lightning Network. When a contract is created, the rules are coded into it and cannot be changed. The automatic fulfillment of contracts is also ensured by a smart contract code. When such conditions are met, such as when a consumer pays the correct amount for coffee, the contract is immediately fulfilled without the intervention of a third party. Once a payment channel has been validated, the Lightning Network anonymizes transactions.

When the two parties have completed their transactions, they can close the channel. The information from the channel is then combined into a single transaction and delivered to the Bitcoin mainnet for recordkeeping.

Will Lightning push BTC worldwide?

The Lightning Network is quickly gaining popularity. According to DappRadar, the Lightning Network has over $110 million in Bitcoin locked in.

According to Arcane Research, Lightning has reached a degree of development, liquidity, and critical mass that has pushed it over the line into being a fully functional network during the past year.

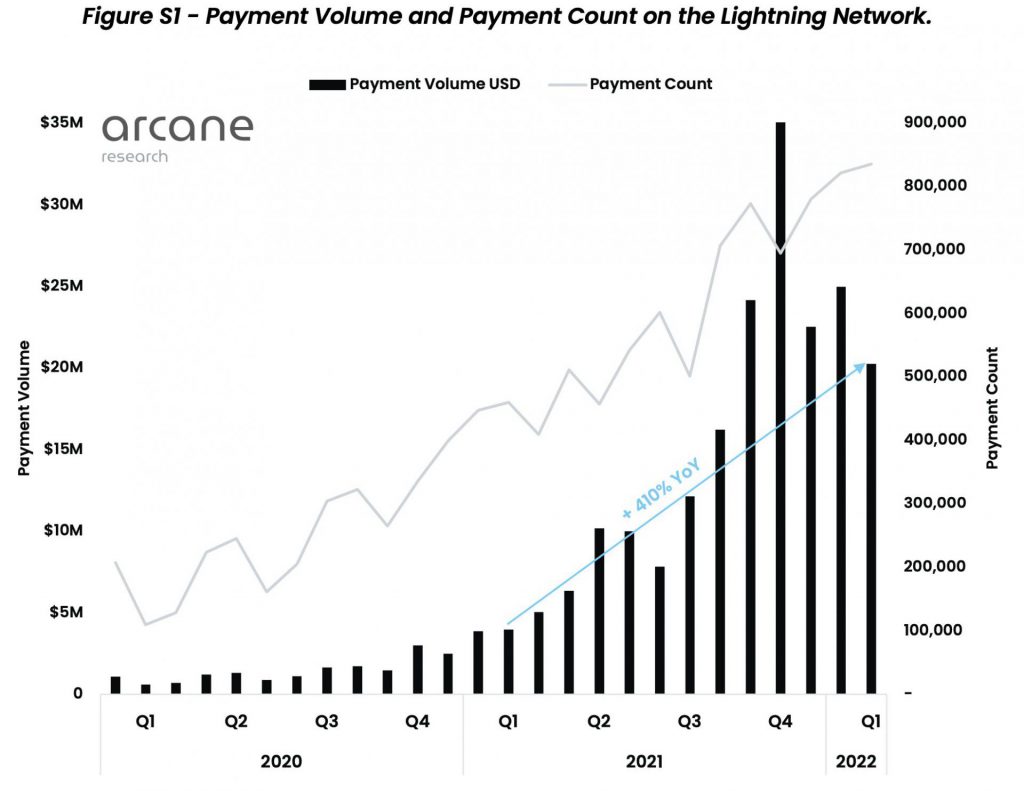

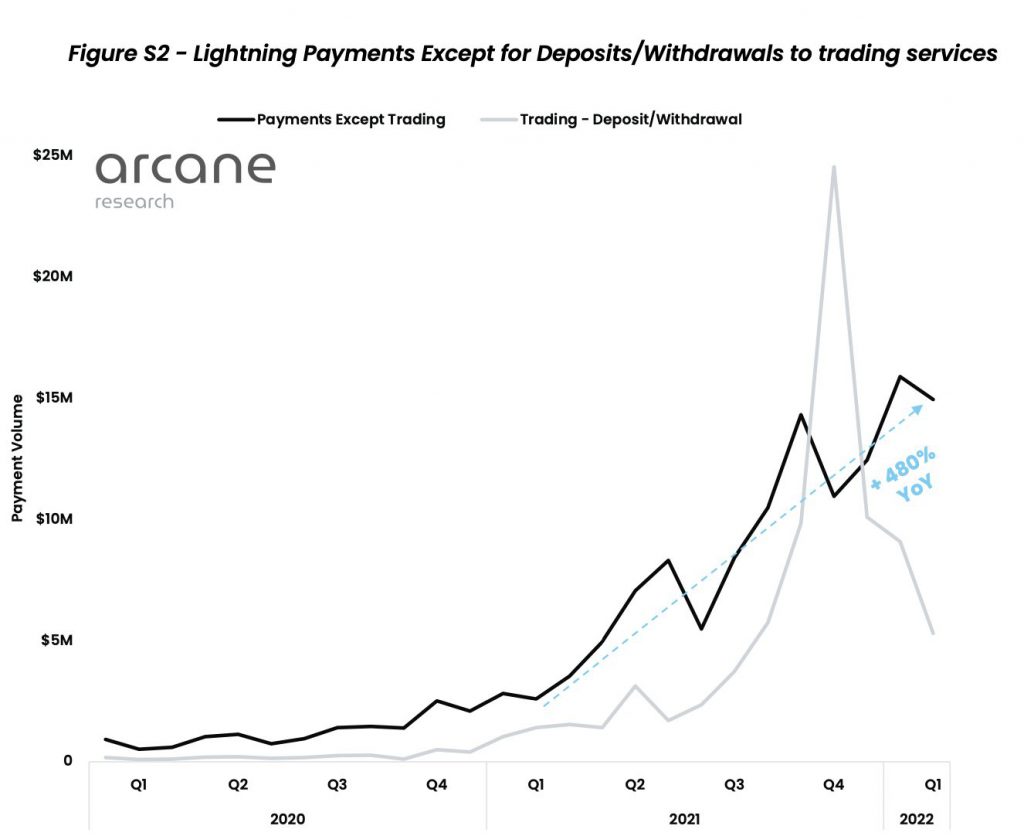

As per the study, the volume of Lightning Network payments peaked in November and has since dwindled. This development, on the other hand, does not accurately reflect the underlying adoption trend. The numbers are muddled in November due to a huge volume of deposits and withdrawals to exchanges with a bullish crypto market. When trading service deposits and withdrawals are excluded from the payment volume, all other payments actually fell in November but have since risen to new highs.

The Lightning Network’s popularity has skyrocketed in the last year, and there’s still lots of space for expansion. According to Arcane Research, just over 100,000 people worldwide had access to Lightning payments last summer. They expect that by spring 2022, more than 80 million consumers will have used Lightning payments through an installed app.

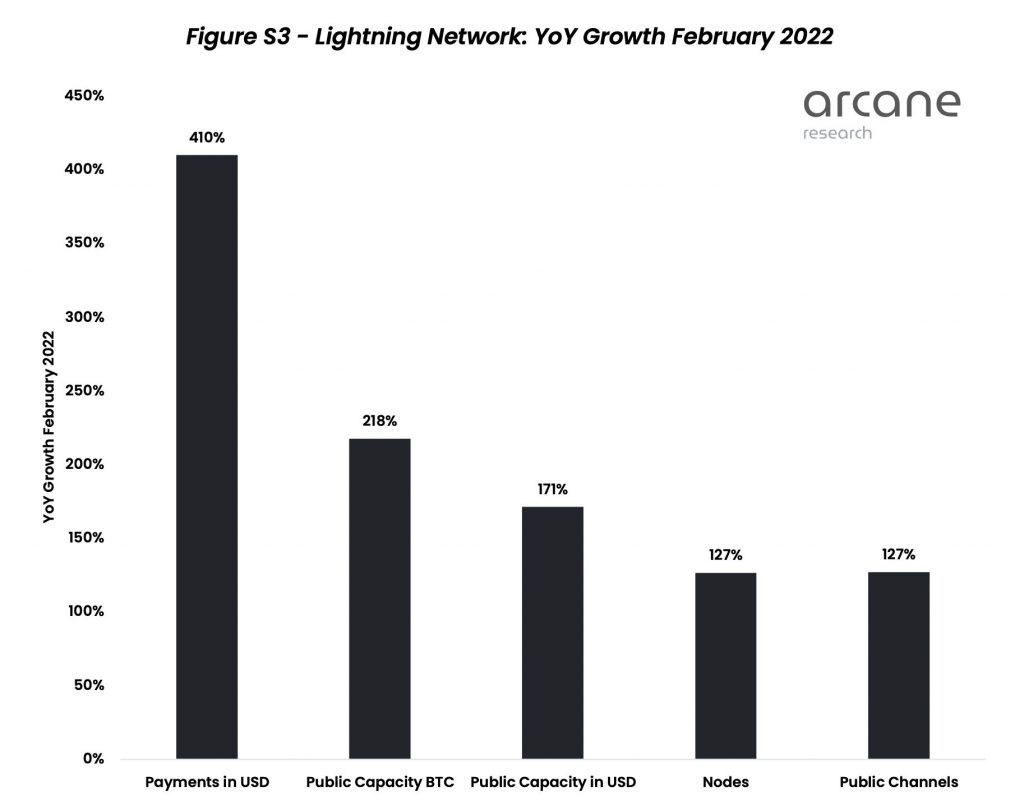

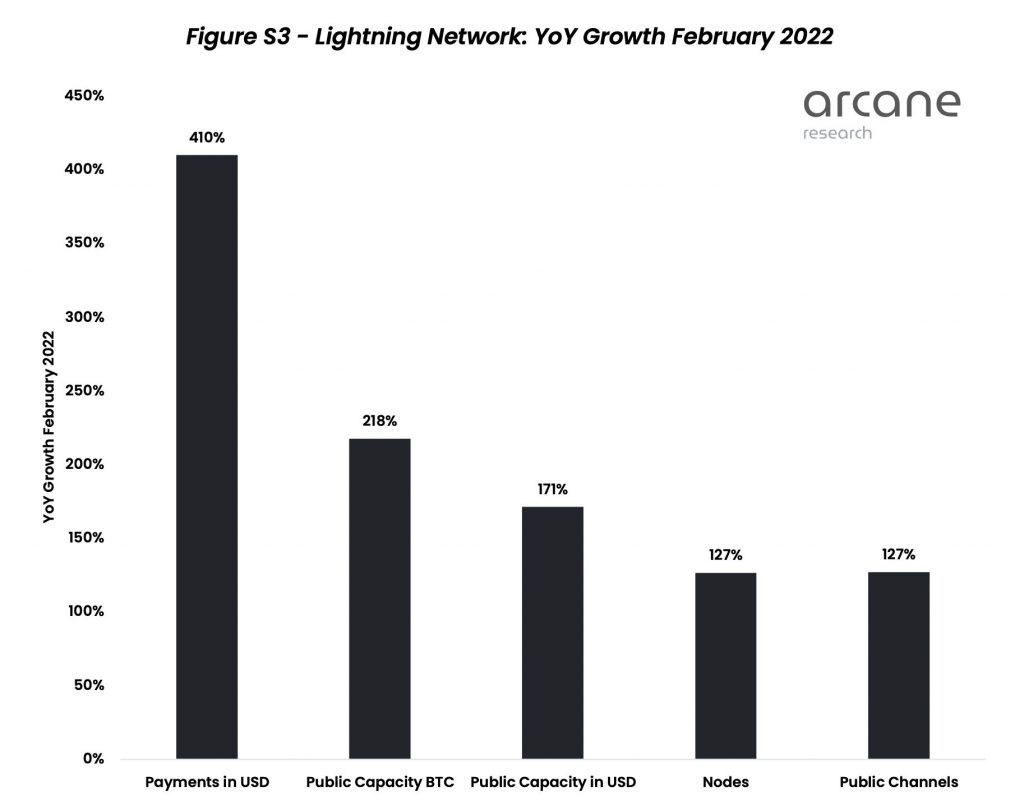

Arcane’s study also shows that usage of Lightning Network has risen more than any other public metric.

The excitement surrounding Bitcoin and the Lightning Network is primarily due to the wonderful improvements it can bring to the world, rather than the interesting technology itself.

In the developing world, the potential for beneficial effects is very significant. Bitcoin and the Lightning Network can help the unbanked gain access to financial services and make remittance payments more efficient.

By facilitating financial inclusion, Bitcoin and the Lightning Network open up new opportunities for these people to improve their life, potentially raising living standards for billions of people over time.