Inflation in the U.S. has started cooling down. The rate fell in December to 6.5% on an annual basis, according to the CPI. For context, inflation stood at 7.1% in November and 9.1% in June 2022.

When the CPI numbers were released in mid-January, Mark Zandi, Chief Economist at Moody’s Analytics opined that people will not be talking about inflation this time next year. With the economy gradually getting back on track, the Federal Reserve is expected to slow its interest rate hike pace.

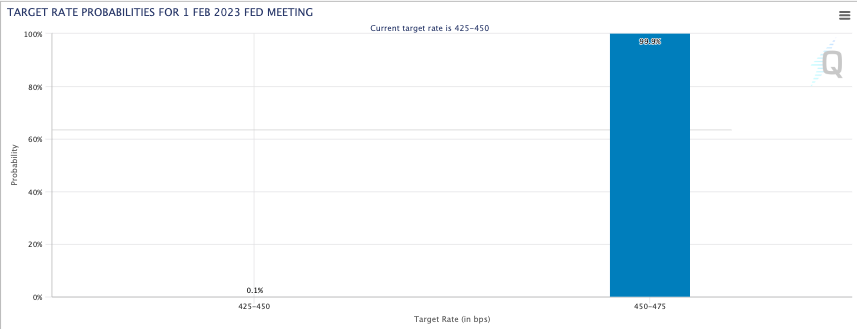

The new rate is all set to be announced at 2 p.m. ET on Wednesday, Feb. 1. According to the CME, there is a 99.9% probability of raising interest rates by 25 basis points [4.5% to 4.75%]. Additionally, interest rate futures show that the Fed’s current rate hike cycle may end in June.

Also Read: US Inflation Rate Falls to 6.5%

In a recent speech, Philadelphia Fed President Patrick Harker emphasized that hikes of 25 basis points “will be appropriate” going forward. He also added,

“I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed.”

What to expect from Bitcoin

At the moment, Bitcoin has established ground around $23k. Apart from the interest rate hike, investors will also be focussing on the comments made by Chair Powell on the robustness of the economy, the job market, the macro recovery, etc. If he hints towards softening measures going forward then a short-term spike can be expected to materialize.

Alongside, if the Fed delivers as expected, then a momentary hype-induced hike could help Bitcoin surpass $25.4k. However, if the hike is perceived to be a hawkish extension by investors, then a drop-down to around $20.7k can be expected.

If the macro outlook remains positive, then an incline toward $32k can be anticipated over the mid-term.