Gold prices are skyrocketing on Thursday after the US dollar cooled down after the Feds FOMC meeting on Wednesday. The XAU/USD Spot gold prices hit $2,208 rising by 22 points with an uptick of 1% in the indices.

Now that gold prices breached the $2,200 mark, how high can the precious metal trade be next? In this article, we will provide a price prediction on the next price target for gold.

Also Read: Currency: What’s Happening With the US Dollar & Japanese Yen?

Gold Prices Forecasted To Reach $2,460 Next

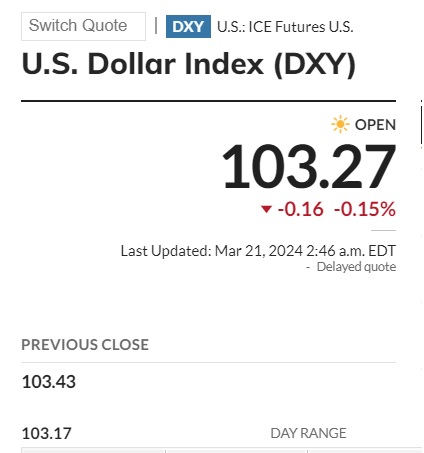

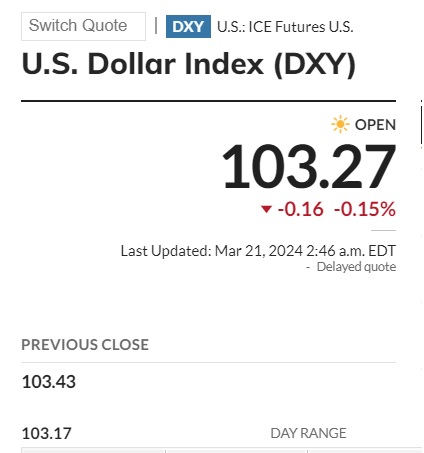

The US dollar dipped from 104.20 to 103.55 on Thursday after the Feds FOMC meeting. The DXY Index which measures the US dollar’s performance shows a deep red as the currency slumped. However, a leading economist has predicted that if gold maintains the same momentum, its next target is $2,250.

Also Read: Dogecoin (DOGE) Price Prediction After Bitcoin Halving

The prices of gold could head north before the next interest rate hike during the Q2 of 2024. The economist forecasts gold prices might hit $2,360 before the event. In addition, the highest gold might trade this year is at $2,460, which could be another new all-time high.

“The upper limit of the rectangle at $2,075 is near-term support. Gold has established itself above the upper part of its multi-year range ($2,075) in the form of a rectangle; this denotes the uptrend has resumed. It has also overcome the peak achieved in December. The break from multi-year consolidation points towards the possibility of a larger upside,” said an economist at the Société Générale to FXstreet.

Also Read: Goldman Sachs Predicts the Future of the Cryptocurrency Market

“The up move is likely to extend towards the next objectives located at projections of $2,250 and $2,360. The target for the rectangle is located at $2,460,” the economist summed it up.

In conclusion, gold could outperform the US dollar, the equities market, and other commodities this year. On the downside, a stop loss for loss is required at the $1,950 level.