Gold futures crash sent shockwaves through financial markets on Friday, and also the precious metals selloff intensified across global exchanges at the time of writing. This market disruption catalyzed various major shifts in silver futures, which plunged alongside gold after President Trump nominated Kevin Warsh to lead the Federal Reserve. Shanghai silver price, which had soared to unprecedented levels just days earlier, collapsed as Chinese speculators unwound their positions rapidly following weeks of what many traders described as an unsustainable rally in gold and other precious metals.

Also Read: Expert: “The Dollar Is Going To Collapse”, It Will Be “Replaced By Gold”

Gold Futures Crash And Precious Metals Selloff Deepens

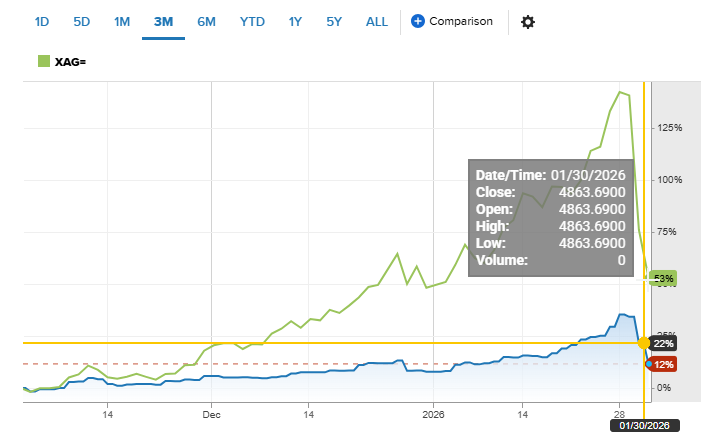

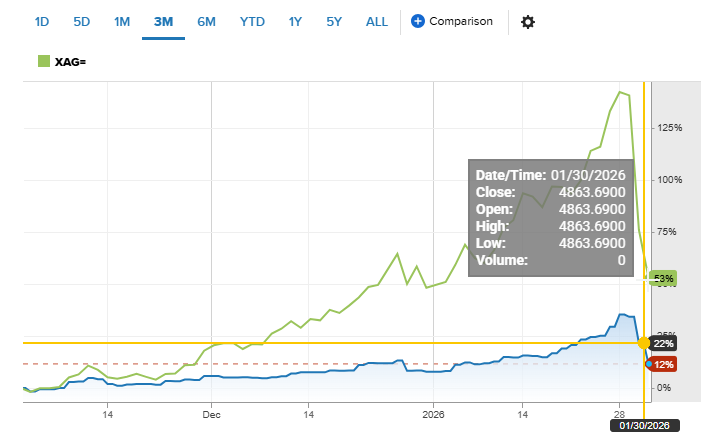

The gold futures crash on Friday witnessed the metal plummet 9% in its worst single-day performance in over a decade, and also silver futures recorded an even steeper 26% decline—a drop that market observers marked as the biggest on record. Through several key trading sessions, the gold futures crash accelerated losses into Monday’s session, with gold falling an additional 6% to $4,538 per ounce right now. The precious metals selloff deepened further as silver tumbled another 12% to $74.36 per ounce, and also the rapid reversal stunned many traders.

Source: CNBC

Chinese speculators drive historic volatility

The wave of buying from Chinese speculators pushed precious metals to fresh records in recent weeks, with gold reaching $5,595 an ounce on Thursday. Across numerous significant market segments, this speculative activity spearheaded unprecedented volatility that Dominik Sperzel, head of trading at Heraeus Precious Metals, described:

“In my career it’s definitely the wildest that I have seen. Gold, it’s a symbol of stability, but such a move is not a symbol of stability.”

Traders across global markets witnessed more than just a simple correction right now—the gold futures crash represented one of the most dramatic reversals commodity trading ever saw. Various major institutional players, including Alexander Campbell, former head of commodities for Bridgewater Associates, identified the primary catalyst:

“China sold and now we’re suffering the consequences.”

Shanghai silver price faces dramatic swings

Shanghai silver price experienced particularly dramatic swings as daily limits on Chinese exchanges forced prices to play catch-up with the global selloff, and also the market structure amplified volatility. Through several key regulatory constraints, a 16%-19% daily limit on price moves for various silver futures contracts on Chinese exchanges engineered additional pressure as the market opened for the new week and tested trading systems. Chinese speculators’ involvement in driving both the rally and the subsequent crash now occupies analysts as a focal point for understanding the magnitude of these moves at the time of writing.

Nicky Shiels, head of metals strategy at MKS PAMP SA, provided historical context for the volatility:

“January 2026 would go down as the most volatile month in precious metals history.”

The nature of the preceding rally intensified the precious metals selloff, as momentum rather than fundamentals drove the gains increasingly right now. Across multiple essential market dynamics, momentum-based strategies leveraged various major positions that Jay Hatfield, chief investment officer at Infrastructure Capital Advisors, explained:

“We had identified about three or four weeks ago that it turned into a momentum trade, not a fundamental trade.”

Market outlook after the gold futures crash

The announcement of Warsh’s nomination ultimately triggered the gold futures crash, a development that markets interpreted as potentially signaling a more hawkish Federal Reserve that would support dollar strength. This policy shift catalyzed numerous significant changes in market sentiment that José Torres, senior economist at Interactive Brokers, analyzed:

“The ‘Buy America’ trade is back as a result, and the independence bid that drove gold and silver to nosebleed record heights right below $5,600 and $122 per ounce early Thursday morning is unraveling.”

Also Read: Tether CEO Talks Post-Dollar World: De-Dollarization To Surge?

Despite the violent nature of the gold futures crash and the broader precious metals selloff, both metals stand significantly higher for the year right now. Silver futures still show gains of around 16% since the start of January, while gold climbed about 8% year-to-date. Through several key market indicators, traders now assess whether Shanghai silver price will stabilize or if further unwinding by Chinese speculators could trigger additional waves of selling in the days and weeks ahead.