Gold prices are trading sideways this month as the U.S. dollar gained strength in the global markets. The XAU/USD index, which tracks the performance of gold shows its price hovering around $2,325 on Tuesday’s opening bell. It is down by nearly 9 points in the charts and shed 0.38% of its value in the last hour.

Also Read: Currency: Indian Rupee Losing Balance Against the U.S. Dollar

Now that gold prices are on the back foot, will the precious metal dust itself and rally in the indices again? In this article, we will highlight a price prediction for gold for July 1, 2024.

Also Read: Shiba Inu To Reach 62 Cents? Here’s When SHIB Could Hit $0.62

July 1, 2024 Price Prediction for Gold

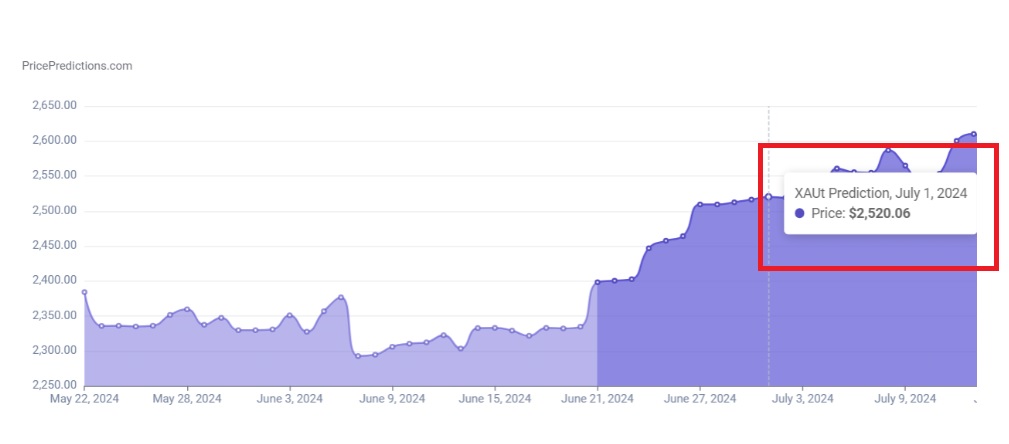

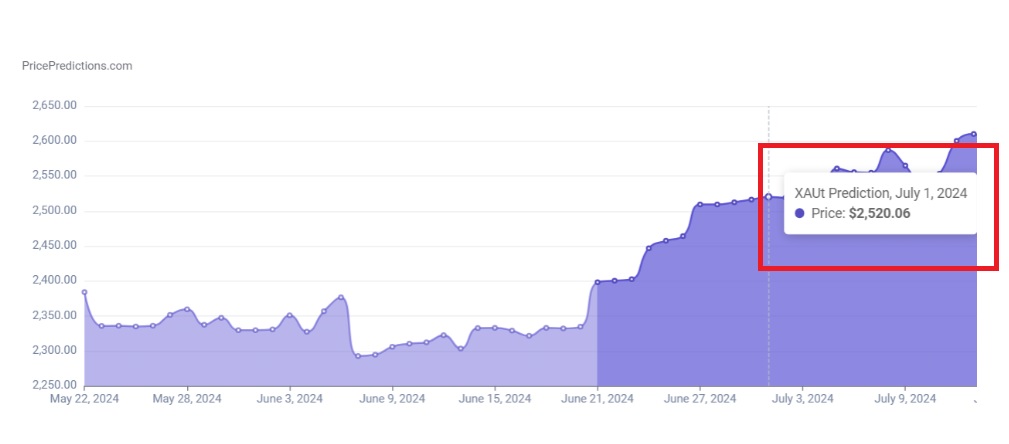

Leading on-chain metrics ‘PricePredictions’ has painted a bullish picture for gold for July 1, 2024. According to the price forecast, the precious metal could kick-start a rally in the next five days and deliver profits.

Also Read: Petrodollar: US Dollar in Jeopardy If Saudi Arabia Stops Accepting USD

PricePredictions has estimated the price of gold could breach the $2,500 mark in July 2024. The forecast estimates that gold prices could reach $2,520 on July 1, 2024.

That’s an uptick and return on investment (ROI) of approximately 8.5% from its current price of $2,325. Therefore, an investment of $10,000 could turn into $10,850 if the forecast turns out to be accurate next month.

Also Read: BRICS: China Warns of Trade War With European Union

Commodities have outperformed the stock market this year delivering double-digit returns in six months. While silver delivered the most gains of 27%, copper generated 23% of profits in 2024. The third in line is gold and it spun returns of about 18% year-to-date. The U.S. dollar has also delivered nearly 5% returns YTD and the commodity market outshined the global equities market.

The demand for copper and silver for industrial purposes reached a peak making their prices shoot up in the charts. In addition, the conflicts in the Middle East are making institutional funds open positions in gold and the U.S. dollar. The development is making the price of gold and the U.S. dollar hit new highs this year.