Bitcoin [BTC] was put into the financial market more than a decade ago to combat centralized systems. From being considered a store of value asset to a payment medium, BTC is still finding its place. While several pour all their funds into the king coin, a few others pocket short-term gains and leave. It has been brought to light that retail investors remain untethered by macro noise as they continue to hold the king coin despite the turn of events.

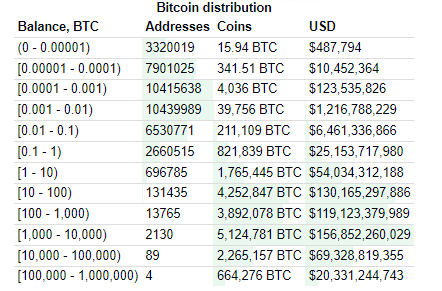

As per a recent chart, retail investors are reportedly considered to entail one Bitcoin or less than that. This means that retail investors who hold more than one BTC currently own about 5 percent of the supply.

Initially, Bitcoin started off as an asset extensively purchased by the average Joe. Shielded against centralized entities, BTC was the asset of the common man. Things took a different turn after the decentralized asset was discovered by the entire globe. As the demand for the king coin surged, the price followed suit. Institutional investors viewed Bitcoin as a promising investment and poured their funds into it.

Now, institutional investors seem to be controlling most of Bitcoin’s supply.

As seen in the above chart only 4 addresses held 100,000 – 1,000,000 BTC. These addresses most likely belonged to institutional investors.

These institutional investors will most likely prolong their interest in holding the king coin. MicroStrategy’s Chief Financial Officer Andrew Kang revealed that the firm’s strategy of buying and holding BTC would not change. With the popularity of BTC increasing, an array of institutional investors are speculated to enter the market and have control over the king coin.

Bitcoin heading towards recovery?

The world’s largest cryptocurrency fell to its knees during the recent crash instigated by Terra’s stablecoin UST. Bitcoin dropped to a low of $26k inducing fear in the entire market. Earlier today, BTC was still below $30k. This further caused commotion in the market. The Bitcoin Fear & Greed Index showed that the market was in extreme fear.

However, at press time, the asset seems to have garnered momentum to move beyond this zone. During press time, Bitcoin was trading for $30,341 with a 4 percent surge over the last 24-hours.