All that the crypto industry is currently talking about is ‘The Merge.’ Ethereum’s [ETH] transition from proof-of-work [PoW] to proof-of-stake [PoS], has been widely anticipated by the entire community. While some [miners] are rooting for a delay, a few others [Bitcoin maxis] has been labeling ETH a security. Amidst all this noise, a lot of them failed to address the post-merge Ethereum visual. Citi, however, curated a report shedding light on the same.

Here are four things to look out for post ‘The Merge’

- Speed

There has been an increase in the demand for crypto over the years. With this, the block time or transaction speed has slowed down. While ideally, an ETH transition takes 15 seconds, it could go on for several days if there’s network congestion.

The Merge could drive the transaction speed by 10 percent by lower the block time, Citi says. However, the overall speed issue would be addressed in the “Surge.” The report further pointed out that the Surge intends to bring in 100,000 transactions per second [TPS] into the Ethereum blockchain. During press time, the network was carrying out 10.59 TPS.

- Fess

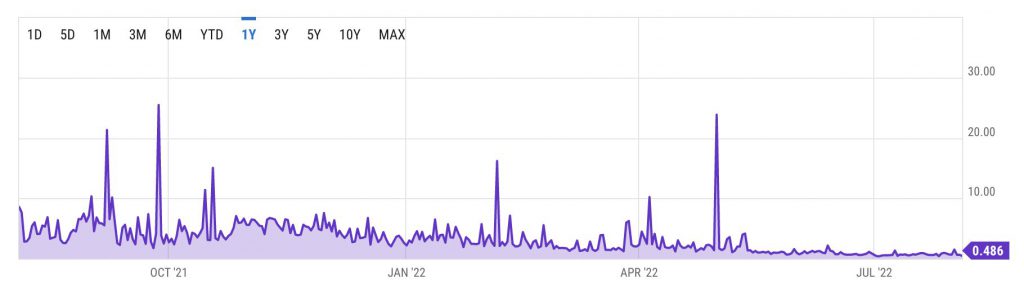

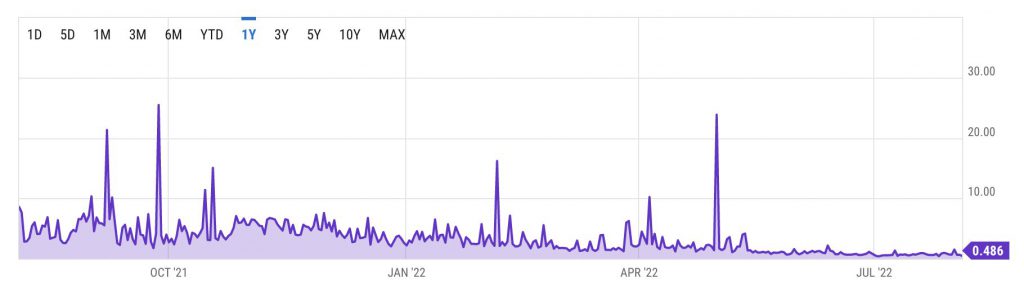

High fees and Ethereum go hand in hand. For several years now, ETH’s high fee has been an issue for several users. However, over the last couple of months, this has witnessed a prominent decrease.

Furthermore, with ‘The Merge’ the block time is expected to dip to 12 seconds from 13 as mentioned earlier. Therefore, a dainty decrease in fees is speculated to follow suit.

- Deflationary and yield-bearing

The term “store of value” is often associated with Bitcoin [BTC]. However, now, Ethereum’s “enhanced store of value properties” could come in handy. Citi noted that the overall issuance of ETH would drop by 4.2 percent a year following its transition to PoS. This would further push ETH to the deflationary arena.

In addition to this, ‘The Merge’ is expected to convert the world’s largest altcoin to a “yield-bearing asset.” The bank believes that with cash flows or the revenue of the network, an array of valuation methods could be employed. With both its deflationary and yield-bearing properties, Citi suggested that it would emerge in a space where the total value locked is both secured and transacted.

- Environment friendly

The entire crypto ecosystem is aware of the backlash that Bitcoin amassed over the years. PoW currencies were called out by many for their energy consumption. While there are more efficient ways of mining Bitcoin now, Ethereum decided to steer away. Since PoS does not require mining or miners, its energy consumption is also reduced.

Citi highlights that following ‘The Merge’ the energy expenditure of the network would reduce by 99.95 percent.

Additionally, with the transition scheduled to take place in September, the price of ETH seemed to be faring quite well. At press time, the altcoin was up by 5.12 percent and had hit $1,700.