September 2021 was not a very appealing month for Bitcoin price-wise. In the said 30-day period, the asset’s valuation dipped from $49.1k to $41.4k. Even so, the bullish sentiment was not dented, and affirmative speculations were being made w.r.t. how the asset could attain $100k over the next few months.

October to mid-November was indeed bullish. Bitcoin went on to attain $69k and create a double peak. Post that, nonetheless, the market stepped into its bear market phase, and has not yet been able to recover.

In fact, the ninth month of the year has historically been one of the worst for Bitcoin, for it has fallen every September since 2017. Notably, BTC has averaged a 7.88% drop for the month over the past six years.

September 2022 outlook for Bitcoin

We’re in September already, and just like the past few years, things seem to be quite tricky for Bitcoin. Taking about what to expect from this month, Shawn Cruz—Head Trading Strategist at TD Ameritrade—said in a Bloomberg interview,

“September is probably going to be another pretty volatile month. The risk is to the downside… You probably see a little bit more of a downside sort of a bias in terms of where I think things can land.”

Furthermore, a few major macro developments are lined up over the course of the next few days that could impact the market.

CPI stats

The U.S. Bureau of Labor Statistics is expected to release the CPI report for August on 13 September at 8:00 AM EST. Participants have been closely keeping track of inflation, and the data release pertaining to the same could act like a catalyst in molding the price of the largest crypto asset.

July’s data was fairly encouraging, for inflation had fallen to 8.5%, dropping for the first time since April 2022. Nevertheless, there were still some concerns in the data—the costs of housing and food continued to rise.

Read More: With U.S inflation easing to 8.5%, will Bitcoin’s rally extend?

Food and housing, in conjunction, contribute almost half of the U.S. inflation number—given their high weightage in the CPI series. So this time around also, they’ll be closely watched. Notably, other component prices—like gasoline—have fallen sharply for the month of August based on EIA data, and as a result, per Forbes,

“CPI data for the month of August may show another subdued month-on-month inflation number, similar to July.”

The Merge factor

Irrespective of how the CPI numbers turn out to be, the crypto market is expected to trade in green on the data release day, for it coincides with the Merge’s D-day. Just yesterday, when the Bellatrix hard fork went live, Ethereum—along with Bitcoin and other major altcoins—climbed up on the charts. So, when the actual Merge goes live, people will likely buy the news, and Bitcoin and co. can be expected to ride the Merge wave.

So, even though looking into past precedents gives us a rough idea as to where the market is heading, upgrades as big as the Merge cannot be taken for granted. Talking along similar lines to Bloomberg, Leah Wald—CEO at digital-asset fund manager Valkyrie Investments—said,

“It’s important to look at last September and the September prior in thinking what’s going on here. But I do also think that each market environment should be considered individually, especially depending on your trading style and time horizon.”

The FOMC Meeting

Now, even if the market trades in green around the Merge, there are still question marks lingering around the sustainability factor. Towards the end of the month, the Fed is expected to deliver another interest hike. Per Reuters, traders anticipate the Fed to deliver a third 75-basis point rate hike at its Sept 20-21 meeting, lifting the benchmark rate to 3%-3.25%.

However, there are odds of the pendulum ending up settling at 50 BPS too. Elaborating on the same, Brian Jacobsen—senior investment strategist—Allspring Global Investments, told Reuters,

“The key thing will be of course the inflation data. That will probably seal the deal as to whether it should be 50 or 75 basis points.”

Backwardation and Correlation

Over the past few months, whenever data or minutes of the meeting releases have taken place, Bitcoin has defied the general expectation and moved in the opposite direction. However, this time around, prices can be expected to slide down.

It is worth noting that the market has been in backwardation over the last couple of weeks, and per Arcane Research’s Vetle Lunde,

“The hedging train is going full throttle. Short-term, this selloff shows signs of being overextended, and this represents an intriguing area to make contrarian short-term bets.”

Also Read: Bitcoin derivative traders bearish: Market in backwardation

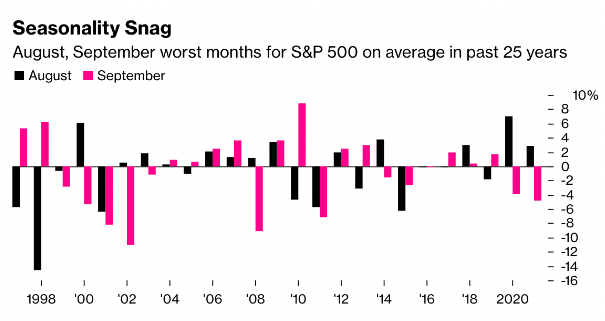

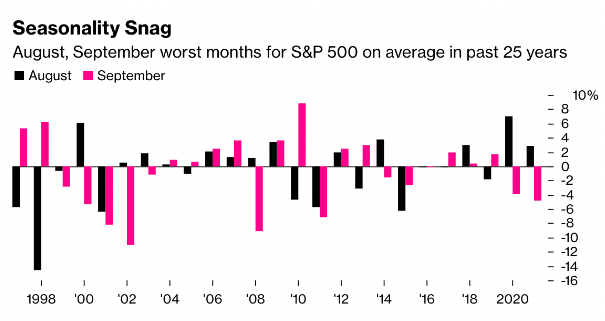

Furthermore, Bitcoin has moved in tandem with the equities lately, and historically, September has not been an encouraging month for the stock market either. So, the odds of a price dip materializing after the Merge hype fizzles out remain to be quite high. Highlighting the same, one of Bloomberg’s recent reports noted,

“Digital assets have also moved similarly to US stocks all year, with correlations between the two remaining strong. September tends to be a tough month for equities as well and this year could prove no different.“