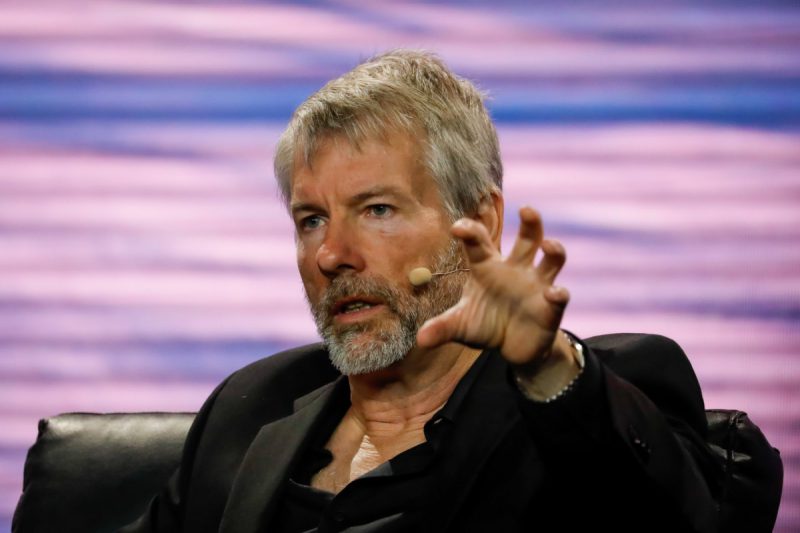

Bitcoin advocate and MicroStrategy CEO, Michael Saylor predicted bullish sentiment for BTC despite the cryptocurrency’s price drop. After the Consumer Price Index (CPI) data reveal for June 2022 displayed a 9.1% increase in US inflation, BTC also fell from over $20,000 to the $19,000 bracket within an hour’s window.

Nevertheless, Saylor is optimistic about BTC’s foreseeable growth arguing that while other currencies are facing devaluation against the dollar, bitcoin will become the only remaining hedge against this inflation. He tweeted,

Following Saylor’s footsteps, crypto exchange giant, Binance CEO, Changpeng Zhao also commented on the CPI stats, without drawing a comparison to crypto. CZ pointed out that since “80% of USD in circulation were printed in the last 2 years”, a 9.1% inflation was in fact a phenomenally low figure. He explained that inflation shouldn’t be 80%, rather “we should be seeing 500% inflation” since “80% are new = 5x of original supply”.

BTC’s Inflation Hedge Potential

This is not the first time that bitcoin is viewed as a store of value and hedge against inflation after drastic macroeconomic data was released. Earlier this year, the research and consulting firm, Gartner published a report emphasizing bitcoin’s institutional adoption by referring to the cryptocurrency’s two use cases — BTC as store-of-value and BTC use case as leverage.

Store-of-Value

Gartner Research analyst Avivah Litan predicted a spike in inflation while viewing at the high print rate, further noting treasurers’ dire need for a strong hedge accumulation. She argued that alongside using gold as a hedge, “now you see treasuries also buying Bitcoin as a hedge against the US dollar and other currencies”. Litan asserted that while gold continues to maintain its stable commodity status; bitcoin is also viewed as a store of value asset which is not considerably different from gold.

Leverage

Along with BTC’s SoV credentials, the Gartner report also pointed out the cryptocurrency’s utility as collateral against crypto loans for enterprises. Furthermore, she emphasized crypto’s high-interest rates as well as a diverse range of leverage tools including derivatives such as futures and options financial contracts.

Litan stated,

“You can get much higher rates than you can get from your bank, or you can engage in other kinds of derivatives and financial instruments”. She added that “traditional companies [are] getting compliant access into this DeFi world so they can put their money to work and make much higher yields”.