While the larger crypto markets are stagnant, some tokens displayed bullish signs as we conclude the first week of 2023. Solana (SOL), in particular, rallied 37.4% over the past few days. This is the first time SOL turned bullish since its crash in early November 2022, following the fall of FTX.

Apart from Solana (SOL), Lido DAO (LDO), and other liquid staking tokens, also began to rally. At press time, LDO was up 35.4% in the 7-day chart. StakeWise (SWISE), another liquid staking governance token, is up by 66.9% over the last week.

This is particularly strange, given that the general crypto market still has a bearish outlook, and investor sentiment is low.

Why is Solana rallying?

Solana’s current rally is credited to the airdropping of $BONK tokens, which led to increased network activity. $BONK is a new memecoin on the SOL blockchain. The new memecoin rallied by almost 4335% within six days. Many are already comparing the new memecoin to Shiba Inu (SHIB).

Solana also released their mobile phone, called Saga. Saga is an Android-compatible mobile device that can interact with the Solana blockchain. Additionally, the mobile division has hinted that they might burn a percentage of $BONK tokens that clients might use to purchase the phone. The first few orders of the Saga phone have already begun shipping.

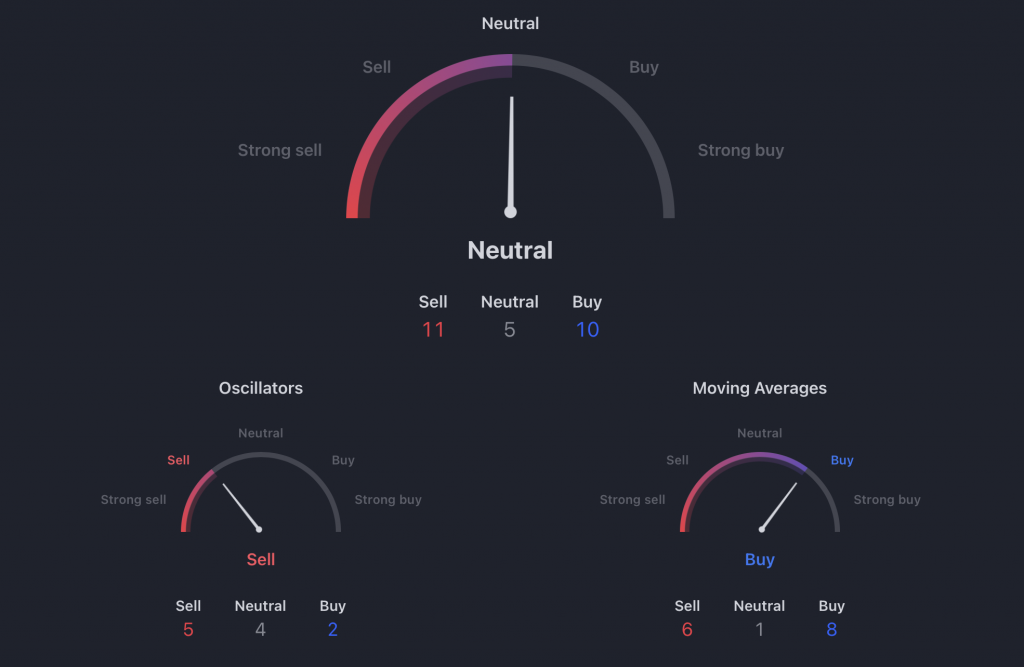

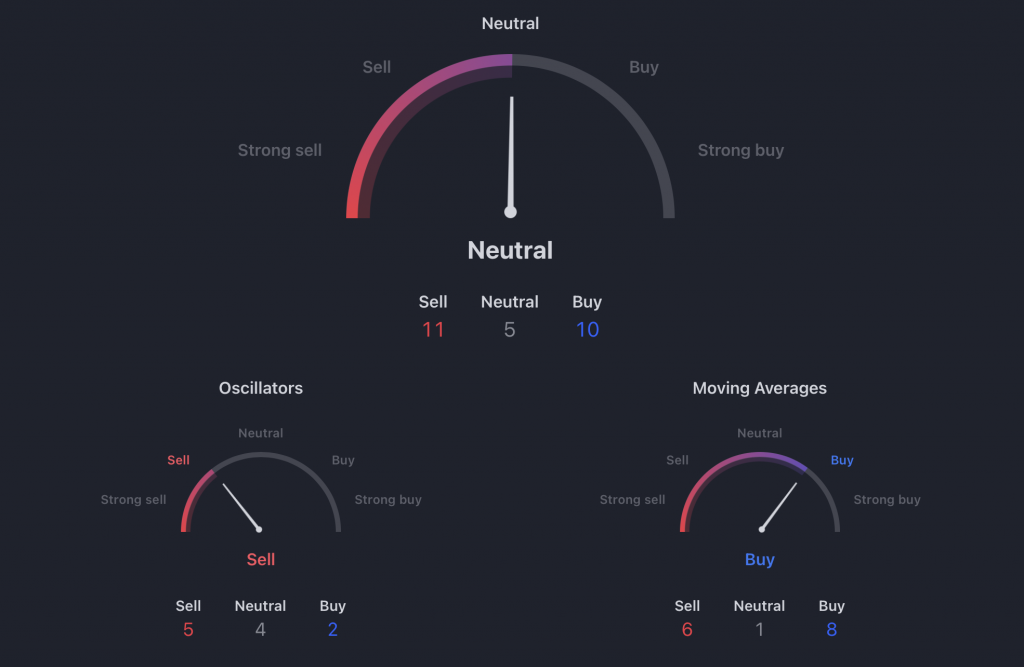

Although the first week has turned out to be great for SOL, there might be things that may barricade its rally. Firstly, a majority of SOL developers jumped ship after the November crash. Moreover, according to TradingView, Solana is showing bearish signs once again. Moreover, a rally based on memecoin airdrops is unlikely to last.

At press time, SOL was trading at $13.20, down by 1.3% in the last 24 hours.

What about Lido DAO and other governance tokens?

The rally of liquid staking governance tokens is most likely due to the upcoming Shanghai upgrade for Ethereum. The Shanghai upgrade is scheduled for March 2023 and will allow ETH stakers to unlock their staked Ether.

However, a majority (77.7%) of staked Ethereum is currently at a loss. Although there are fears of a mass sell-off upon the staked ETH being freed, it is unlikely that investors will sell their coins at a devaluation.

At press time, Lido DAO was trading at $1.30, down by 3.5% in the last 24 hours.