Industry leader Bitcoin was floating back around $29K on Wednesday after the last couple of days brought about some respite in the market. Looking at a few metrics, the overall landscape for Bitcoin hadn’t changed much, with bears still holding most of the aces. Let’s take a look at how the Bitcoin fares after Wednesday’s drawdown.

Several metrics were discussed in an earlier article which suggested that a possible rebound could be around the corner. As was observed in the past few days, Bitcoin’s price recovered by nearly 9% since tagging $29K support on 9 May before erasing gains once again on Wednesday.

The brief recovery was partly helped by a $45 Million in institutional inflows. In a weekly report, data tracker Coinshares suggested that investors were taking advantage of the ‘substantive price weakness’ presented by new lows in the market.

Among those buying the Bitcoin dip, addresses holding over 0.1% of Bitcoin’s circulating supply, also known as ‘large holders’, were buying aggressively. Large holders NetFlow spiked to its highest level since March, suggesting accumulation in progress.

Now, despite some positives, the macro outlook still presented a larger bearish market at hand. As of 10 May, a significant number of Bitcoins were still held on crypto exchanges – the largest supply dump since May 2021.

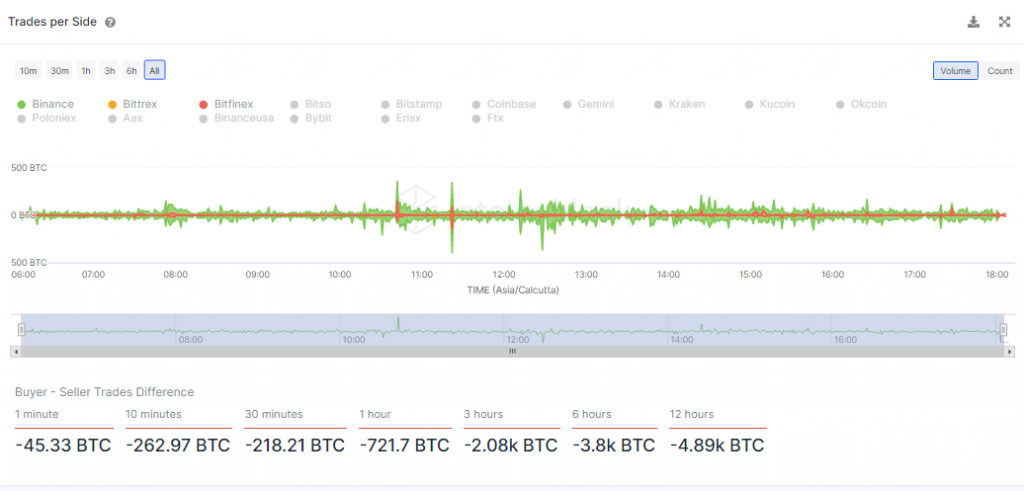

At press time, investors were still wary of BTC’s short-term prospects and were placing sell orders to offload their Bitcoins. Sell-side traders dominated buy-side traders as a bearish-near term outlook remained.

Bitcoin’s Future Prospects?

The key region for Bitcoin remains between $29-31K. Investors have known to accumulate coins within this area before but without assistance from retail traders, it’s difficult to look past a bearish short-term narrative.

Meanwhile, bulls can regain some command above $37K buy judging from the abovementioned metrics, selling pressure is still dominant and investors might have to wait a little longer for the outlook to change.