How to Buy Stocks With ITIN Number: Comprehensive Guide

Investing in the stock market is a powerful tool for growing wealth and achieving financial goals.

However, many people mistakenly believe that a lack of citizenship or a Social Security Number (SSN) prevents them from participating in the stock market.

The truth is that anyone can invest in the stock market without a Social Security number.

This article will explore why investing is essential, how to invest with an Individual Taxpayer Identification Number (ITIN), and the step-by-step process of investing in the stock market without an SSN or ITIN.

Also read: ‘Crypto-Stocks’ Might be Better Than Crypto Right Now

Why investing is essential

Investing in the stock market can be a game-changer in building wealth.

While not everyone earns a high salary or inherits a fortune, investing provides an opportunity to grow real wealth over time. Let’s take a look at some compelling examples:

- Amazon Stock: Imagine if you had invested $1,000 in Amazon stock 20 years ago. As of the time of writing, that investment would be worth an astounding $193,872.83! With an average annual rate of return of 30.10%, you would have earned nearly $200,000 in passive income.

- Apple Stock: If you had invested $1,000 in Apple stock 30 years ago, that investment would now be worth $231,328.61. With an average annual rate of return of 27.05%, you would have earned a quarter of a million dollars in passive income.

These examples demonstrate the power of long-term investing in the stock market. Investing wisely can potentially achieve substantial financial growth and secure a better future for yourself and your family.

Also read: Coinbase Stocks Rally As Grayscale Scores Major Win Against the SEC

Investing Without a Social Security Number, or ITIN

Now that we understand the importance of investing, let’s explore how you can invest in the stock market without a Social Security Number or ITIN.

Understanding the Social Security Number (SSN) Requirement

Traditionally, brokerage firms have required investors to provide a Social Security number as part of the account opening process.

This requirement is primarily due to the Patriot Act, which aims to combat money laundering and terrorist financing by mandating stricter identification procedures.

However, not having a Social Security number does not mean you cannot participate in the stock market. Alternative options are available, such as obtaining an Individual Taxpayer Identification Number (ITIN) or opening an account with brokers offering SSN alternatives.

How to Buy Stocks With ITIN Number

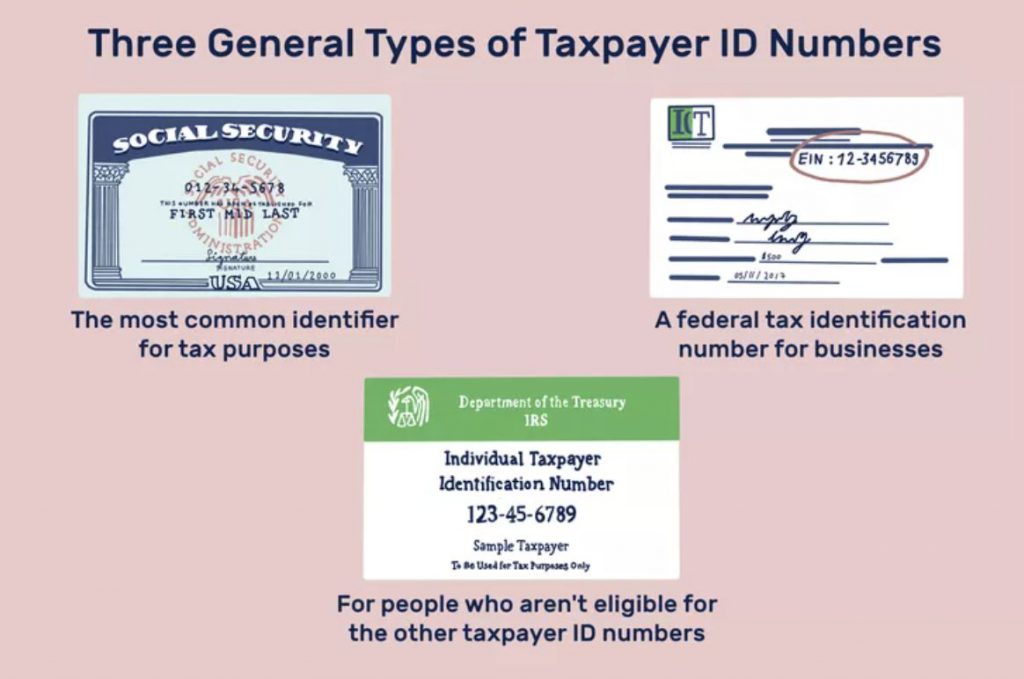

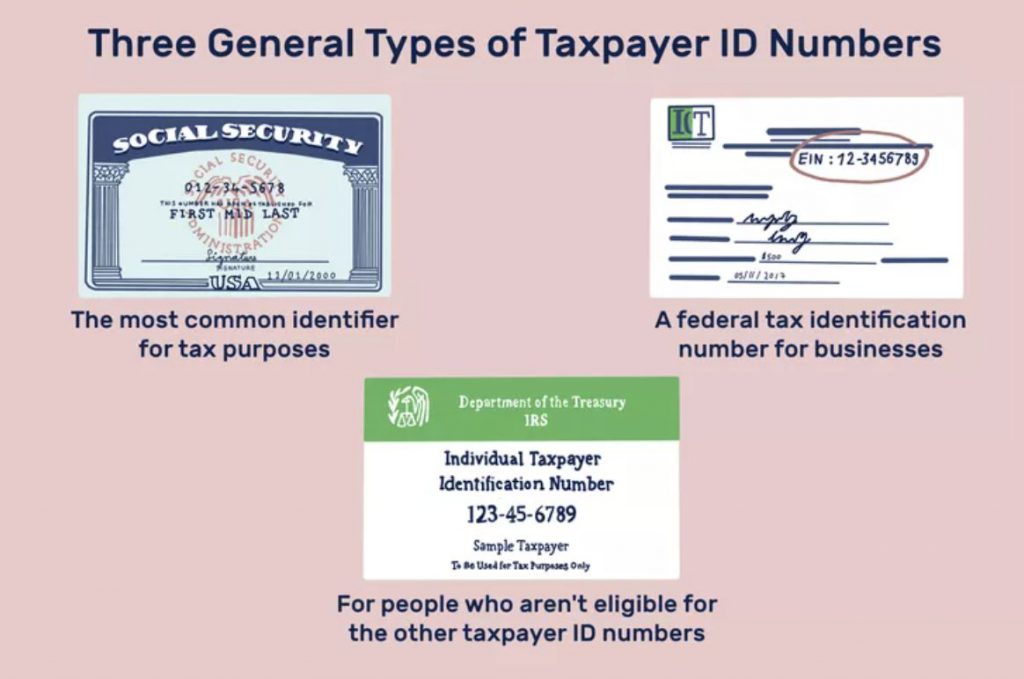

What is an Individual Taxpayer Identification Number (ITIN)?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who must have a U.S. taxpayer identification number but do not qualify for a Social Security number.

ITINs are used for tax reporting purposes and can also be used to open a brokerage account.

To obtain an ITIN, you need to complete IRS Form W-7 and submit it along with the required documentation to the IRS.

The documentation typically includes proof of foreign status and identity. Once approved, you will receive an ITIN that can be used for various purposes, including investing in the stock market.

Brokers That Offer Alternatives to SSN

Several brokerage firms recognize the need for alternative identification options and offer solutions for investors without a Social Security number.

These brokers work with investors who possess an ITIN or other forms of identification, allowing them to open a brokerage account and participate in the stock market.

One popular brokerage firm that offers this alternative is TD Ameritrade. They have an easy and streamlined process for opening a brokerage account using an ITIN.

By partnering with an acceptance agent authorized by the IRS, investors can complete the necessary paperwork and open an account without a Social Security number.

How to Invest Without an SSN or ITIN

Now that we have covered the importance of investing and the options available for investors without a Social Security Number or ITIN, let’s dive into the step-by-step process of investing in the stock market:

Step 1: Determine Your Investment Goals

Before you start investing, it’s essential to define your investment goals. Are you investing for retirement, buying a house, or funding your child’s education?

Understanding your goals will help you make informed investment decisions and create a tailored investment strategy.

Step 2: Research and Educate Yourself

Investing in the stock market involves a certain level of risk, and educating yourself about the market and investment strategies is crucial.

Review books, articles, and reputable financial websites to gain a solid understanding of investing fundamentals.

Step 3: Choose a Brokerage Firm

Selecting the right brokerage firm is crucial for investing without a Social Security Number, or ITIN. Look for brokers that explicitly state they accept alternative identification options, such as an ITIN or other valid forms of identification. TD Ameritrade is a reputable brokerage firm that offers this option.

Step 4: Gather the Required Documentation

To open a brokerage account without a Social Security Number or ITIN, you must provide alternative documentation per the broker’s requirements.

This may include your ITIN, passport, driver’s license, or other valid identification documents.

Step 5: Complete the Account Opening Process

Following the broker’s account opening process once you have gathered the necessary documentation

Furthermore, this typically involves filling out an online application, providing personal information, and submitting the required identification documents.

Step 6: Fund Your Account

After your brokerage account is approved and opened, you must fund it to start investing. You can transfer funds from your bank account to your brokerage account through an electronic funds transfer (EFT) or wire transfer.

Step 7: Research and select investments

With your account funded, it’s time to research and select investments that align with your investment goals and risk tolerance.

Consider diversifying your investments across different asset classes to minimize risk and maximize potential returns.

Step 8: Place Your Investment Orders

Once you have chosen your investments, place your buy orders through your brokerage account.

You can specify the number of shares or the dollar amount you want to invest. It’s essential to review and confirm your orders before submitting them.

Step 9: Monitor Your Investments

Investing in the stock market is a long-term endeavor, and monitoring your investments regularly is crucial.

Additionally, stay informed about market trends, company news, and economic indicators that may impact your investments. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Step 10: Seek professional advice if needed.

If you feel overwhelmed or uncertain about investing, don’t hesitate to seek professional advice from a financial advisor.

They can provide personalized guidance based on your unique financial situation and help you make informed investment decisions.

Conclusion: How to Buy Stocks With ITIN Number

In conclusion, Investing in the stock market is a powerful tool for growing wealth and achieving financial goals. Lack of a Social Security Number, or ITIN, should not deter you from participating in the stock market.

By obtaining an ITIN or opening an account with brokers that offer alternatives to SSNs, you can invest in the stock market and potentially achieve significant financial growth.

Remember to define your investment goals, educate yourself, choose the right brokerage firm, gather the necessary documentation, and follow the step-by-step process outlined in this article. Happy investing!