Amid de-dollarization efforts and the rising prominence of the economic bloc, it is fair to ask how BRICS could affect the US economy. Specifically, as the collective grows in prominence, and takes aim at the greenback, America could be facing certain economic outcomes.

The US dollar has been firmly entrenched as the global reserve currency since World War II. Yet, 2023 has brought to the forefront a potential end to that event. Moreover, as the BRICS bloc has focused on an increase in their economic influence in the world, their native currencies have seen similar rising prominence. Consequently, this has an adverse effect on the US dollar.

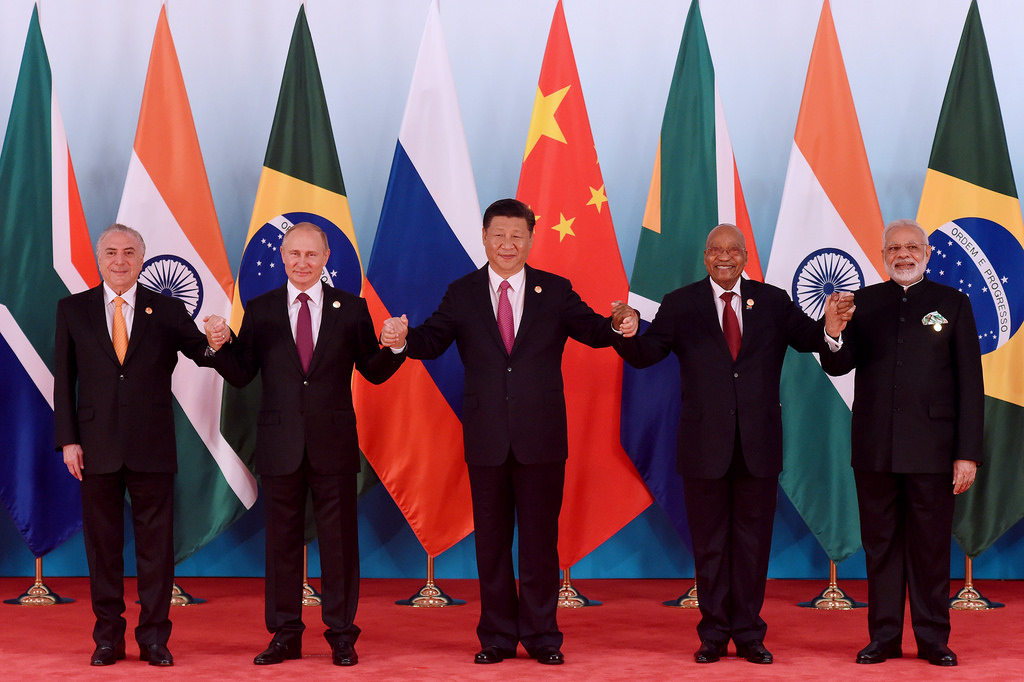

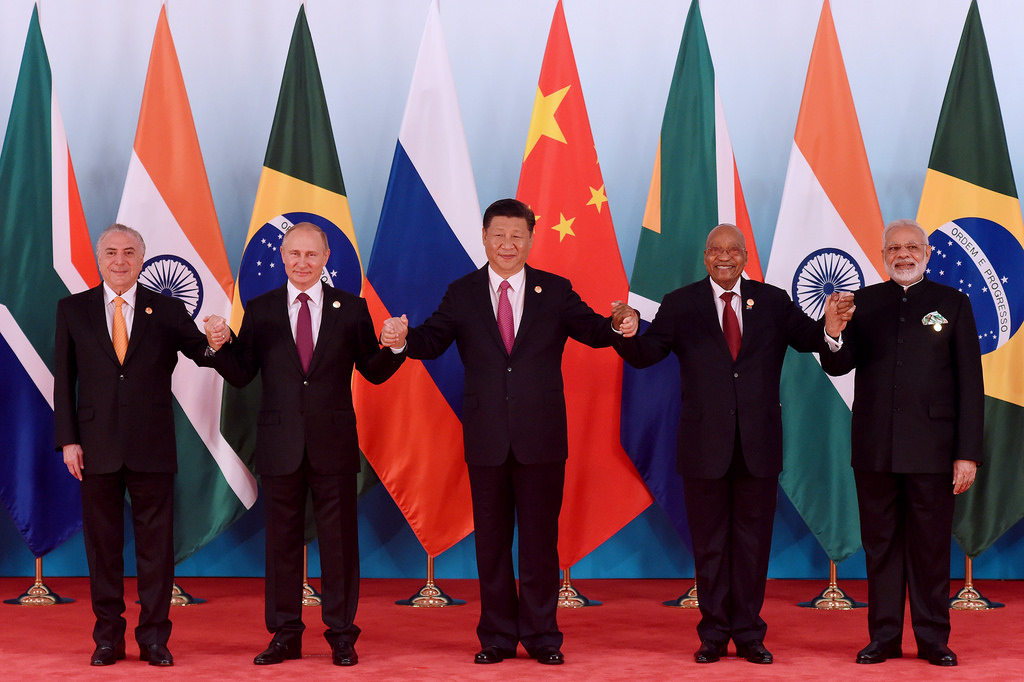

BRICS Rising Power

Throughout the year, the rise of the BRICS bloc has been a constant headline. Moreover, as Western sanctions have separated the West from Russia, the world has followed suit. Thus, leading to a separation between the West, and BRICS.

Yet, as that delineating reality continues to evolve, BRICS presents a force that could affect the US economy, and push de-dollarization. Specifically, due to its direct impact on the global presence of the US dollar. A presence that the BRICS nations have been outspoken about limiting.

Amid the recent rise, national currencies like the Chinese yuan have grown in use. Subsequently, it is becoming a relevant currency in international settlements, allowing a supplemental currency for the US dollar.

Alternatively, Russia has led efforts to create a replacement for the greenback internationally and push ahead with de-dollarization efforts. Now that the BRICS currency is being developed, an agreement is expected this year. Susbeuqnelty provides a potential reserve currency replacement for the dollar.

Effect on the US Economy

It would be unrealistic to believe that these developments would have no impact on the US economy. Contrarily, a collapse of the dollar would lead to inflation in the US. Subsequently, a decrease in its value would follow, which could be dangerous for the citizens of the country.

Prices across the country would increase, which would impact Americans already battling inflation. Alternatively, macroeconomic circumstances are already presenting a fragile economic outlook for the country. Along with potential debt default, the country’s financial situation is becoming increasingly volatile.

To fight back against these dangerous situations, there must be action. Specifically, the US has to stabilize its currency amid international action. Moreover, doing things like reducing the national debt or increasing US exports to increase dollar demand could be active steps.

However, the BRICS currency’s presence in global trade is undeniable. Subsequently, fighting seems immensely difficult considering the other factors present in the economy currently. Conversely, many predict an eventual negative fate for the US dollar.