The crypto-verse has welcomed a plethora of new cryptocurrencies over the last couple of years. While some have made the cut, a few others were victims of a pump-and-dump. Amidst all of this, prominent crypto assets like Bitcoin (BTC), Ethereum (ETH), and others witnessed immense growth over the years. Following a promising streak, the bears intervened and pushed the market down to the ground.

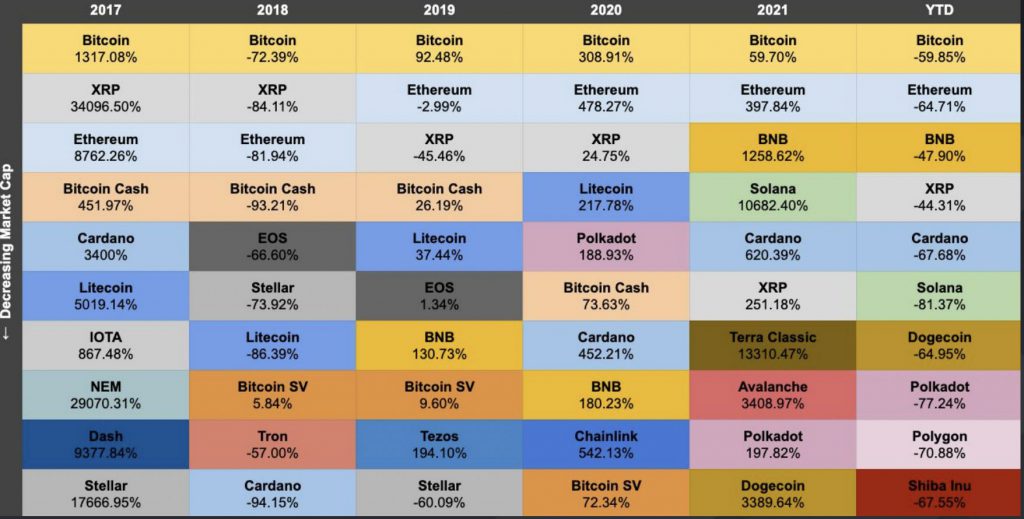

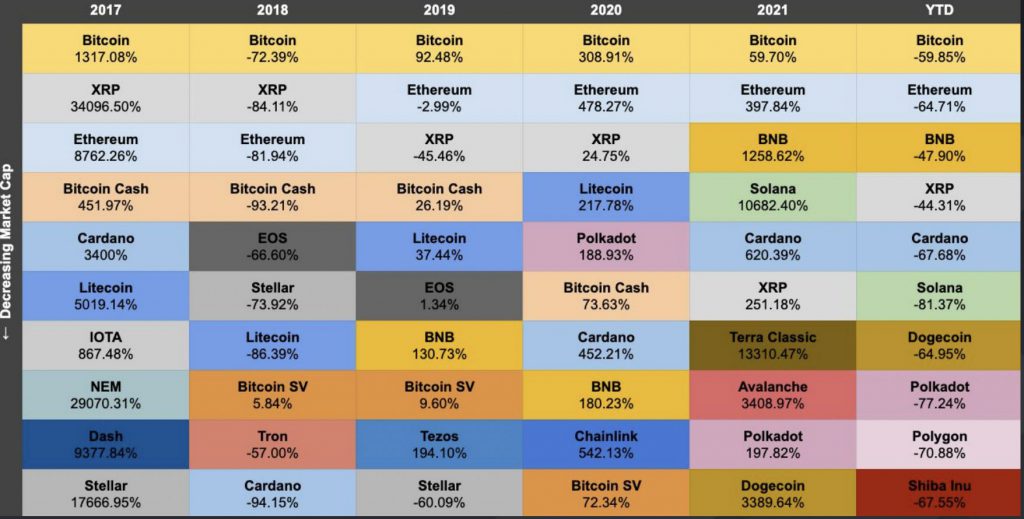

A report, curated by prominent crypto exchange Binance, highlighted the performance of the largest coins by market cap over the years. Per the report, Bitcoin was seen leading the market with its year-to-date performance. Currently, the asset’s YTD was -59.85%.

As seen in the above image, Ethereum, as well as Binance Coin, took over the second and third spots. XRP hovered between the second and third spots for quite a while. However, since 2021, the asset had decided to take a backseat. This dip could likely be a reflection of the ongoing lawsuit that Ripple has been engaged in with the Securities and Exchange Commission [SEC]. XRP joined the list of assets that encountered the lowest YTD drawdowns.

The YTD average performance of the top 10 largest cryptocurrencies was at -64%.

Bitcoin’s dominance witnesses a shake-up

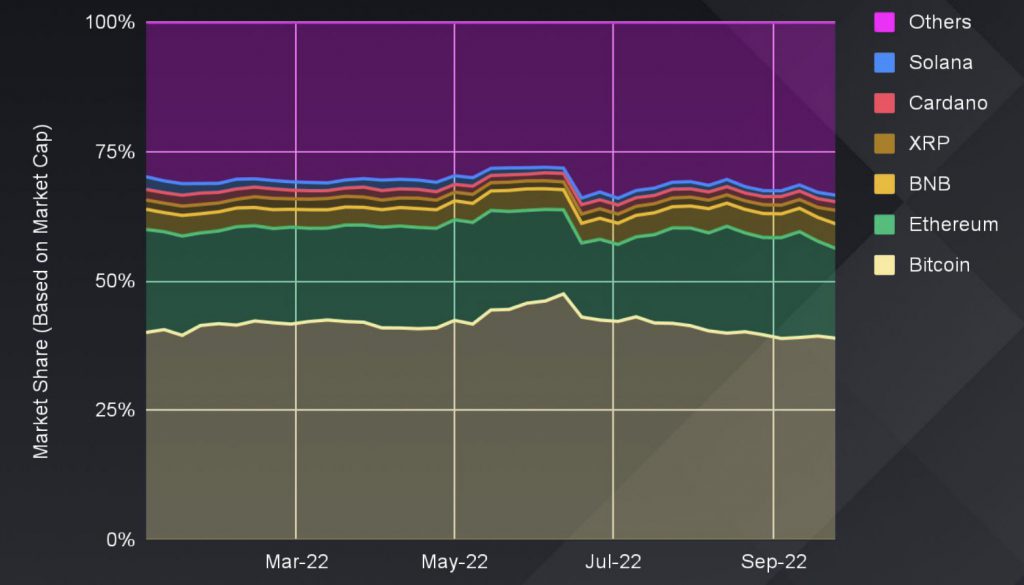

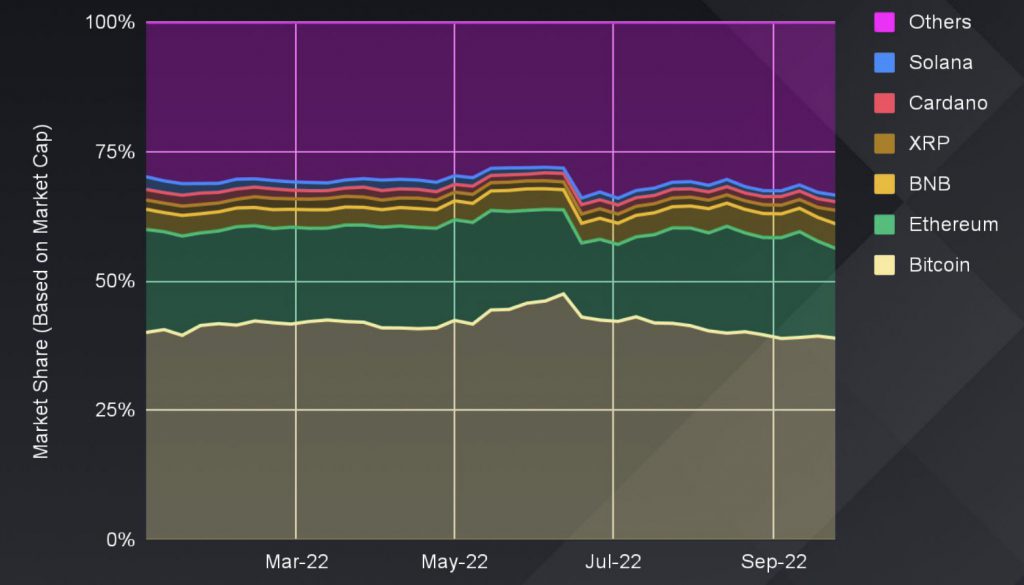

It’s no news that Bitcoin has been dominating the crypto space for a long time. The asset was the very first cryptocurrency and is currently the largest by price as well as market cap. In a new turn of events, the market share of prominent cryptocurrencies was disrupted.

Bitcoin’s dominance took a hit as Ethereum, XRP, as well as Binance Coin, surged. The report read,

“BTC dominance has fallen since its YTD peak in June (post-Terra collapse) as other L1s gain market share. A notable gainer for Q3 is ETH, which gained ~3% market share. This is likely contributed by interest in ETH due to the Merge.“

At press time, Bitcoin was trading for $20,321.86 with a daily rise of 5.30% over the last 24 hours. Bitcoin’s dominance was at 39.6%, while Ethereum’s was at 18.7%.