Right from whales to institutions, most large participants with a hold in the market have been trying to catch Bitcoin’s falling knife lately. Well, they have a valid reason to do so. The current discounted market price does make BTC quite attractive to long-term HODLers who wish to cling to the asset through multiple cycles of profit and loss.

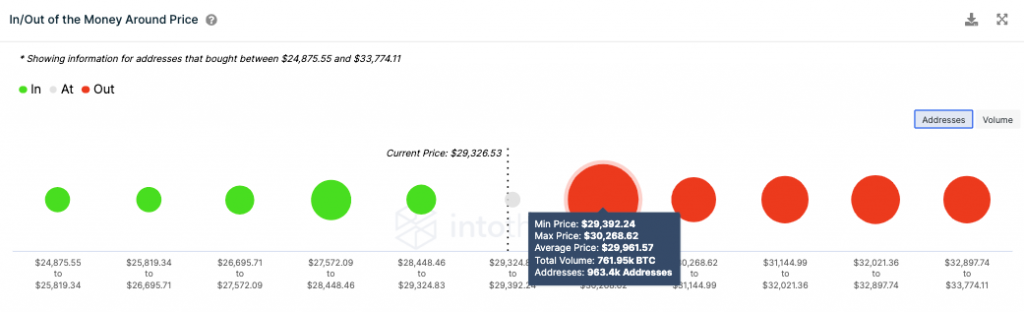

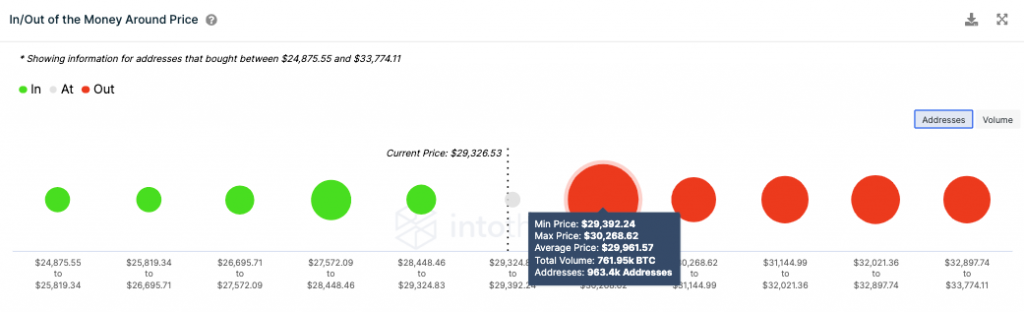

Of late, almost every level has been tested for Bitcoin. Nonetheless, the zone between $29.3k to $30.2k has been the most targeted. Over here, approximately 963k addresses have bought a sum total of 761.95k BTC. Towards other higher ranges, the number of coins purchased has relatively been around 6-7 times less.

Time for investors to HODL Bitcoin and chill?

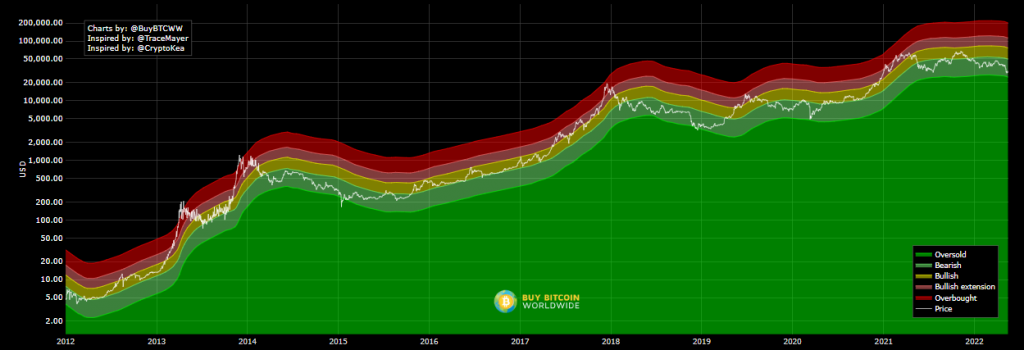

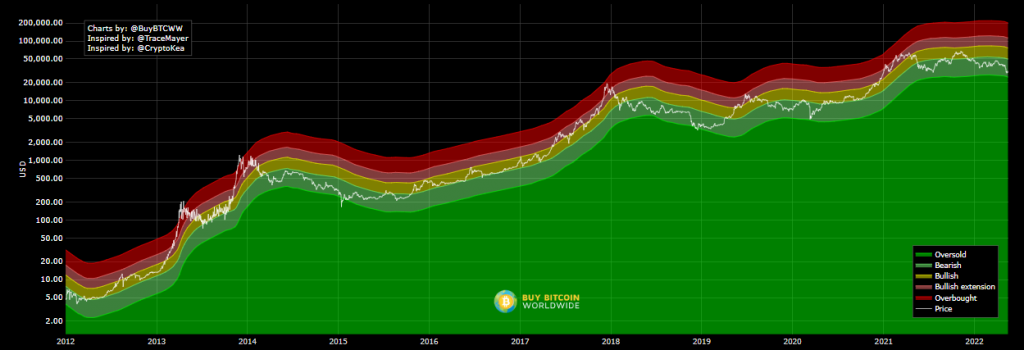

With Bitcoin’s price continuing to fall, a host of buying opportunities have arisen. However, the same might not be the case for long, as Bitcoin is likely on the verge of bottoming out. Well, leaving technicals aside, the Mayer Multiple is indicative of such a trend.

The Mayer Multiple, as such, was created to compare and analyze Bitcoin’s price w.r.t. its past movements. Whenever Bitcoin has rallied, this metric’s reading has majorly reflected readings above 1.5.

Over the past few days, the MM has been hovering towards the lows, around at 0.65. Now, as can be seen from the chart below, the Mayer Multiple has not remained at such low levels for prolonged periods. In fact, it has historically been higher than 0.65 for 94% of the time.

Alongside, Bitcoin’s price has been engulfed in the ‘bearish’ band [light green] on the chart. Around $24k, it would step into the ‘oversold’ region [neon green]. Interestingly, this has happened only around three times in the past, and on every occasion, Bitcoin has ended up re-bounding within a short span of time.

So, per this model, Bitcoin is likely to set to form a bottom anywhere in the lower $20k bracket and reverse its trend. However, it is important to note that these observations are made with respect to historical actions, and crypto trends are subjected to different trends during every bullish/bearish cycle.