Governments all across the world were putting effort into their respective Central Bank Digital Currencies [CBDC]. One of the first nations to introduce a CBDC was Nigeria. In 2021, the eNaira made its debut. However, the absence of adoption has compelled the government to artificially increase adoption.

Recently, Nigeria announced to bring down the total amount of cash that can be withdrawn by businesses and individuals. This was reportedly done in light of the country’s “cash-less Nigeria” initiative that was originally started back in 2012. However, the latest move was carried out to boost the use of the eNaira.

Speaking about the same, the Director of Banking Supervision Haruna Mustafa said,

“Customers should be encouraged to use alternative channels [Internet banking, mobile banking apps, USSD, cards/POS, eNaira, etc.] to conduct their banking transactions.”

As per the notice issued by the Central Bank of Nigeria, businesses would entail a daily withdrawal limit. A limit of $45 or ₦20,000 and $225 or ₦100,000 every week from ATMs. The previous limits before the announcement were $338 [₦150,000] for individuals and $1,128 [₦500,000] for businesses.

A similar withdrawal limit for withdrawals in Nigeria’s banks is also in place. The bank will levy a 5% fee to individuals who withdraw more than $225 [₦100,000] and a 10% fee on corporations that withdraw more than $1,125 [₦500,000] every week from banks.

In addition, a $45 or ₦20,000 daily cap on withdrawals on point-of-sale terminals is also in place. Individuals who attempt to withdraw funds from ATMs and banks on the same day will have to pay a 5 percent service fee.

Here’s how popular Nigeria’s CBDC is

The Central Bank of Nigeria has encountered trouble in convincing Nigerians to employ the CBDC. A dainty 0.5 percent of the population has been using the CBDC since its 2021 launch.

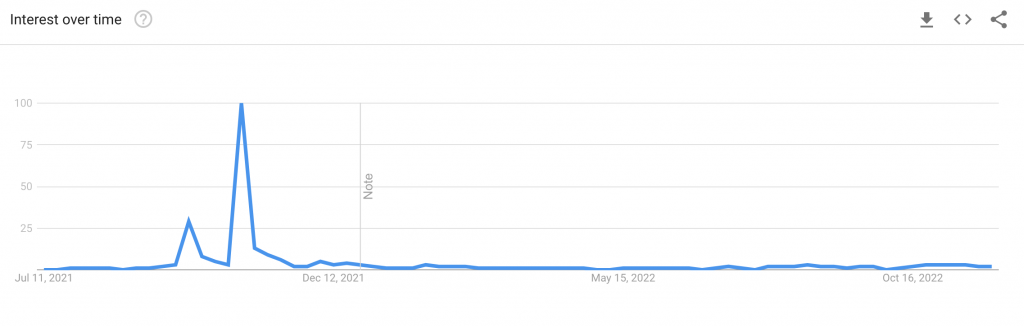

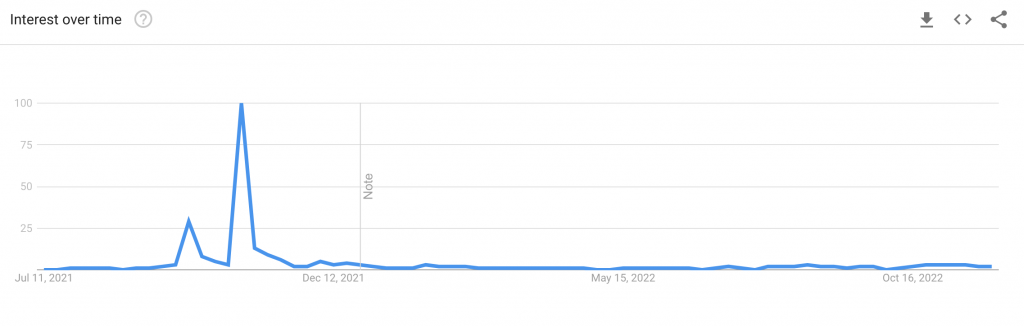

As seen in the below chart, the search volume for eNaira has been almost non-existent. The CBDC made noise back during its launch and there has been no fervor around the asset ever since.

With several other countries yet to roll out their CBDCs, Nigeria’s experience would bring about fear among other governments.