Nvidia’s dividend has caught investors’ attention. The tech giant’s recent moves have stirred excitement, prompting a closer look at its dividend yield and investment opportunity for potential investor returns.

Also Read: GOOGL vs. META: Which AI & Big Data Stock Will Have a Better October

Exploring Nvidia’s Dividend Yield: A Prime Investment Opportunity

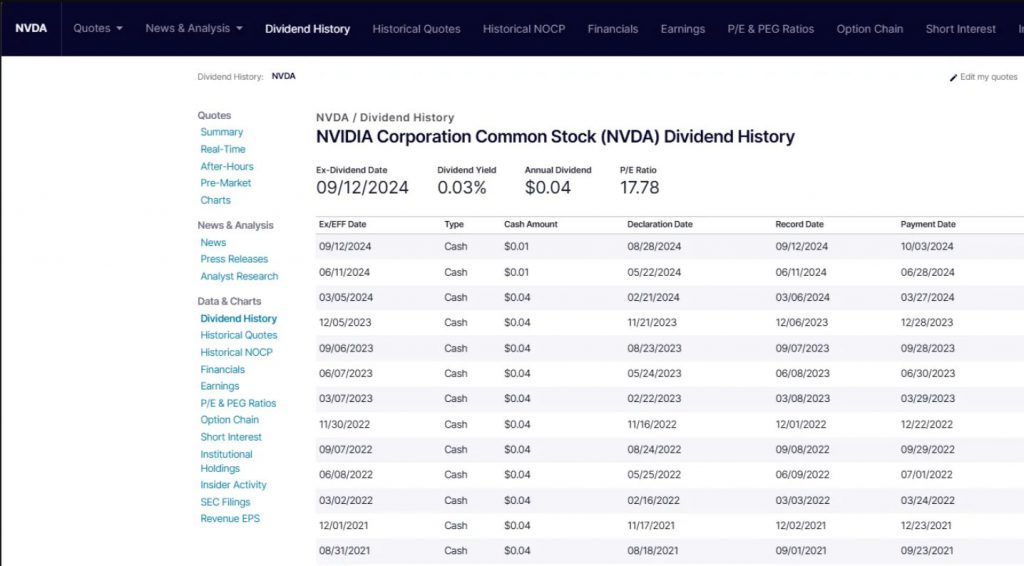

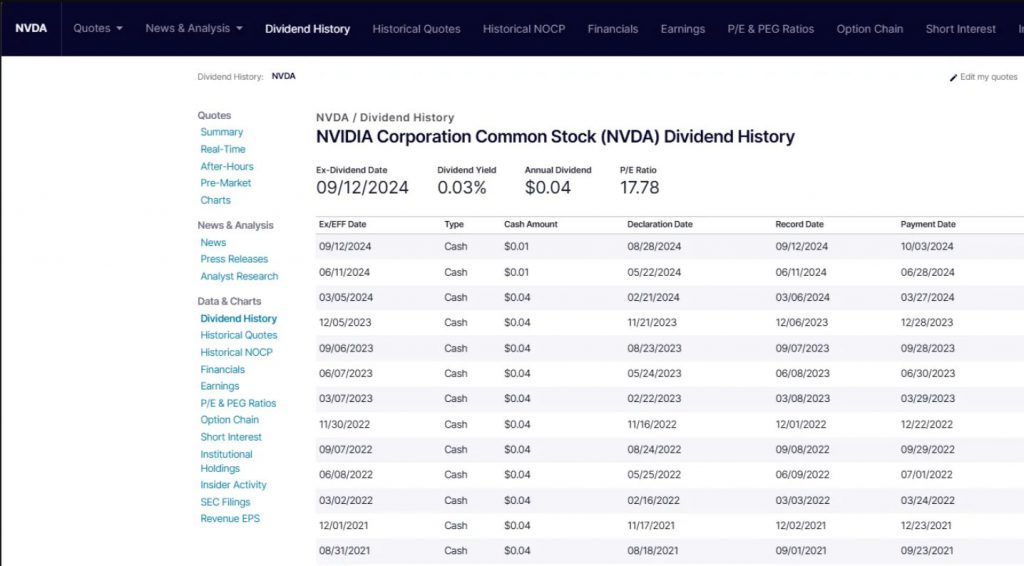

Nvidia recently announced a $0.010 quarterly dividend, with a record date of September 12. This small payout is part of a bigger plan that’s intriguing investors.

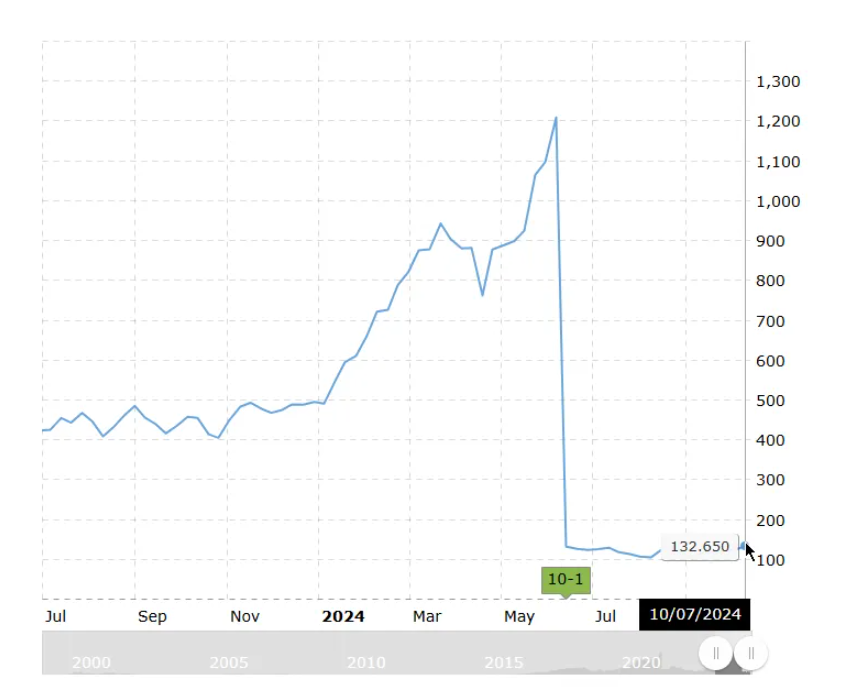

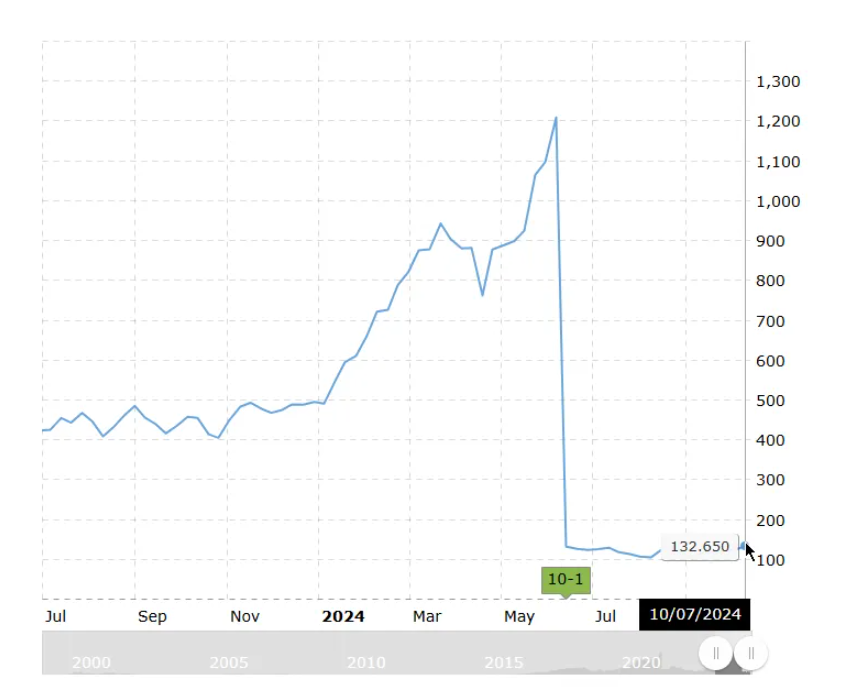

Dividend Growth and Stock Split

Nvidia raised its dividend by 150%. It also did a 10-for-1 stock split. These moves make shares easier to buy. A Morningstar Report stated:

“Nvidia more than doubled its quarterly dividend and said it would enact a stock split to make its shares more accessible to employees and investors.”

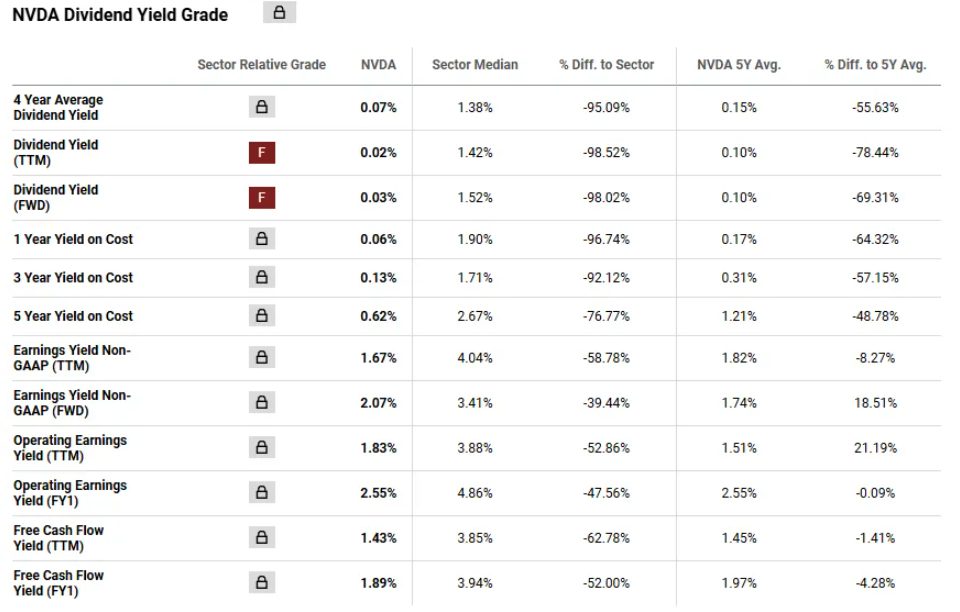

Yield vs. Growth: The Nvidia Paradox

Despite the increase, Nvidia’s dividend yield is low at 0.04%. This is because the stock price is rising fast. Shares went up 7.51% in a week and 179.05% this year.

Also Read: Argentina’s Stablecoin Boom: A Hedge Against Economic Chaos

Investment Potential Beyond Dividends

Nvidia’s appeal comes from its market position and growth potential. It leads in the AI and GPU markets, making it popular with investors.

CEO Jensen Huang’s vision adds to the optimism. On May 22, 2024, Huang said:

“AI infrastructure spending will top $1 trillion over the next five years, and Nvidia is likely to be the biggest winner because it has a dominant market share in the GPU space.”

Analyst Outlook

Wall Street likes Nvidia. Sixty-five analysts call it a ‘Strong Buy’ with a $149.54 target in 12 months. This hints at a 12.53% rise, potentially boosting investor returns.

Also Read: Nvidia: NVDA to Overtake Apple as Most Valuable Company?

Nvidia’s dividend strategy and growth potential offer a unique chance. Its market position and future outlook make it attractive for income and growth seekers.