Time and again, the adjective wild is associated with the West. Back in the day, the phrase was synonymous with the territories located to the West of the Mississippi River that had no formal laws enacted. As a result, people could get away with any kind of “wild” behavior. However today, “Wild West” has sort of becoming the pop-culture nickname for the States as a whole.

The West has, undoubtedly, made progress on a host of fronts over the years, and has been bearing the flag of development. However, when it comes to crypto, the landscape remains to be fragile.

Fragile why?

Consider this—Quite recently, a draft of the Crypto Bill was leaked, and seemingly it fell in the gap between clear regulation and innovation. While regulatory clarity is the need of the hour on one hand, stalwarts from the space have every now and then picked holes and highlighted how it might end up hindering innovation.

Alongside, a PoW mining moratorium bill that got passed in the Senate recently is currently lying on the NY Governor’s desk for a final nod. If given a green flag, a two-year ban on new cryptocurrency mining permits would be imposed, making it challenging for miners to sustain.

In fact, blockchain companies like Ripple that are registered in the US have their customer hub outside the States. They’ve been spreading their roots outdoors, away from home simply because of the not-so-demanding compliance norms.

Is Coinbase’s Armstrong correct?

The afore-highlighted exhibits are just instances from the last few days. If dug more, the list wouldn’t end so soon. Even so, at this stage, one thing is quite clear: Almost no entity—may it be exchanges, investors, parent companies, or institutions—have a completely unblemished safety net provided by the regulators.

Despite the wobbly state of the whole landscape, crypto exchange Coinbase’s CEO believes that the West could create a niche for itself and dominate the space going forward. In a recent Coinbase podcast, the exec said,

“Crypto represents a really compelling alternative for the West and the Western values to basically embrace decentralization as the new World Order.”

If not done, the Coinbase exec opined that, perhaps, the Chinese Yuan might end up becoming the new reserve currency of the world. Despite the Eastern nation doing “many good things,” per Armstrong, it is not aligned with the hardcore “US-Western liberal values.”

He further asserted,

“And so, it may be actually beneficial to have a decentralized West to compete with the centralized East.”

The West v. East war: Bitcoin edition

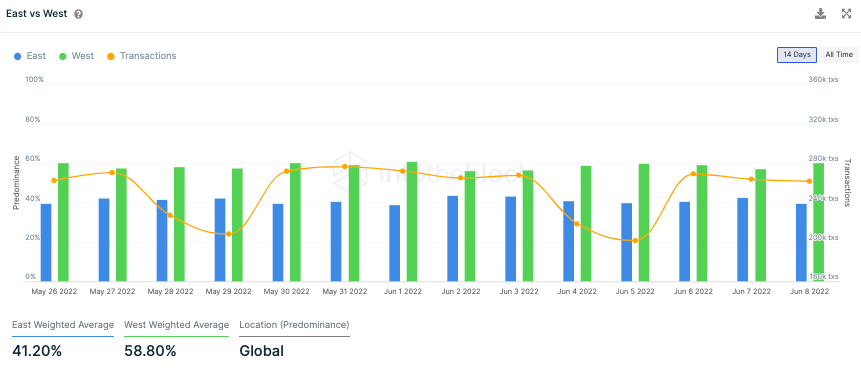

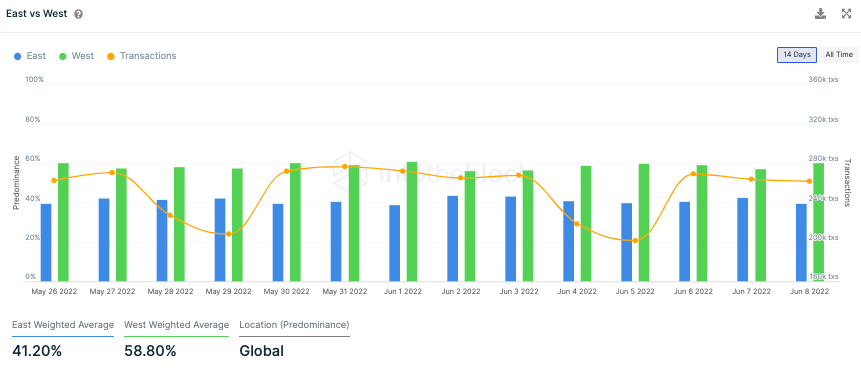

Well, it is a known fact that the West has a fairly higher dominance in the crypto market when compared to the East. In fact, such has been the case since its inception. Per the latest bi-weekly numbers from ITB, the West has been clocking-in an average of close to 60% of all Bitcoin transactions, while the East has a merely 40% participation in the same. Essentially, the ratio stands at 3:2, with the West clearly having an upper hand.

So at this stage, does it seem like the keys remain to be with the West, making the crypto market rely on the mercy of its native market participants? Well, partly yes, and partly no.

Of late, the market has been in a bad shape, and has majorly been suffering due to the Western dump. In the month of April alone, Bitcoin peeled off approximately $10k from its value by falling from $47.4k to $37.5k. Post that, in May, it fell to $26.7k—a value that was last noted back in December 2020.

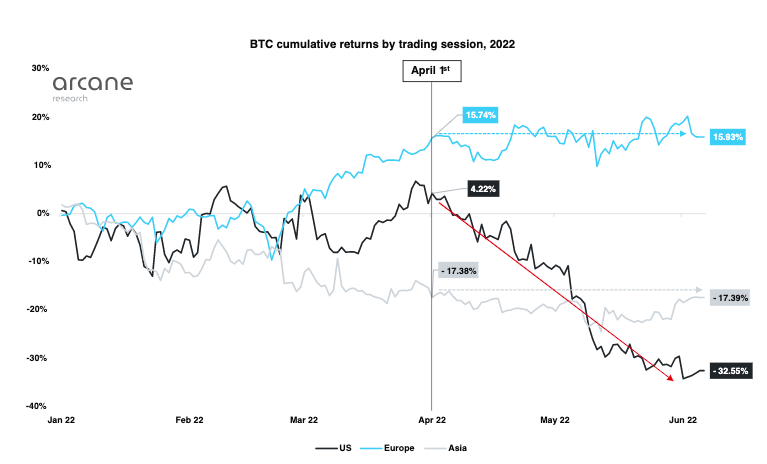

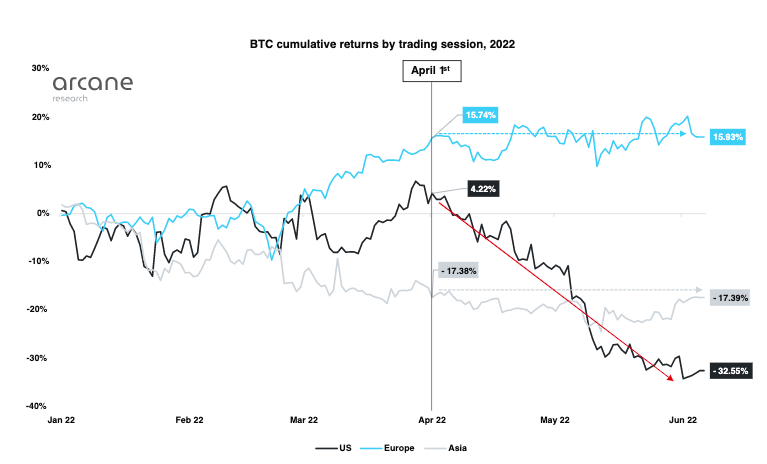

Recently, Arcane Research published a report titled, “The entire BTC sell-off since April occurred during U.S. market hours,” pointing toward the Mule that triggered the slump in prices. Typical “wild” behavior, right?

The report noted,

“The sell-off in bitcoin since April has been driven by American traders, which aligns well with the trend of BTC being strongly correlated to U.S. equities ever since we entered Q2, 2022.“

So, East to remain the submissive one?

The East has time and again risen up to the occasion whenever needed. Back in mid-May, the crypto transactions taking place in the Eastern hemisphere had noted an incline from 38.5% to 48.2%. Around the same time, a rise in the Kimchi Premium Index was noted, bringing to light the presence of buying bias in the Korean market.

Resultantly, Bitcoin followed the broader Eastern market cues, and briefly rallied by about 10%, despite the Western dumping and the Terra ecosystem drama happening in the background.

Bitcoin’s price has been, by and large, consolidating around $30k of late, and the Eastern accumulation, especially that of Europe and Asia, has almost double-handedly managed to keep BTC’s price boat afloat. Bringing to light the said trend, Arcane Research’s report noted,

“Since early April, BTC has seen neutral cumulative returns during European and Asian trading hours.“

Well, there is evidently blood on the West’s hands, but it wouldn’t be fair to shift the entire blame on its head. Not-so-favorable macroeconomic conditions have managed to instill fear in the minds of market participants from the other side of the hemisphere, resulting in a fair amount of selling from their end too. Per Arcane Research,

“This should not be interpreted as U.S. sellers alone contributing to BTC’s weak performance. Traders globally, and in particular, market makers and funds, have likely sought to de-risk alongside the broad equity markets, using Nasdaq and S&P 500 as a proxy for the overall risk appetite.“

When viewed with an optimistic lens, the East’s 40% dominance is no small number. It’s merely a few miles short of the mid-way mark. Even so, the market has honored that and has been receptive to their buy/sell actions, vindicating its decentralized nature.

Bottom line

Back last year when El Salvador adopted Bitcoin as its legal tender, the celebrations weren’t restrictive to the West alone. The crypto community from the East too joined in and popped the champagne.

Nakamoto, as such, created Bitcoin to give people the power to control money. The ultimate idea was to give ordinary people a chance to take part in a decentralized financial system, binding the world together and making it one global village.

The West single-handedly wouldn’t be able to achieve much. The world has already seen too many wars, and another unwanted crypto competition war between the West and the East would do no good.

Having said that, the East has—undoubtedly—been lagging on various fronts when compared to the West. But history serves as a testament that it has always coped and managed to re-align before it has ever become too late.

For the crypto flag to remain hoisted, it is essential for both boats to rise. When the need arises, they’d also have to assist each other during turbulent phases, and only then would the space be able to thrive.

And on that very note, I sign off by politely disagreeing with Armstrong.