Is there a Canadian Bitcoin ETF? Exchange-traded funds (ETFs) are also a new cryptocurrency trend in 2021. Many countries are looking to adopt Bitcoin tokens as futures for trading. Canada is way ahead of the United States, with two fully functioning Bitcoin ETFs far more spread and established.

The United States is doing equally well except that SEC is taking time to approve Bitcoin ETFs; it has only authorized one. More than one Canadian Bitcoin ETFs exist, the Evolve Cryptocurrencies ETF (EBIT) and the Horizon’s Bitcoin ETF Canada (HBIT).

1. Evolve Cryptocurrencies ETF (EBIT)

Evolve Cryptocurrencies ETF is a Canadian Bitcoin ETF with 68% Bitcoin holdings; the rest is Ethereum. It began trading on the Toronto Stock Exchange on September 29.

Market Cap

The Fund makes up a total of 65% percent of the cryptocurrency market cap.

Characteristics

- Utilizes no leverage

- Pays no distribution

- Is rebalanced monthly

- Its Bitcoin holdings name is the Evolve Bitcoin ETF (EBIT).

- There is no management fee; however, the underlying ETFs in the Fund have a 0.75% fee.

EBIT

EBIT exposes investors to daily Bitcoin price movements in relation to the US Dollar. It achieves this by utilizing the processes of redemption and creation that the ETF offers. The methods allow the ETF to be less costly, tax-efficient, and more transparent than mutual funds. The Fund amassed an asset value of $2.1 million during the first day of trade. The Fund has now grown into an estimated value $181 million.

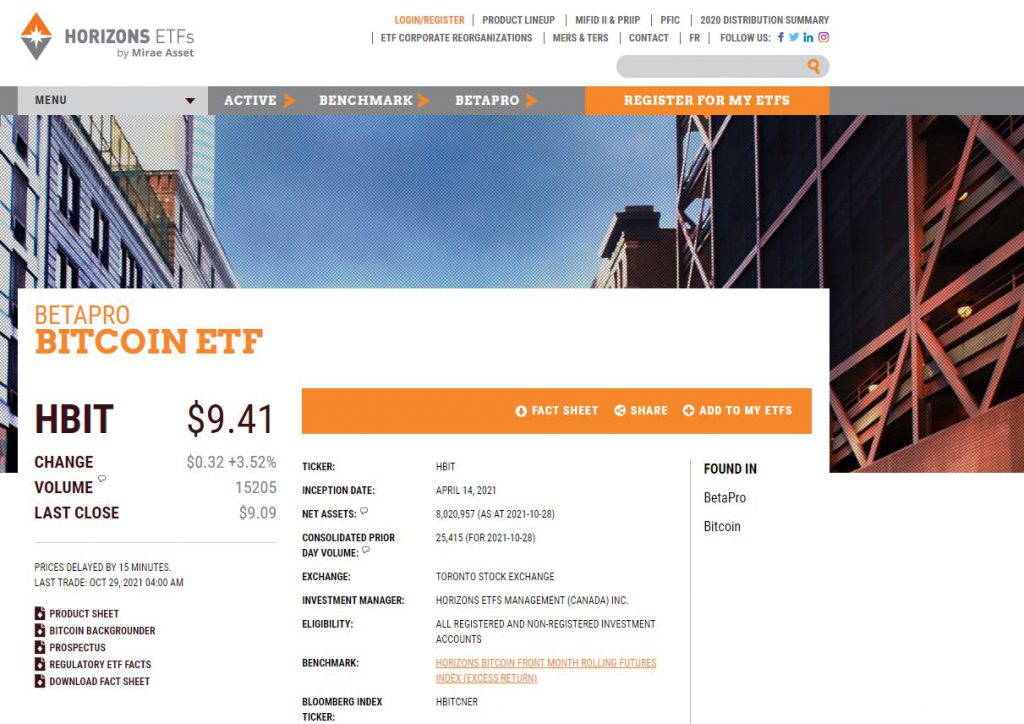

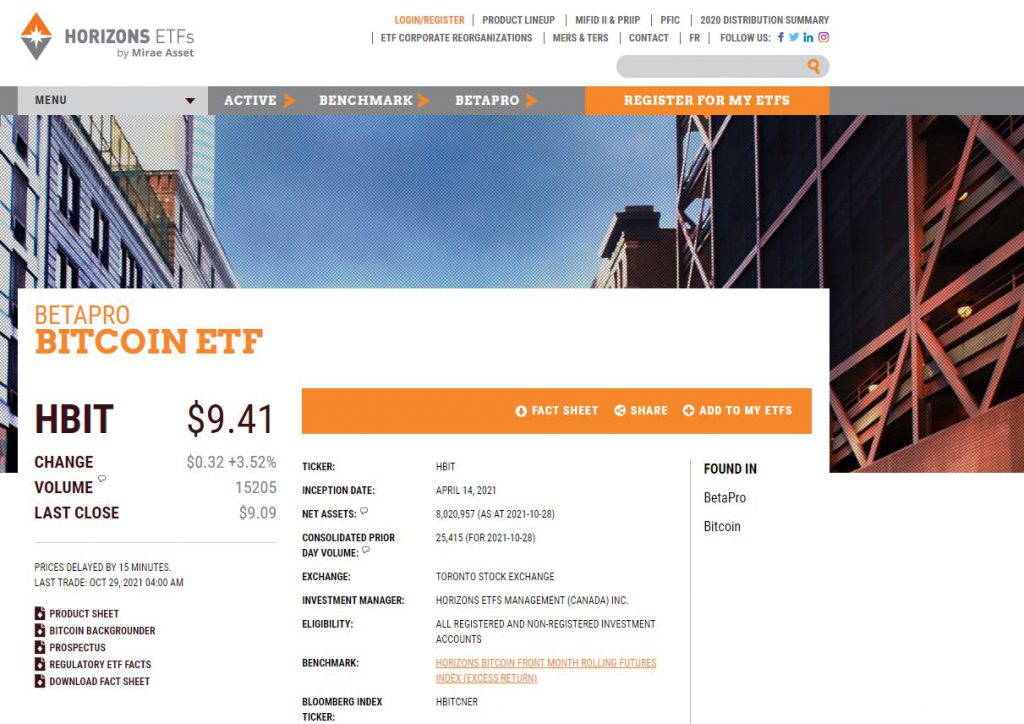

2. Horizon’s Bitcoin ETFs Canada (HBIT)

HBIT is an ETF that launched the BetaPro Bitcoin ETF (HBIT) and the BetaPro Inverse Bitcoin ETF (BITI), allowing the trading of both long and short Bitcoin futures ETFs. All the shares trade on the Toronto Stock Exchange (TSX) under the symbolic representation HBIT (Cdn$Shares).

Characteristics

- Leveraged funds

- Inverse-leveraged funds

- Inverse exposure to asset classes by use of derivatives and futures contracts

- Gives long and inverse exposure to the Horizon’s Bitcoin Front Month Rolling Futures Index, which is Excess Return through the Index

- World’s first ETF to provide inverse exposure to bitcoin futures

- Provides daily liquidity amidst the highly volatile Bitcoin markets that enable traders to take either long or short term positions of the asset class

- Allows buying BTC through a broker; the traders do not need to open a separate cryptocurrency account

- It offers a way in which short exposure to Bitcoin ETFs does not require the use of a margin account or a direct shorting of futures.

- Provides daily investment results that correspond to the opposite of the daily performance that replicates the returns generated over time.

Canadian Bitcoin ETF

Adoption of Bitcoin ETFs is the right step for Canada. It is inspiring how Canada has embraced the new technology that is taking us to a new era. Bitcoin is the new currency, slowly replacing fiat. Embracing Bitcoin ETFs is a smart move because amid a global transition, adopting the incoming new technology will make the state rich, including the citizens. Other countries should follow suit soon.