The crypto markets witnessed some of their worst weeks this year. Bitcoin, the original cryptocurrency, had its worst performing quarter in Q2 of 2022. The crash also saw the collapse of many major crypto firms. Nonetheless, a new Civic Science report has found that most investors hold firm, regardless of the market downturn.

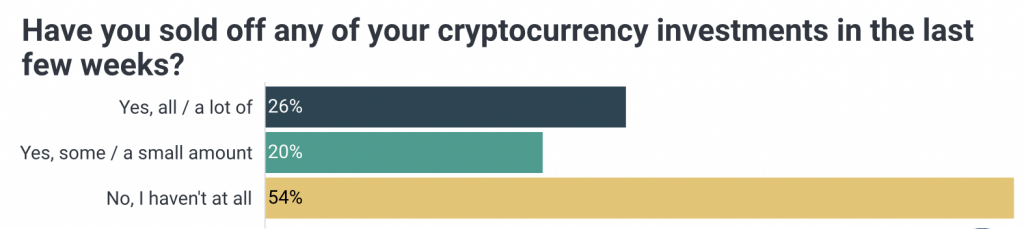

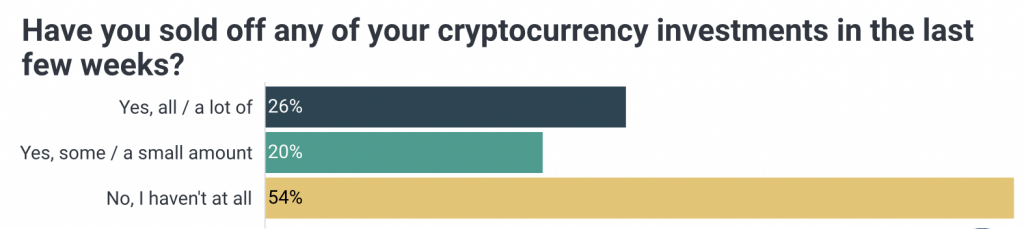

Civic Science says a quarter of the general population has invested in crypto, and 71% of those polled had not invested in the emerging asset class. Moreover, 54% of the individuals who had crypto have not sold any of their holdings, and 20% reported having sold a small amount, while 26% said having sold all or most of their holdings.

The report says that lower-income investors were more on the selling side. This is no surprise, as more affluent investors have the resources to weather the storm.

Who was most affected by the crypto crash?

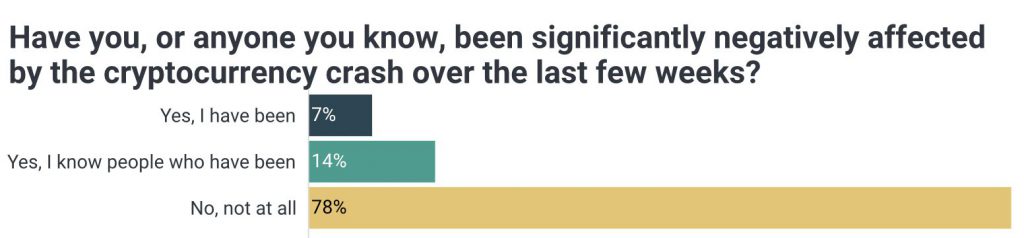

The report states that 7% have been negatively affected by the current market situation. While 14% claimed to know people affected by the same. 78% reported that they were unaffected by the market slump. This means that almost all individuals with crypto investments have been negatively affected.

Thus, the report shows that lower- and higher-income individuals were affected by the crash. However, higher-income individuals have a safety net, such as hedges against crashes and inflation. On the other hand, lower-income individuals need to cash out their investments to make ends meet.

This aligns with a report by the European Central Bank, which found that lower and higher-income families were more open to crypto investments, while middle-income families were the most skeptical. This is most likely because lower-income families have little to lose, and higher-income families have the option of losing.

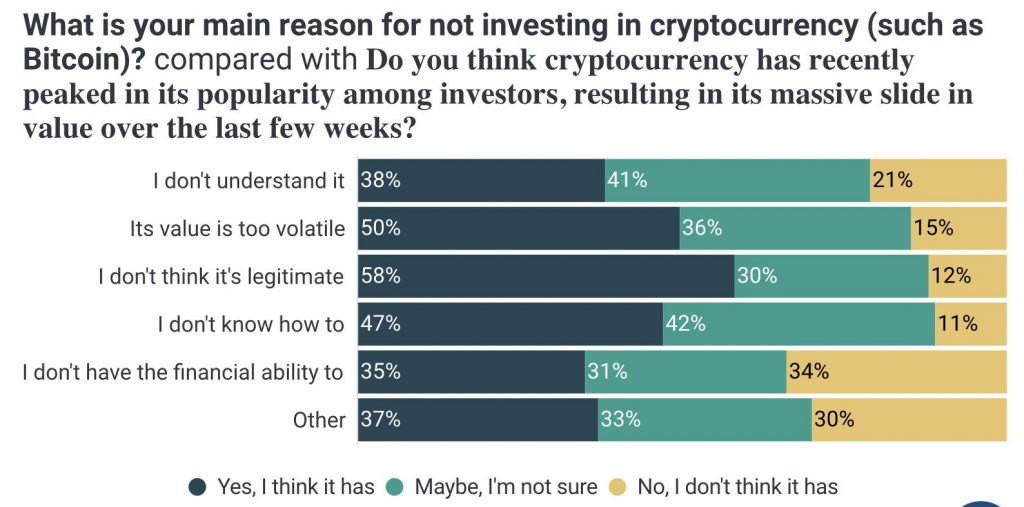

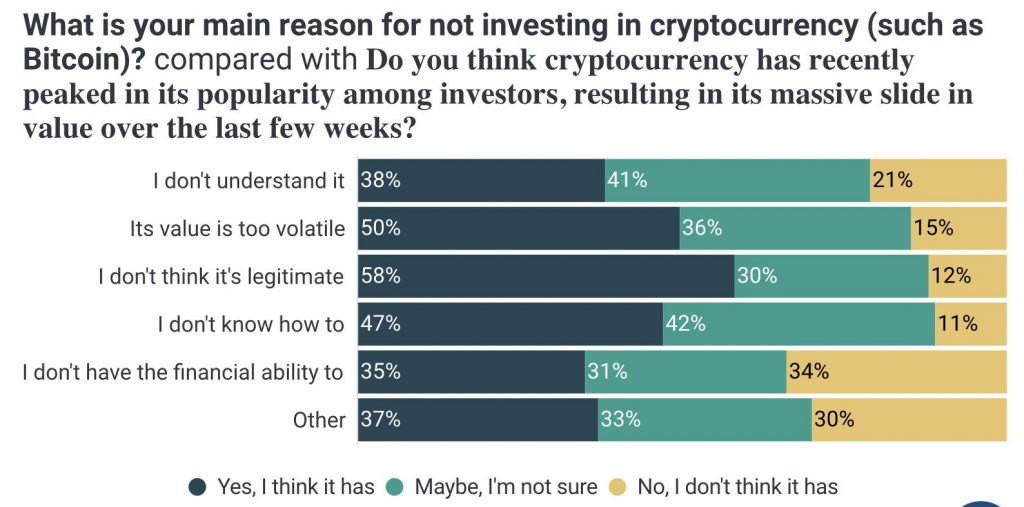

Additionally, the report found that some have not invested in crypto because of the perceived lack of legitimacy. Another reason was the volatility of cryptocurrencies, followed by the lack of knowledge.