Metaverse has been a trending topic of discussion lately. The Apple Worldwide Developers Conference 2023 [WWDC ’23] was one of the main reasons why the Metaverse was under the spotlight. The technology giant unveiled its ‘Vision Pro’ AR/VR headset a day back, making the entire industry excited about its involvement in the industry.

Also Read: Ethereum: 67% of New NFTs Minted Are Profitable

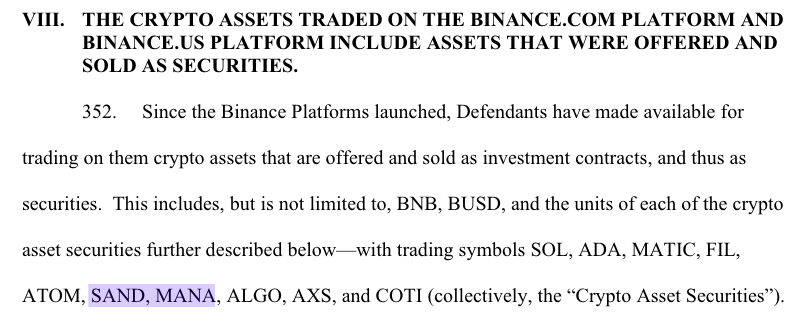

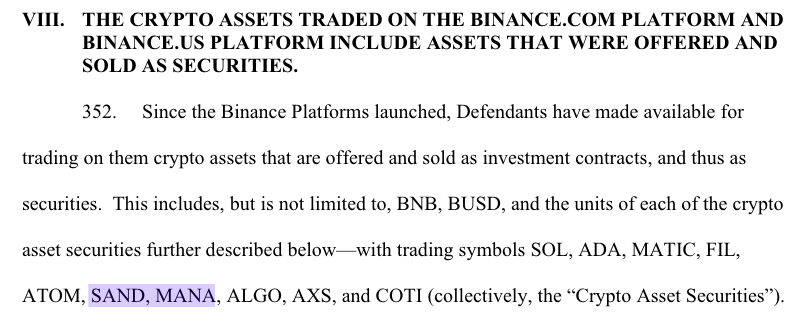

Just as the hype was gaining steam, the cryptoverse was stumped by another situation. The U.S. SEC sued the biggest crypto exchange, Binance, and its executive, Changpeng Zhao for securities law violations. The regulator has accused the exchange of mishandling customer funds. Additionally, it also blamed the exchange for allegedly lying to both regulators and investors regarding its operations. The agency further went on to deem a host of tokens as securities. Metaverse-related tokens like The Sandbox [SAND] and Decentraland [MANA] were a part of the list.

Also Read: Crypto: U.S. CFTC Looking to Change Risk Rules

Reactions: People, Price

People from the space believe that more targets will eventually be added by the SEC. Web3 gamer with the Twitter handle ‘Brycent’ said,

“They will probably come down on many more. There are just the biggest players Web3 gaming has had from a Metaverse token perspective over the last few years.”

Riding on the WWDC hype, SAND and MANA was one of the top gainers on early Monday. However, by the end of the day, they were a part of the top losers list. Over the past 24-hours, both the tokens shed roughly 10% value respectively.

SAND went on to create a daily low at $0.505, while MANA dropped down to $0.448. However, neither of the aforementioned levels was lower than the troughs created in May. On Tuesday, June 6, both tokens were trading borderline green. At press time, they were priced at $0.52 and $0.46 respectively.

Also Read: SHIB, PEPE: Bitcoin Devs Want to Crush $500 Million Meme Coin Market