After a fruitful Q1, Bitcoin briefly carried the positive momentum into Q2. In mid-April, the market’s largest crypto asset went on to breach $31,000. Right after that, however, the correction phase set in. After weeks of lackluster performance amid the legal drama, Bitcoin started rallying again on the back of BlackRock’s BTC ETF application. The bullish phase kept renewing as others including WisdomTree, Invesco, and Valkyrie joined the party. With the help of the aforementioned catalysts, Bitcoin easily breached $30k a few hours back.

Well, BTC investors’ short-term ROI has evidently pumped up. Parallelly, even long-term investors have been relishing the fruit. MicroStrategy, the largest institutional holder of Bitcoin, is one such entity.

A day back, CryptoQuant’s Ki Young Ju brought to light that MicroStrategy’s holdings, comprising 140k BTC, were on the verge of breaking even at $30,045. Well, when Bitcoin’s price attained the level earlier today, MSTR’s BTC portfolio nullified all its losses. At press time, BTC was priced at $30,080, indicating that MicroStrategy’s BTC holdings have yet again become profitable.

Also Read: Bitcoin Spikes to $138,000 on Binance.US: Investors Become ‘Greedy’

MSTR: An alternative to BTC spot ETFs?

Now, with a host of asset managers applying for Bitcoin ETFs, investors are waiting for the SEC to approve them. In their filings, firms have argued that such investment vehicles will provide investors with indirect exposure to Bitcoin. In fact, they’ll also offer “important protections” that are not always available to them when they invest directly in the asset.

The SEC time and again, underlined that it’s concerned about market manipulation of Bitcoin’s price. In fact, in almost all of its previous rejections, it has stated the same reason. The agency has turned down several ETF applications, including those of Grayscale, VanEck, and WisdomTree, in the past.

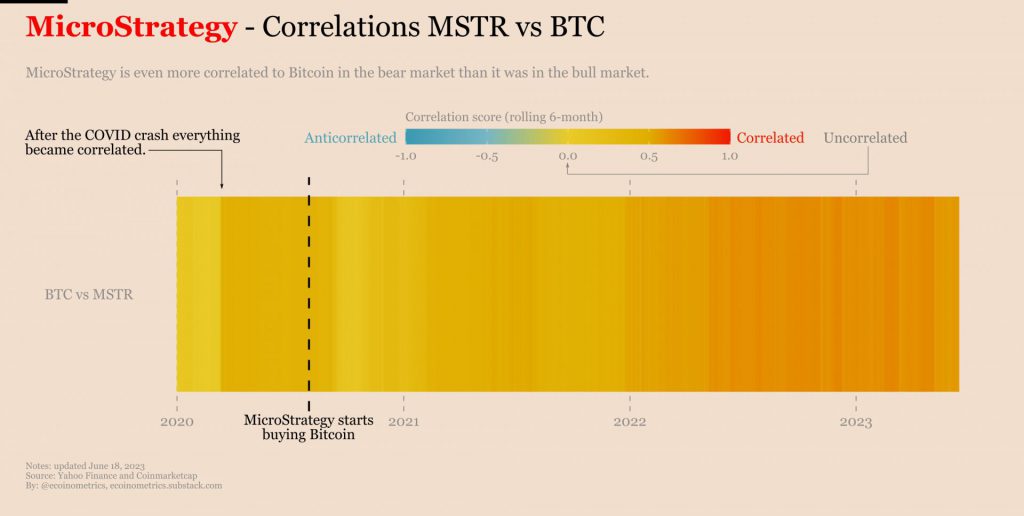

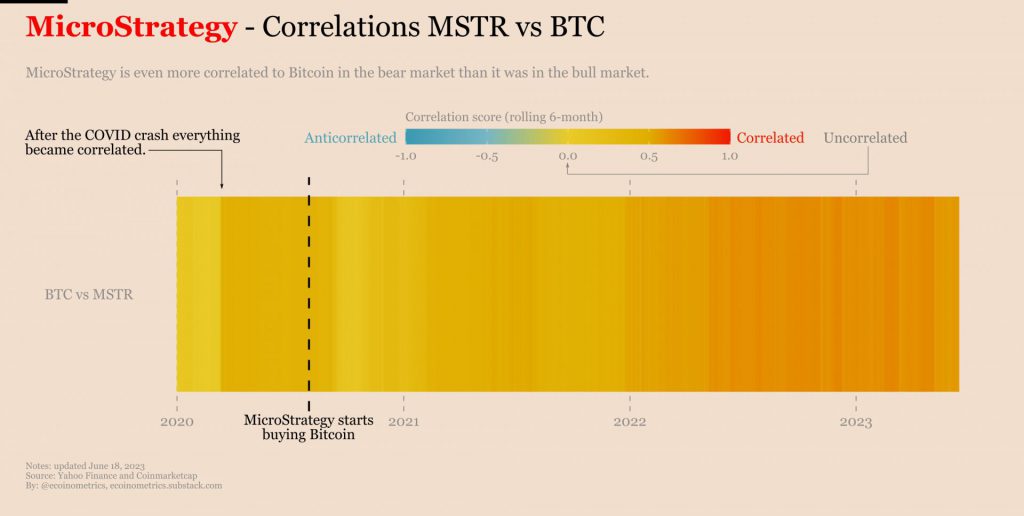

So, at this stage, if investors are seeking to get indirect exposure to Bitcoin, they might as well look into MicroStrategy’s stock. Chalking out how MSTR is proving to be a good alternative right now, a recent Econometrics analysis pointed out,

“MicroStrategy is more correlated to Bitcoin during this bear market than it was during the bull run. So if you are looking for some indirect exposure to BTC no need to look further than MSTR.”

Also Read: $1.5 Trillion Asset Manager Invesco Reactivates Bitcoin ETF Filing

Well, alongside the theoretical rise in the correlation, MSTR’s price has been following in the footsteps of Bitcoin. As illustrated out below, both the assets peaked at a similar time, hovered around bottoms at the same time, and are currently trying to initiate a trend flip.

On the weekly, their inclines are quite similar, i.e. 14.2% [BTC] and 12.9% [MSTR]. Both Bitcoin and MicroStrategy’s stock broke above their immediate resistance around the 23.6% Fib level recently. If the same gets established as support, then the assets’ prices can climb a step higher. In such a scenario, inclines to $35.9k, and $422.43 [38.2% Fib level] can be expected.