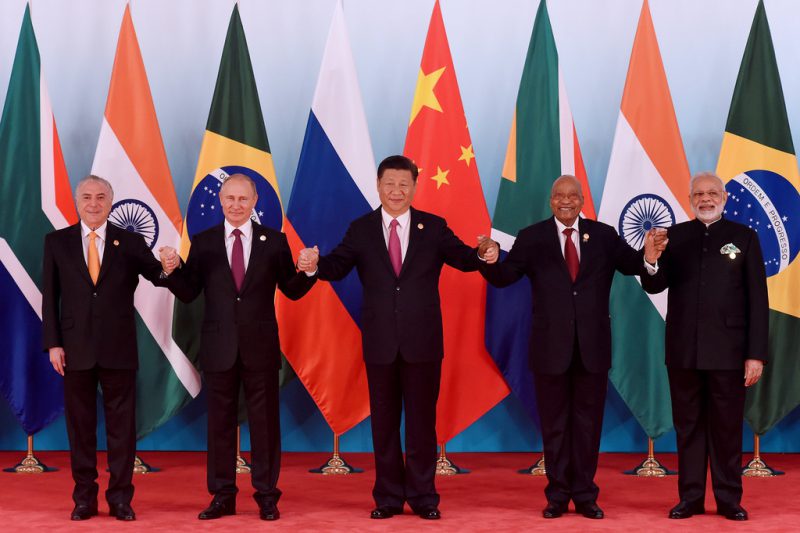

BRICS is receiving formal applications from several countries around the world showing interest in joining the alliance. A handful of nations from the Middle East are looking to enter BRICS and trade in the new and yet-to-be-decided currency.

The shift comes after the bloc of five nations collectively decided to trade in their native currency and sideline the U.S. dollar. Countries in the Middle East are ready to drop the dollar from international trade settlements and push the new tender globally.

Also Read: Egypt Looking To Join BRICS & Accept the New Global Currency

The Middle Eastern nations that are ready to join the BRICS alliance are Saudi Arabia, the United Arab Emirates, Bahrain, Egypt, and Algeria. Iran is also trying to enter the bloc as the nation is plagued with sanctions pressed by the U.S.

The countries are rich in oil and send millions of barrels to the U.S. and across the globe every day. If the Middle Eastern nations join BRICS, they could dismiss the U.S. dollar and begin settlements with the new tender.

The Middle East could also make European nations pay through the new tender and not the dollar. Therefore, the stakes are high for the USD and the next BRICS summit in South Africa could decide its fate.

Also Read: Iran Prepares To Join BRICS, Says President Ebrahim Raisi

Middle Eastern Nations & BRICS Alliance

A total of 19 countries have shown their interest in joining the BRICS alliance, according to Bloomberg. While 13 countries have formally sent in their applications, six other nations have informally asked to join it. The developing countries could tilt the Western financial power towards the East and create a new world order.

Also Read: 5 Oil-Rich Nations Ready To Join BRICS Alliance

In conclusion, the Middle Eastern countries joining the BRICS bloc could be worrisome for the dollar. The greenback could lose its status as the global reserve currency making way for a new tender to take the centerstage. This could cause devastating effects on the American economy and bring in a series of financial woes.