Bitcoin has been engulfed in a macro downtrend over the past few months. From its peak of $69k registered in November 2021, the king-coin has been trading around $19k of late.

However, most proponents continue to advocate that having Bitcoin on balance sheets would aid in improving companies’ fate. In fact, when Netflix released its Q1 earnings report, the likes of Natalie Brunell and others suggested the said remedy. Companies HODLing Bitcoin have evidently not been in a good shape lately.

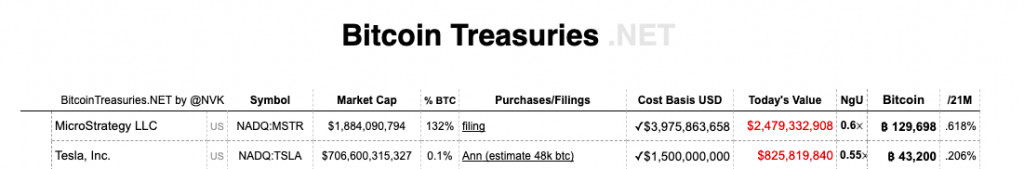

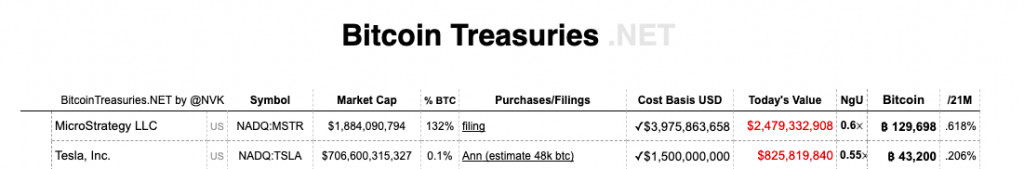

On one hand, MicroStrategy’s Saylor has been fervently buying the dip to average down the buy price. On the other, the unrealized losses of the remaining companies have been rising. Elon Musk’s Tesla has been one such company. Back in February last year, the car-maker bought $1.5 billion worth of BTC. Owing to the asset’s price depreciation, the value of the company’s HODLings has massively reduced. Outlining the same, The Telegraph reported,

“Elon Musk’s Tesla is facing a $440m (£363.5m) writedown on its Bitcoin holdings after a spectacular slump in the digital currency’s value.”

On the last day of Q2, Bitcoin traded at around $19k. Per the same, the company’s investment worth stood at an estimated $820.8 million. Chalking out how the same would reflect in its quarterly results, The Telegraph brought to light,

“Tesla is likely to record an impairment on its Bitcoin holdings of around $440m – equivalent to 9pc of its annual profit last year – when it reports quarterly results later this month.”

Tesla is GMI or NGMI?

Per basic Math, Tesla bought 46,000 coins at an approximate price of $32,610 each. Last year, to test liquidity, it sold around 4100 BTC, at roughly $60,000 each. Post accounting for impairment losses, the company’s average buy price stood around $27k-$28k per BTC.

So, is Tesla currently in a fix? Well, most indicators at this stage point towards the fact that Bitcoin’s price has either bottomed out or is merely a few thousand dollars from creating a bottom. Also, some sort of recovery is expected from the markets in Q3.

Notably, Tesla’s figure, more or less, coincides with MicroStrategy’s average buy price of $30.6k. Per data from Bitcoin treasuries, both the companies rank one and two on the HODLings list. One choosing to HODL and the other buying more coins only points towards smart money conviction with respect to long-term recovery.

End of the day, the gap created by the drop in Bitcoin’s price would gradually be filled by the bulls. The same would be reflected positively in the said companies’ financial health going forward.