Bitcoin is currently above $57,000 in the charts. The short-term price trend is looking bullish, and the long-term has been positive since July 2021. At the moment, BTC is looking to breakout above a descending channel pattern, which will allow further bullish momentum but a peculiar disruption might hinder the aforementioned narrative. In this article, we will analyze if BTC is actually facing an immediate bearish threat.

Over 38,000 Bitcoin re-entered Exchanges

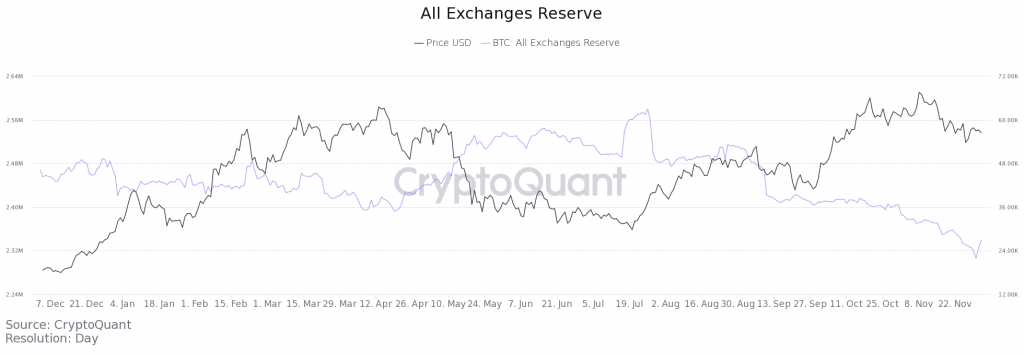

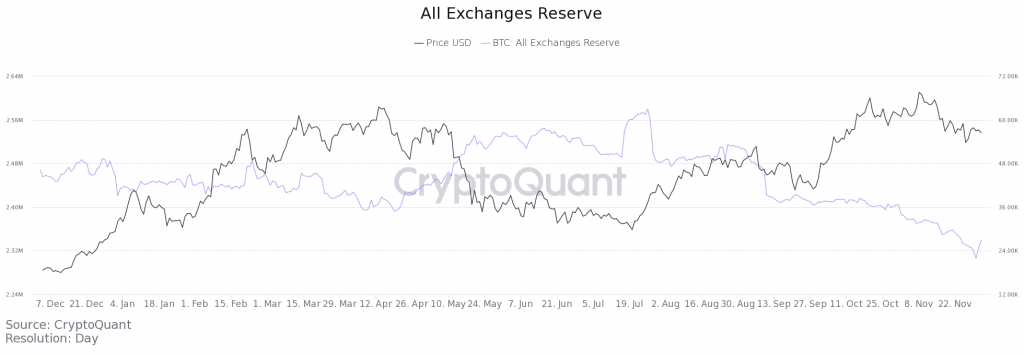

The decline of Bitcoin exchange reserves since the beginning of 2021, has been a strong bullish narrative. It infers to a reduction of BTC on platforms, which leads to a rising illiquid Bitcoin supply.

More than 78% of the current BTC supply is illiquid, but over the past 24-hours, a drastic change was in the notice. More than 38,000 BTC re-entered exchange platforms, indicating a possible whale dump. Exchange reserves witnessed a massive inflow back in July 2021, before BTC dropped down to $28,800. Hence, a similar sense of uncertainty is lapping Bitcoin at the moment.

However, there was one silver lining in the proceedings.

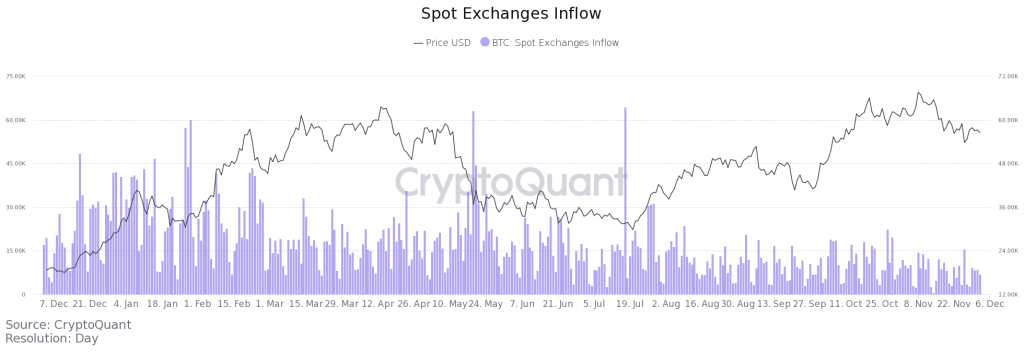

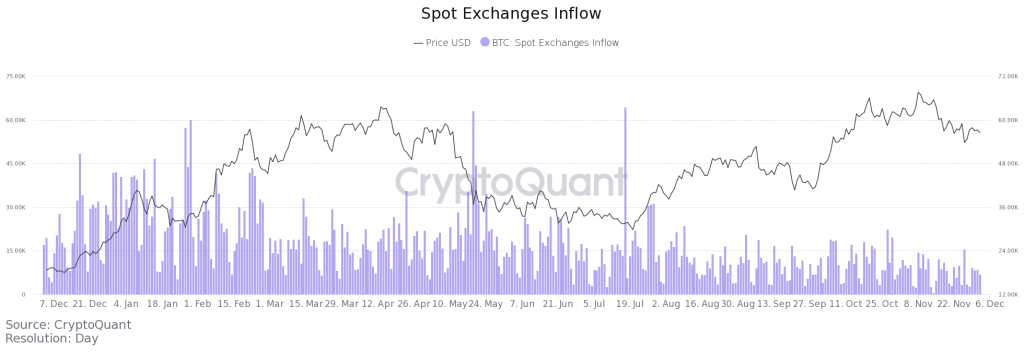

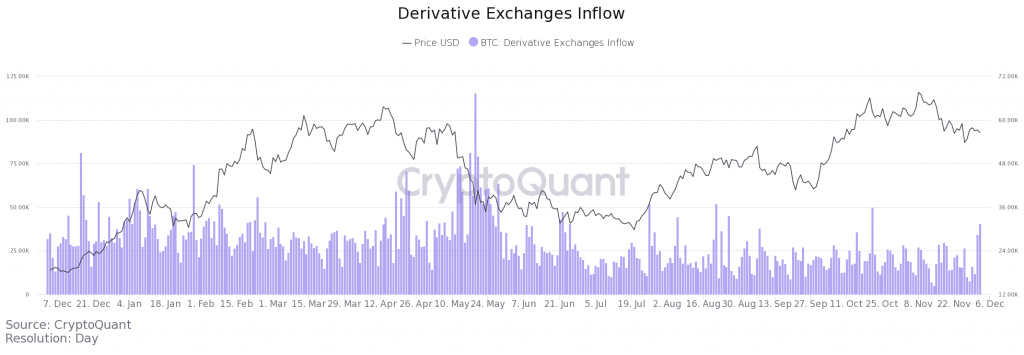

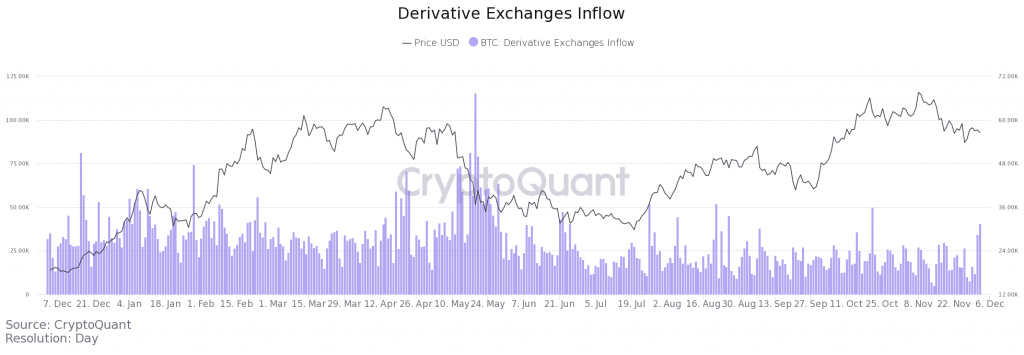

In between spot and derivatives exchanges, the former did not register a significant rise in BTC inflows(see above chart). Hence, inference can be drawn that investors were not involved in dumping Bitcoin on the exchanges.

On the other hand, derivatives exchanges witnessed a strong spike in Bitcoin inflows. It means traders are most probably making the move to re-set their leverage orders. Now, this particular situation is not entirely bullish as traders might be looking at a better long position opportunity in the near term.

Should Bitcoin investors be worried?

As mentioned earlier, Bitcoin’s long-term is majorly bullish. However, it is currently reaching a point of confluence between incline support(white line) and declining resistance(white dotted line). In order for Bitcoin to maintain a bullish bias, it is ideal that the price moves upwards after reaching the confluence. Until then, BTC holders may sit tight and analyze the market.