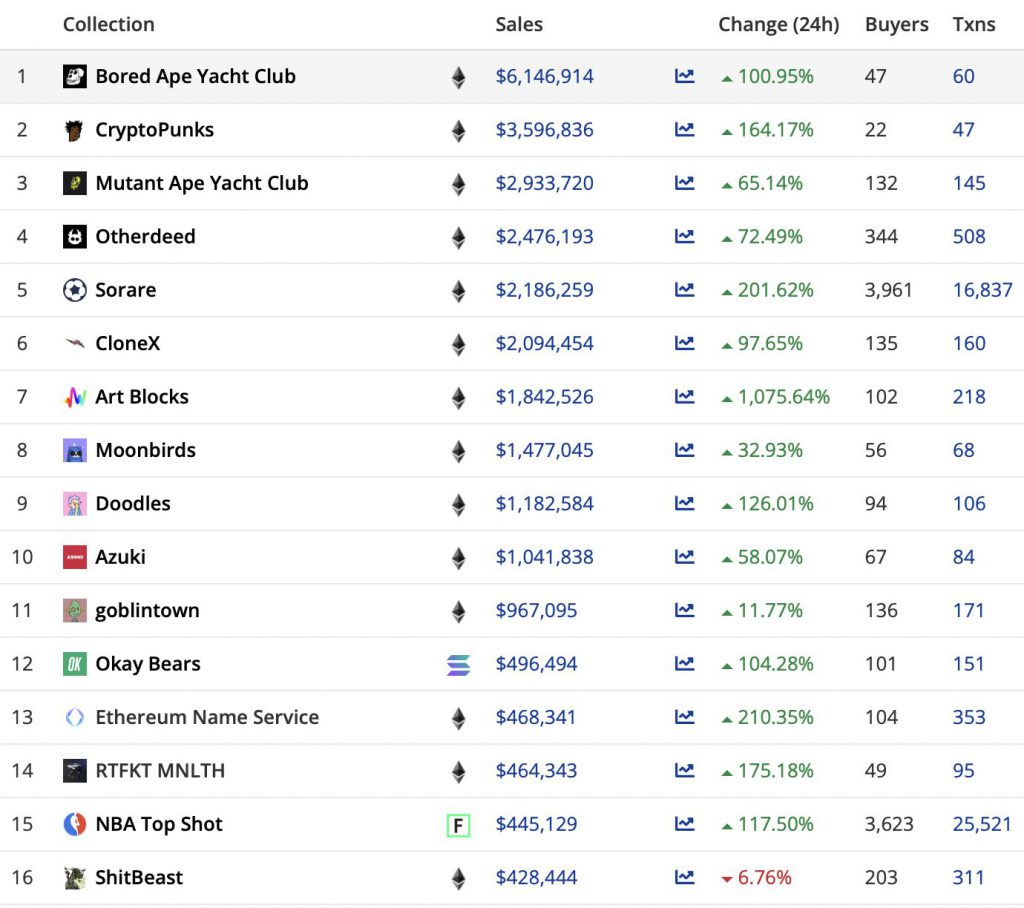

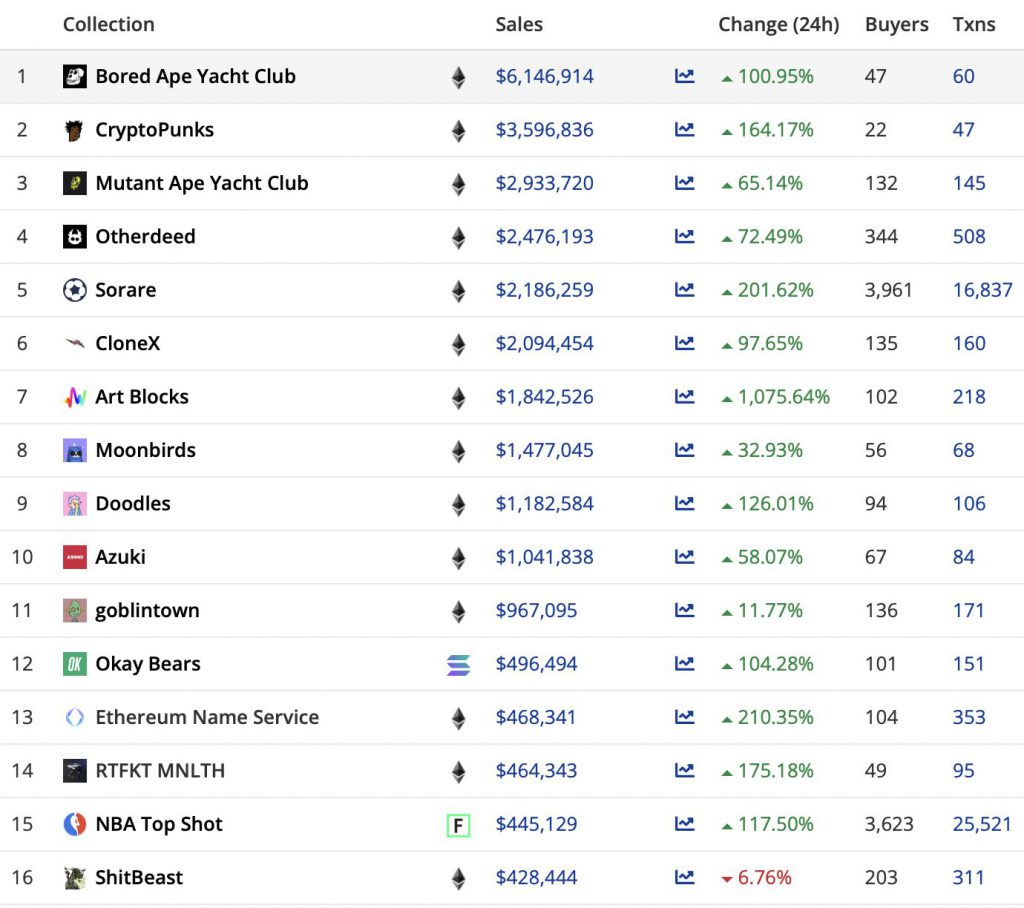

According to the data available on Cryptoslam.io, Non-fungible token (NFT) trading volumes have witnessed a sharp spike.

As floor prices fall, investors are flocking to NFT initiatives such as Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Crypto Punks, and Sorare, which have all witnessed more than 100% increases in 24-hour trading volumes.

While GoblinTown was a thing a few weeks ago, it is currently one of the least traded, with only an 11% increase compared to the ones offered by Yuga Labs (BAYC and MAYC). Art Blocks saw a whopping 1075.64% increase in trading volume, the largest in the top-10 list.

CryptoPunks #8620 and #5690 sold for 275 ETH each, or $327,000, in the past 24-hours. On the other hand, BAYC NFTs #393 and #3441 sold for 118 ETH, or $140,000, and 105 ETH, or $124,000, respectively. Earlier this year, these NFTs would have gone on to sell for millions of dollars.

According to the data available on DappRadar, Solana’s Magic Eden is currently the top NFT marketplace. The marketplace, however, saw a 3.28% dip in users. OpenSea on the other hand took the second spot but witnessed a whopping 20.35% dip in users.

This data suggests that only a small number of investors, most likely whales, are making all the moves. Although floor prices for projects like the BAYC and CryptoPunks have dropped to 82.5 Ether (ETH), or $96,700, and 47 ETH, or $54,800, respectively, from all-time highs of 153.70 ETH and 123 ETH, investors are still buying up assets above the floor prices.

DappRadar also shows that the NFT index, which is based on circulating supply, is down by 23%.

Ethereum (ETH) prices have taken a beating, in effect impacting the gas fees. At press time ETH was trading at $1,214.54, down by 34.7% in the 7-day charts. This reduction in value comes amid a market sell-off fueled in part by the latest Consumer Price Inflation figure, which came in at 8.6% in May.