The failure of several cryptocurrency-related businesses prompted a newfound fear among users. To combat this, many platforms began sharing their proof-of-reserves reports over the last couple of months. Prominent exchange, OKX went on to publish its third monthly PoR report earlier today. The firm highlighted how it currently holds billions in Bitcoin, Ethereum, and stablecoin Tether [USDT].

While this is OKX’s third report, it is the first to include a “more detailed asset balance dashboard.” According to this, the exchange is over-collateralized with $7.5 billion in reserves. The reserve ratio does not include OKX’s native token OKB.

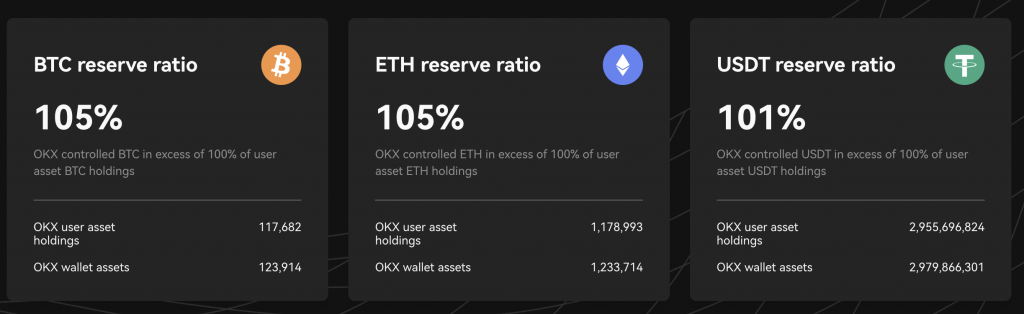

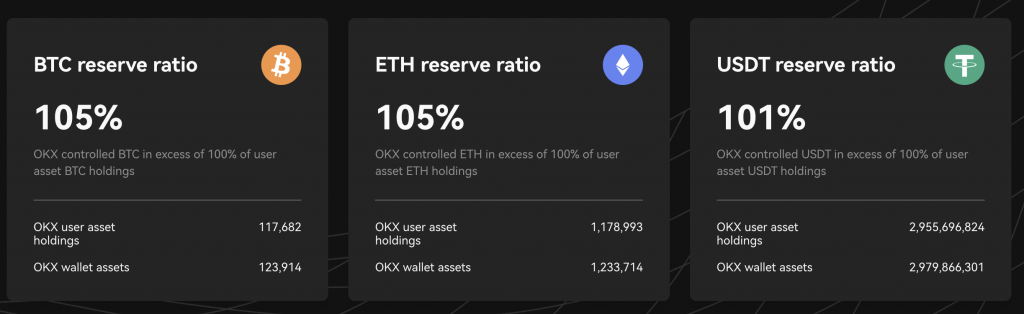

With 1:1 reserves, the reserve ratios are 105% for Bitcoin, 105% for Ether, and 101% for USDT.

While the reserve ratio for Bitcoin and Ethereum are the same, that of USDT is quite lower. OKX’s user asset holdings for Bitcoin are at 117,682 while its wallet assets are at 123,914. For Ethereum, on the other hand, OKX has 1,178,993 user investment holdings. The exchange’s wallet assets are at 1,233,714.

OKX and its “clean” reserves

By displaying this data, OKX claims its PoR to be the “largest 100% clean asset reserves among major exchanges.” According to CryptoQuant’s statistics, OKX’s reserves are entirely clean. While Huobi is 60% clean, Binance is 87% clean, Bitfinex is 70% clean, and so on.

Acknowledging CryptoQuant’s creation of a metric to gauge the “cleanliness” of reserves, OKX has decided to reveal the precise asset composition. This is referred to by CryptoQuant as an exchange’s reliance on its own native cryptocurrency.

Elaborating on the firm’s latest report, Haider Rafique, the CMO of OKX said,

“We’ve already taken a leadership position by publishing our PoR monthly. As industry standards for PoR continue to take shape, we expect that our reserve asset quality will be one of many key differentiating factors for OKX in the market.”

Earlier, Mazars Group handled the PoR reports for other crypto exchanges that are competing with OKX. However, the audit firm recently ended its relations with the other platforms. This included the likes of Binance, KuCoin, and Crypto.com. Therefore, OKX is presently on a level-playing field with the other larger exchanges.