Asset manager giant PIMCO is taking baby steps toward increasing its exposure to digital currencies by investing more in digital assets.

According to the chief investment officer Daniel Ivascyn, PIMCO has the potential to disrupt the crypto-financial scene. While in an interview with CNBC, Ivascyn shared that PIMCO did its due diligence by speaking to investors before investing in the digital asset. He also added that the firm plans on trading certain cryptocurrencies. The trading is part of their “ trend-following strategies.”

“We’re looking at potentially trading certain cryptos as part of our trend-following strategies or quant-oriented strategies,” said CIO Daniel Ivascyn

Growing Crypto Acceptance by Institutions

Daniel shared PIMCO has some exposure to crypto since some hedge-fund portfolios are trading digital asset-linked securities. “We’re trading from a relative value perspective. So we’re not taking directional exposure,” Ivascyn shared. The company is set to cast more of its net into the crypto waters.

This announcement by PIMCO is a reflection of the growing interest in crypto by various companies and institutions across the country and world. In Asia, crypto’s market cap is up by 706%, with institutional capital being the driving force.

In September, Nickel Digital Asset Management carried out a survey. The survey by the European investment manager revealed that 62% of global institutional investors plan on making their first crypto investment within 12 months with no prior exposure. This survey backs up the evident interest in crypto by institutions.

Some of these institutions that have shown interest in crypto include financial companies Fidelity and PayPal. Other institutions have even gone a step further by adding Bitcoin to their balance sheets, such as Square and MicroStrategy.

Some banks, such as Morgan Stanley and Goldman Sachs, have gone as far as to offer Bitcoin services to their clients. Many more institutions are embracing various digital currencies as a mode of payment for their multiple goods and services. There’s no stopping the growth of crypto at this rate.

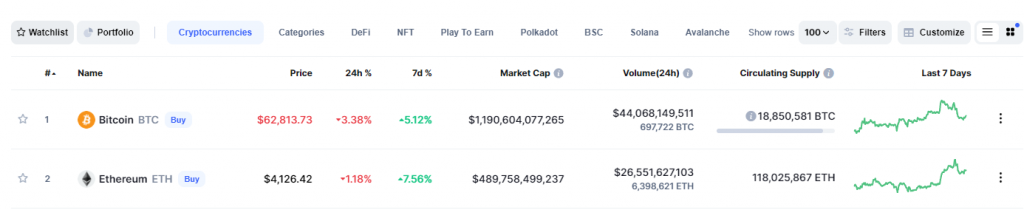

ETH and BTC are trading for $4,126 and $62,813, respectively. BTC has achieved its all-time high mark due to the successful debut of ProShares ETF. Additionally, the anticipation of the launch of BTC futures ETFs has been linked to the rise in BTC prices. The total crypto market capitalization is currently at around $2.63 trillion.

About PIMCO

PIMCO is a global investment management firm. Founded by Bill H. Gross, the firm focuses on the management of active fixed income. Other managed investments are equities, ETFs, hedge funds, commodities, private equity, and asset allocation.

As of December 31, 2020, PIMCO’s assets under management totalled $2.2 trillion. The company is also home to around 2,900 employees. Its headquarters are in Newport Beach, California. The firm is estimated to have annual revenue of $822M.

Some banks, such as Morgan Stanley and Goldman Sachs, have gone as far as to offer Bitcoin services to their clients. Many more institutions are embracing various digital currencies as a mode of payment for their multiple goods and services. There’s no stopping the growth of crypto at this rate.

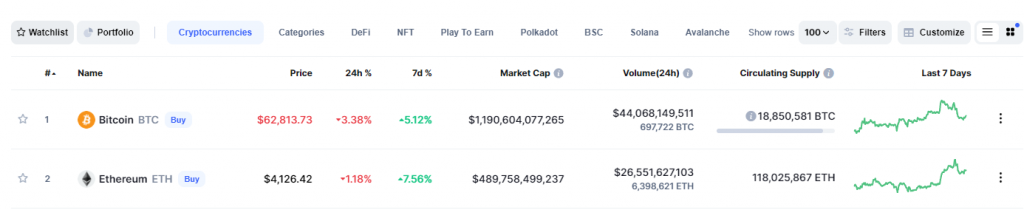

ETH and BTC are trading for $4,003 and $65,955, respectiv