Traders lost out on $365 Million in liquidations as altcoins scampered to find support on their charts following Bitcoin’s mid-week correction. In a similar position, Polygon’s MATIC attempted to find assistance at major support but exchange data showed that sellers still maintained the majority.

Considering the uncertainty of a bullish rebound, investors were advised to wait for further developments before betting on MATIC. At the time of writing, MATIC traded at $1.28, down by 3.7% over the last 24 hours.

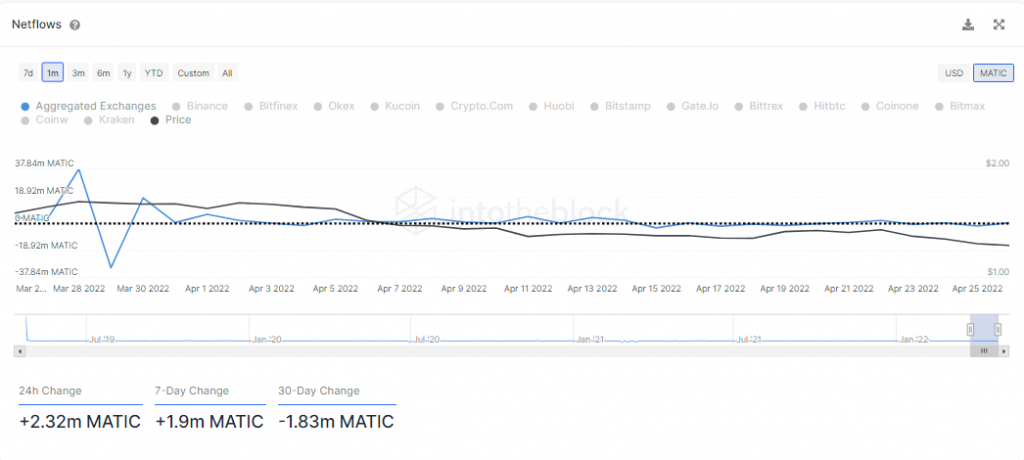

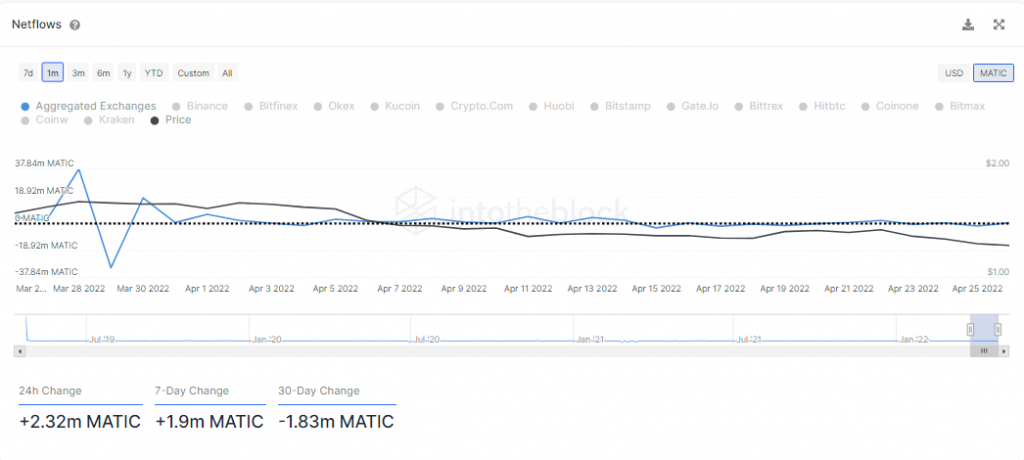

Data from IntoTheBlock showed that 2.32 Million MATIC tokens had entered exchanges in from wallets during the day as holders deaveraged their potions following the market decline. Echoes of profit-taking were also visible after MATIC’s 7% ascent on 25 April. The Large Holders NetFlow spiked around the same period, suggesting that most investors had profited from their MATIC sales. Generally, this is a positive sign as investors tend to rebuy following a market dip but in MATIC’s case, sentiment counited to remain bearish.

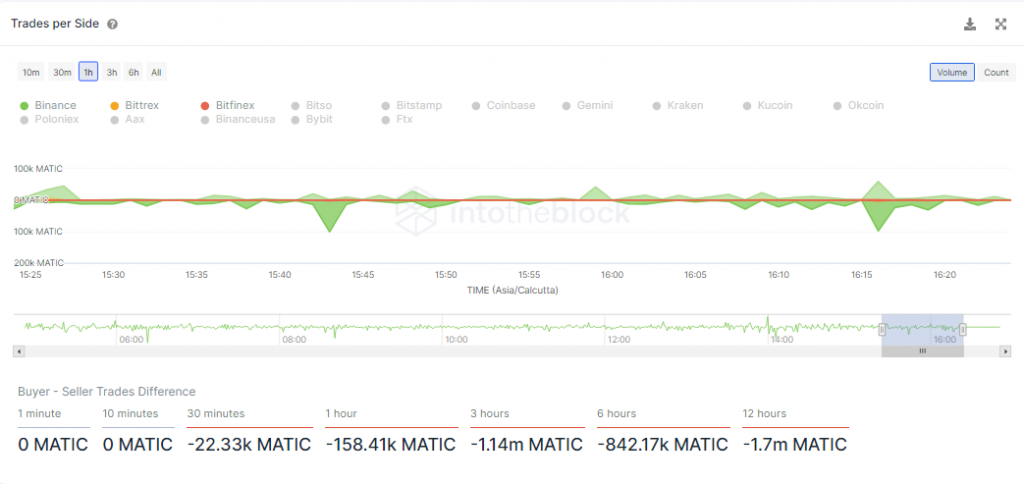

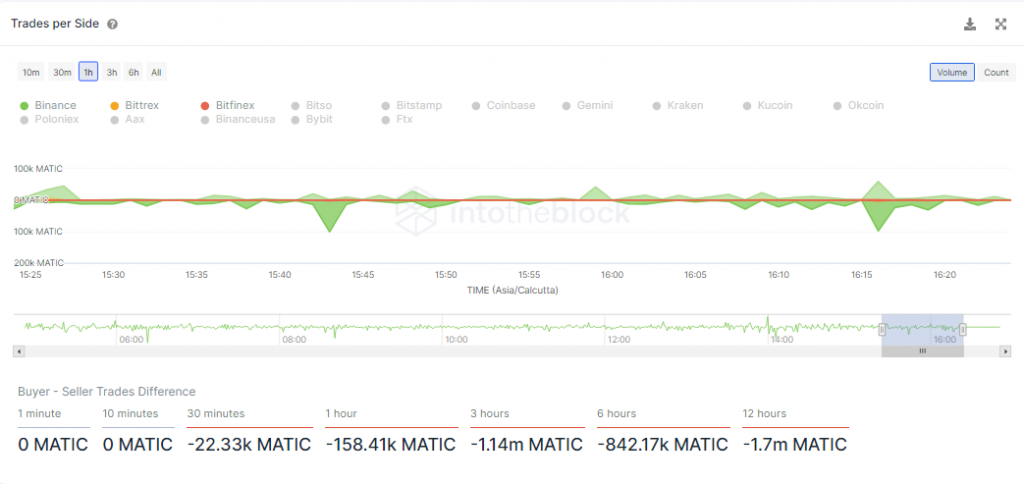

Trades made over the past few hours showed that investors were still placing sell orders on exchanges even though MATIC’s price had tagged a major support zone of $1.25-$1.35.

MATIC Daily Chart

With sentiment still not shifting in favor of the bulls, it is uncertain whether MATIC would be able to revive its value within its major defensive area. The candles were below their 4-hour 20-SMA (red), (yellow) and 200-SMA’s, which meant that sellers had more incentive to pile more pressure than to buy the dip.

With that in mind, a more logical one for investors was to wait for another move before placing a bet. In case a daily candle extends below $1.25, investors can take up short calls and exit around $1.15. A stop-loss can be kept at $1.35 as a close above the 20-SMA (red) might invalidate a short position. The trade setup carried a 1 risk/reward ratio.