Polygon’s native token MATIC hit the coveted $1-mark last week and investors who were part of its earlier bull run would understand why it’s a significant development. Back in October, MATIC surprised crypto investors after the $1-mark fueled a massive rally that went against the broader market trend. Eventually, MATIC climbed by 180% and set a new ATH at around $2.94. With the $1-mark already triggering a few buy orders this week, here’s taking a look at whether MATIC can buck the trend again and relive a similar rally.

Polygon holders show signs of accumulation

Since 75% of MATIC’s supply is held by whales, the first reaction would be to gauge how large holders were reacting in the current market. Interestingly, there were signs of accumulation, with the large holders NetFlow up by 95% since MATIC hit the $1-mark. Similar spikes were observed prior to the MATIC rally last year as well.

However, a significant ingredient was missing this time around – a rising TVL. Unlike last year where Polygon’s ascent was backed by users staking more assets on the network, the same was absent this time around. Polygon’s TVL was significantly from its peak, with the network unable to attract investors like before. April was particularly brutal for TVL growth, with the figure down by 17% from $5.7 Billion to $4.7 Billion.

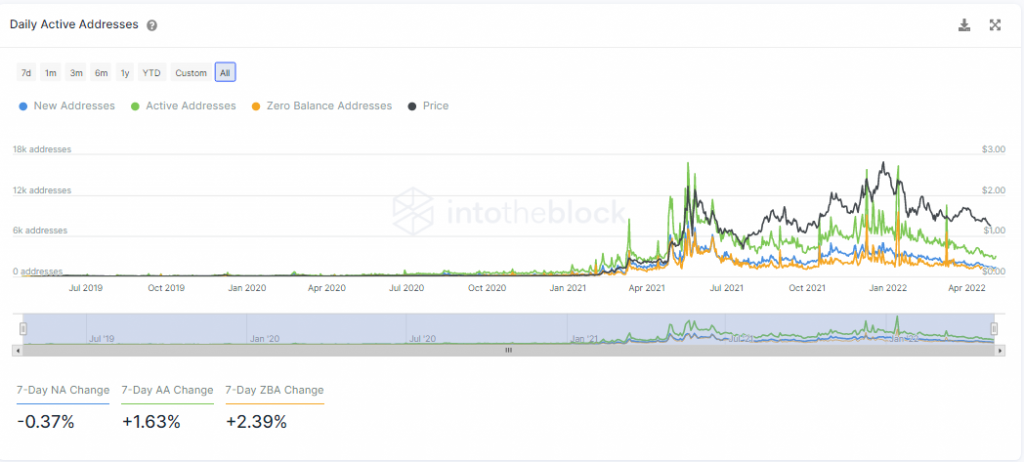

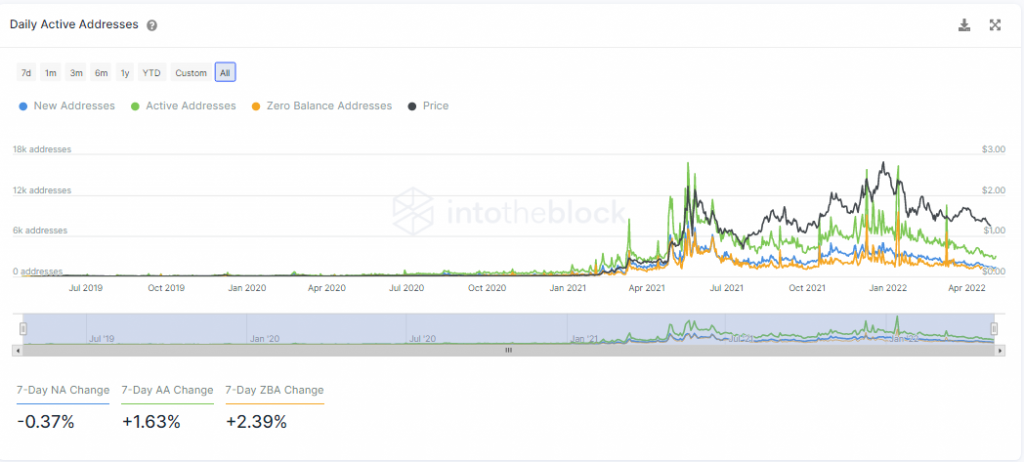

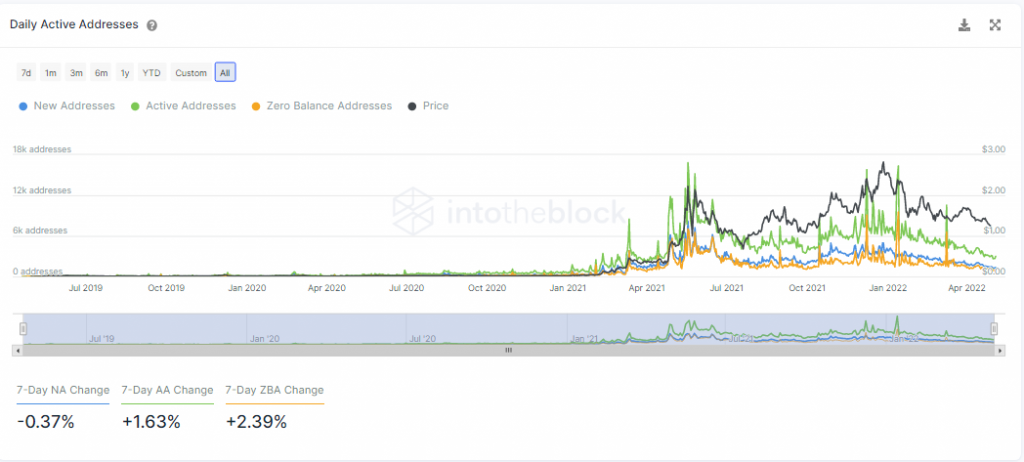

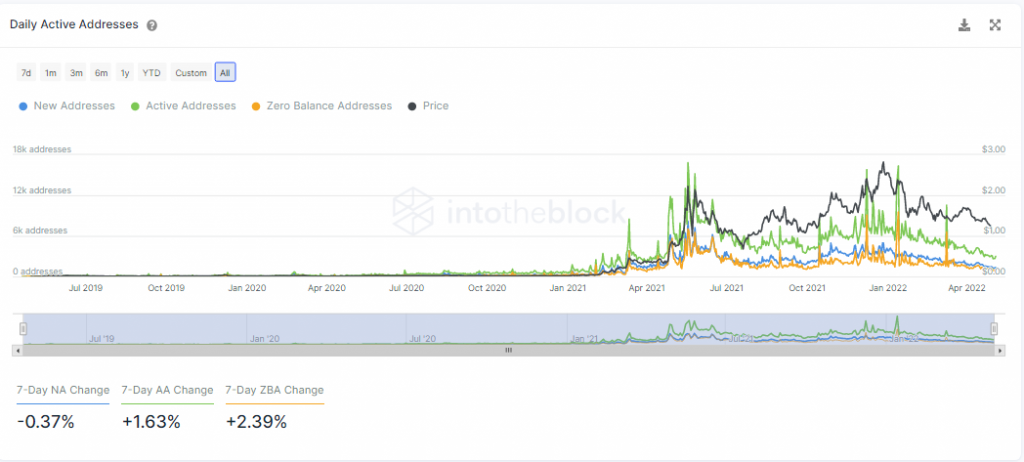

Daily active addresses gave a more telling picture of network growth. According to IntoTheBlock, Polygon’s daily active addresses were currently at monthly lows after constantly falling throughout April. New addresses were also dwindling as the network failed to attract fresh investors unlike its rally last year.

Conclusion

MATIC may have established a reputation for bucking the trend during a weaker broader market but expecting a repeat of the same is certainly a longshot. Why? In two words – network growth. Unlike earlier, MATIC’s network growth was uninspiring and if anything, the readings went against a rally.