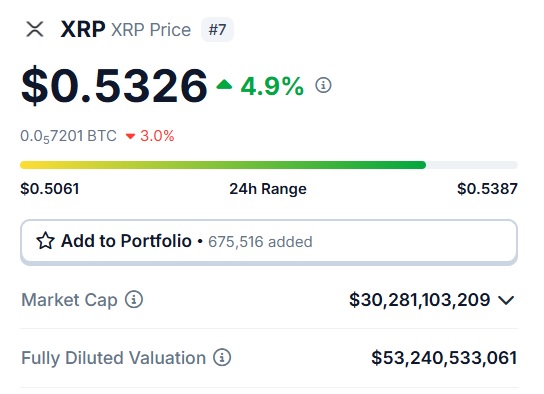

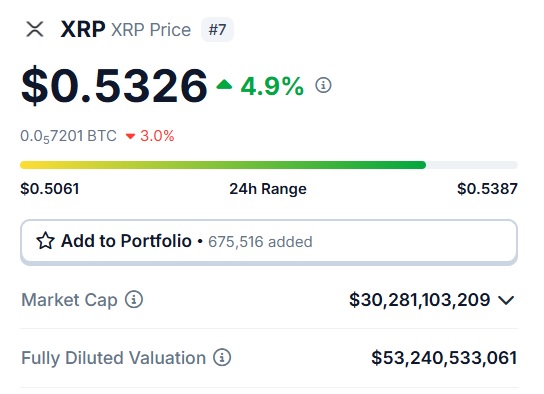

Ripple’s native token, XRP, spiked 5% in the indices on US election day as the results poured in. XRP touched a high of $0.53 and is attracting bullish sentiments in the indices. The broader cryptocurrency market remains in the green, with Bitcoin inching toward a 10% climb. The shift in the market trend is due to the US election, as investors remained on the sidelines before the counting.

Also Read: Elon Musk To Make Donald Trump Talk About Dogecoin?

Apart from Bitcoin Ripple’s XRP, Dogecoin spiked the highest as it surged nearly 25% in the charts on the election results day. The spike comes after speculation that Donald Trump could give Elon Musk a cabinet role if elected. This made investors take entry positions in Dogecoin hoping that the cryptocurrency could soon be endorsed by the President-elect.

Also Read: Can US Election Results Propel Bitcoin (BTC) Towards $80K?

Ripple: What is Next for XRP After US Election Results?

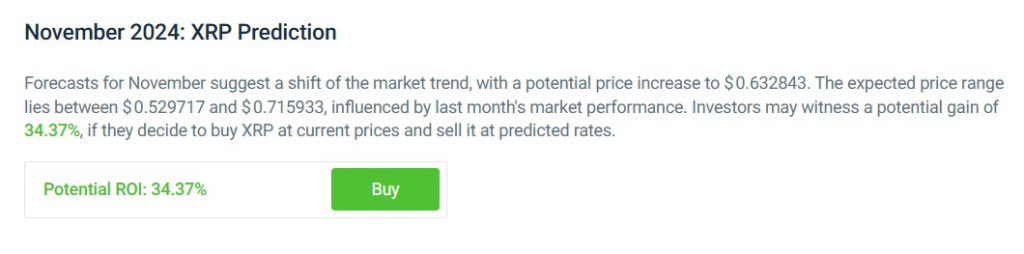

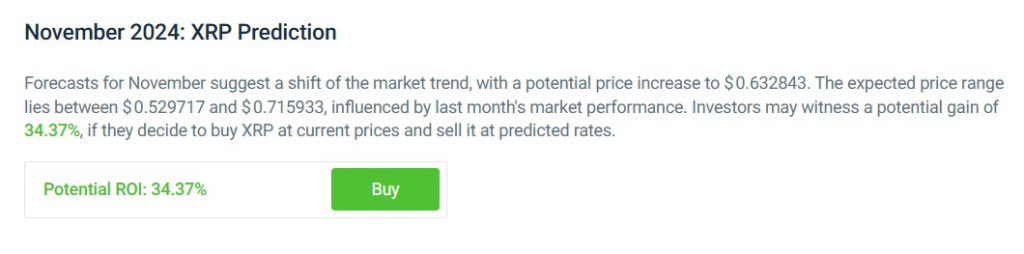

Leading on-chain metrics and price prediction firm CoinCodex remains bullish on Ripple XRP’s prospects in November. According to the recent price prediction, XRP could continue scaling up in the charts and hit a new monthly high. The latest price forecast estimates that Ripple’s native token could surge by nearly 35% after the US election results.

The estimates indicate that XRP could hit a high of $0.715 by the end of November 2024. Therefore, if the forecast is accurate, an investment of $1,000 could turn into $1,350.

Also Read: Cryptocurrency: 97% of All Meme Coins Are Officially Dead

“Forecasts for November suggest a shift of the market trend, with a potential price increase to $0.715. Investors may witness a potential gain of 34.28%, if they decide to buy XRP at current prices and sell it at predicted rates,” read the prediction.

Also Read: The Global Shift Beyond De-dollarization to De-Westernization

The US election results also pulled the Asian stock market as India’s Sensex spiked 450 points on the opening bell. Japan’s Nikkei is up 830 points, and Singapore’s SGX surged 185 points. The cryptocurrency and stock market remain in the green on the day of the US election results.