De-dollarization is gaining unprecedented momentum right now as Western sanctions against Russia continue to reshape global finance in significant ways. Following Russia’s 2022 invasion of Ukraine, the US and its allies imposed sweeping sanctions that have, perhaps unexpectedly, accelerated the ongoing move away from dollar dominance in international trade and finance.

Also Read: Two Economic Giants Team Up to Shatter US Dollar Dependence with 6 De-Dollarization Projects

How US Sanctions on Russia are Speeding Up Global De-dollarization

Russia’s Economic Pivot

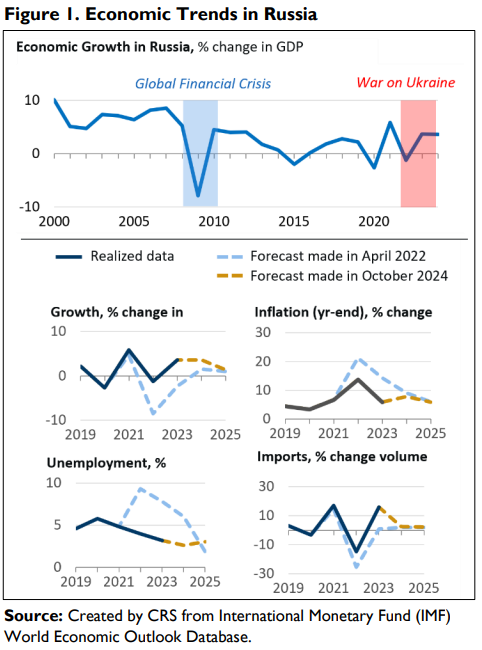

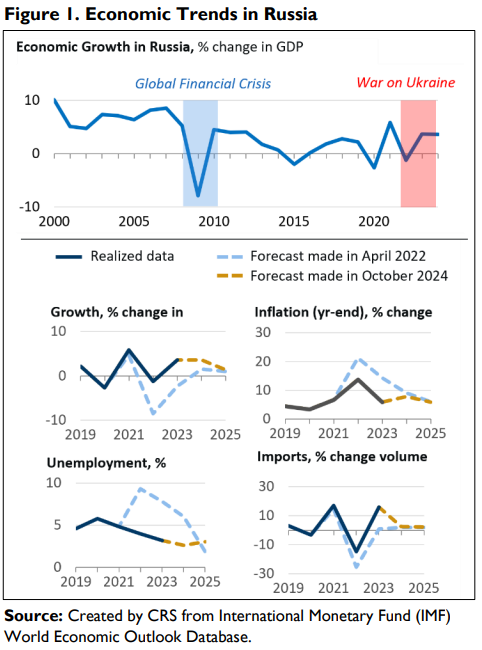

Russia’s economy has shown rather surprising resilience against the sanctions, with the IMF currently reporting better-than-expected performance in several key metrics. The de-dollarization push has been facilitated by Russia’s somewhat rapid transition to alternative trading partners and also by its continued energy exports to various global markets.

Also Read: Shiba Inu: How Much $5,000 Would Turn Into if SHIB Reclaims Its All-Time High?

Russian Finance Minister Anton Siluanov stated:

“More than 90% of mutual payments with China have been transferred to national currency.”

China-Russia Financial Alliance

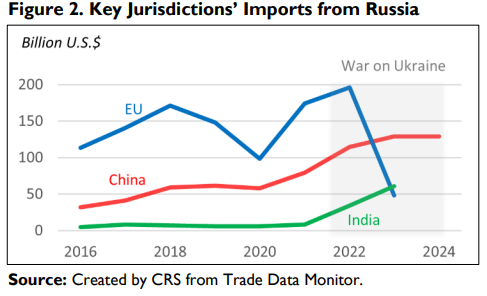

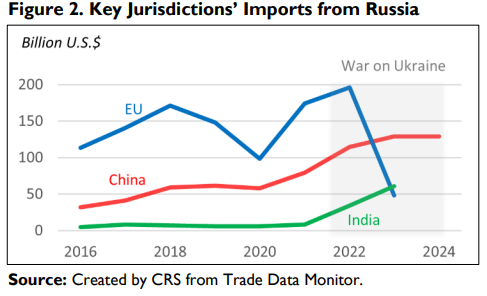

De-dollarization efforts have intensified quite a bit as China has emerged as Russia’s key economic partner in recent months. Trade between the two countries has reached historic highs at this point, with China’s imports from Russia increasing by around 60% between 2021 and 2024, according to available data.

Also Read: 2 Stocks to Consider Buying as US Markets Rebound

Brahma Channelly, author of international relations books, observed:

“The efficacy of U.S. sanctions has been eroding with the relative decline of American power, and a growing body of evidence suggests that such measures have often proved counterproductive to America’s own economic and geopolitical interests.”

Global De-dollarization Impact

The sanctions have prompted the development of various alternative payment systems designed to operate independently of Western financial infrastructure. As of now, Russia has expanded its SPFS system, while also joining China’s CIPS international payment system for cross-border transactions.

A Congressional Research Service report noted:

“Russia’s economy has largely withstood sanctions to date, but economic pressures within Russia are building.”

Also Read: Pi Network Surges 100% After Breakout: Is $1.87 the Next Target?

The ongoing de-dollarization trend extends beyond just Russia and China at the moment. According to the Wall Street Journal, Saudi Arabia has engaged in “active talks with Beijing to price some of its oil sales in yuan.” This global de-dollarization movement presents some significant financial risks as traditional systems fragment in different ways, though the dollar still accounts for approximately 58.85% of international reserves per IMF data from Q1 2024.