After recording its best-ever day on 13 May since the Robinhood listing, Shiba Inu’s bullish bias way quickly faded away on Monday morning. The price was dangerously close to breaking down from a bearish pennant and with downside risks still intact, a 40% correction cannot be ruled out this week.

As highlighted in an earlier article, Shiba Inu had to establish new supports between $0.0000 to avoid slipping down to its July 2021 levels. Now, the weekend spike was the first stepping stone needed to establish a new base but let’s take a look at whether SHIB was able to stand its ground.

On the 4-hour time frame, Shiba Inu created a few highs above $0.0000100 but was unable to withstand selling pressure as gains were limited to the 61.8% Fibonacci level (calculated through SHIB’s decline from $0.00001794-$0.00000874). As pressure weakened on Monday morning, SHIB moved back below the 50% and 38.2% Fib levels, and a candle had already punctured below the bearish pennant pattern. The development primed SHIB for weaker price action.

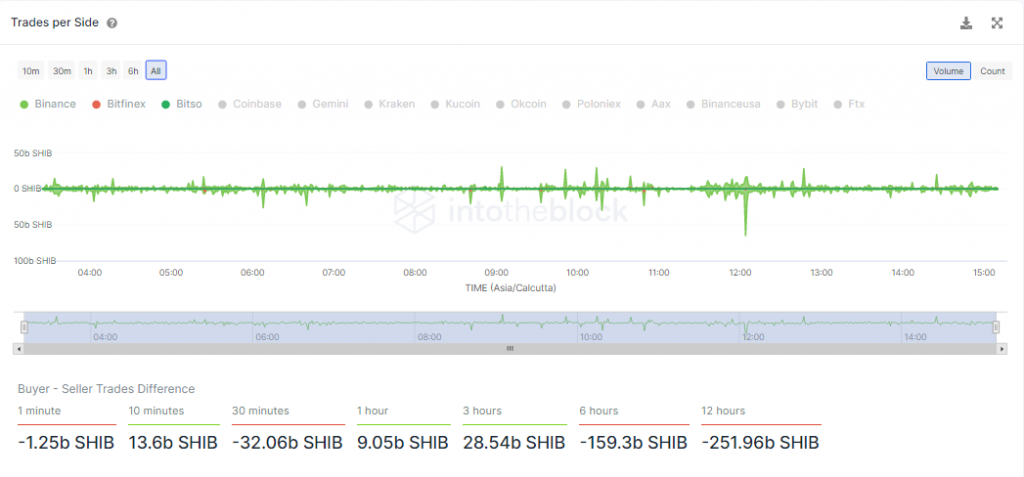

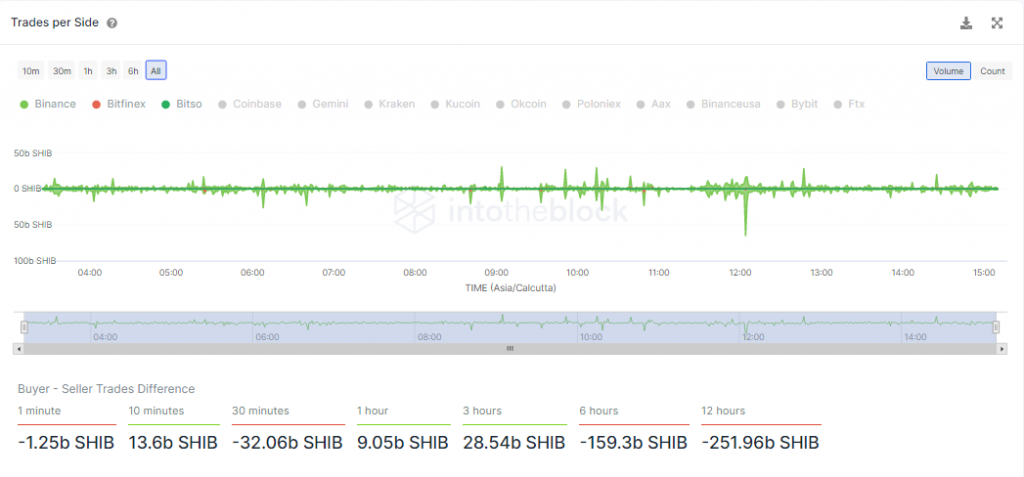

This was further supplemented by exchange data which showed that most investors were skeptical of buying Shiba Inu. Although a few buy orders were made in the past hour, sell-side pressure still dominated at press time.

What happens if SHIB breaks below $0.0000100?

Now, if Shiba Inu breaks below the bearish pattern and closes below $0.0000100, its market structure could shatter once again. The lack of immediate support could see SHIB extends losses to $0.00000600 – a level which SHIB hasn’t tested since July 2021.

On the plus side, the $0.00000600 level seemed to be a good buy opportunity for long-term investors. The area had triggered multiple rallies for SHIB last year, each ranging between 70%-80%.

However, until then, Shiba Inu traders must be prepared to take more hits on their investments. To hedge risks, a short setup can be initiated below $0.0000100 and take-profits can be set at $0.00000600. A stop-loss can be kept at $0.00001400. The trade setup carried a 1 risk/reward ratio.