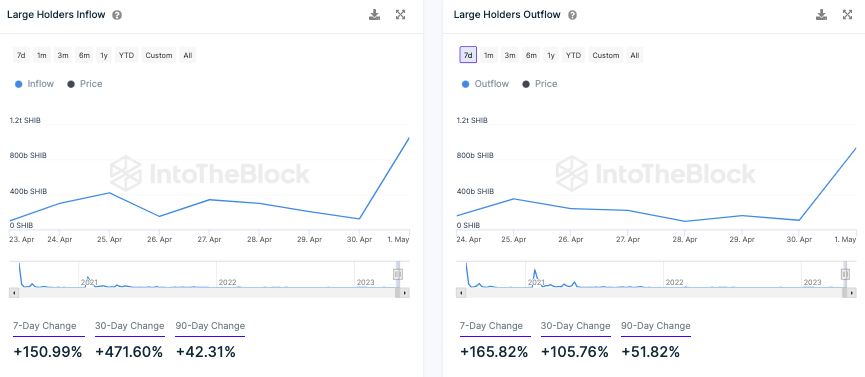

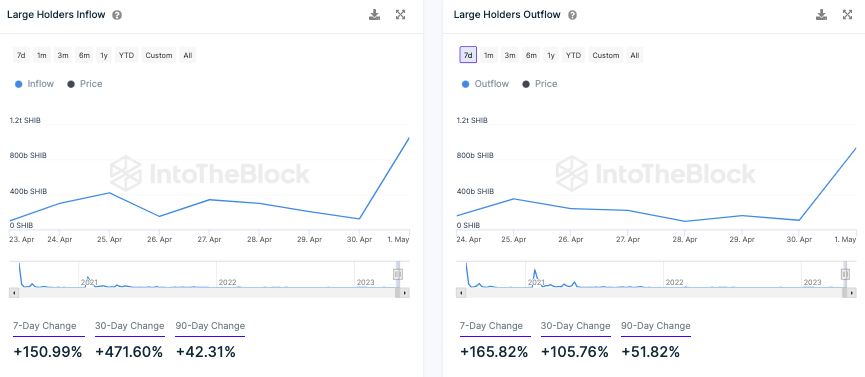

Large holders have been quite actively participating in the Shiba Inu ecosystem of late. Over the past week, both inflows and outflows have risen by more than 150%. Simplistically put, a rise in holders’ inflows indicates that they are increasingly buying, while a rise in outflows means they are selling at a faster rate.

As shown below, inflow-related transactions have inclined by over 150%, while outflow-related transactions have inclined by over 165%. However, the tokens bought were larger in quantity and carried more weight than their counterparts, resulting in a positive net-flow figure.

Also Read: Shiba Inu: Will SHIB’s Trading Volume Fall Below $100 Million?

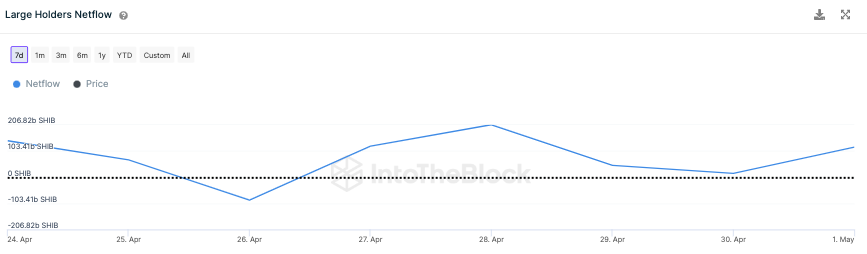

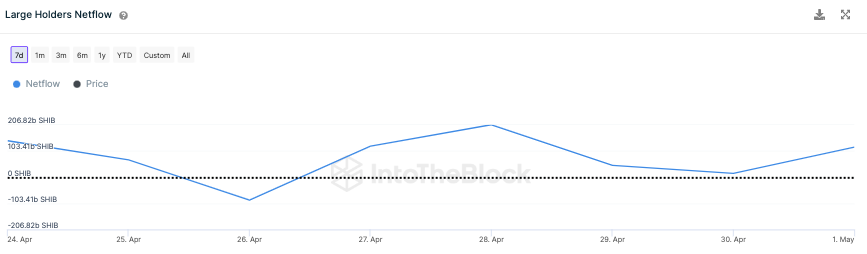

As shown below, the large holders’ net-flow curve has gradually been climbing up, suggesting that the buy-bias is in formation. In fact, this is one of the many conditions essential for a trend reversal. Specifically, the net flow reflected a value of 118.7 billion SHIB tokens at press time.

Also Read: Dogecoin Founder ‘Answers’ How to Turn $1,000 Into $100,000

Is Shiba Inu advancing toward a roadblock?

Now that the stars are slowly aligning in SHIB’s favor, will its price be able to defy its ongoing downtrend and register a recovery rally anytime soon?

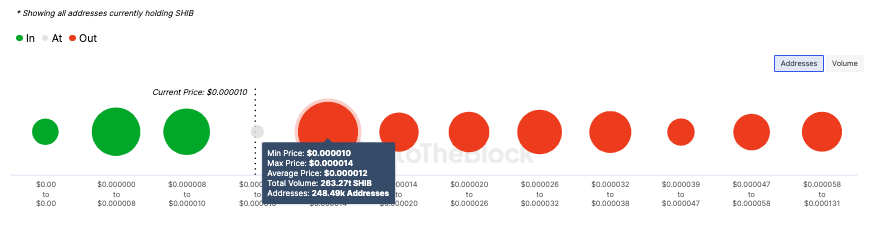

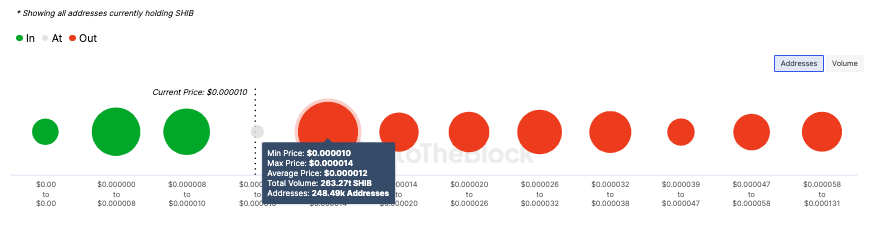

At the moment, there is a large resistance cluster around SHIB’s current price. In the range between $0.00001 and $0.000014, close to 250k addresses have bought a whopping 263 trillion SHIB tokens.

So, how could this impact Shiba Inu’s price? Well, as and when SHIB’s price inclines and these participants’ holdings break even, they’ll be triggered to sell. This could end up adding bearish pressure on the price and prevent it from gliding up further.

On the bright side, however, there is two strong on-chain support range that extends from $0.000008-$0.00001 and $0.000006-$0.000008, indicating that SHIB’s losses could be capped.

Also Read: Coinbase Execs Sued for Dumping $3 Billion Worth of COIN Shares