New listings and a metaverse introduction have capped an important period for Shiba Inu. Bullish speculations on the meme coin were evident on the chart, with SHIB recording a 77% increase between 3-7 February. On Friday, the hike was met with some resistance as SHIB inched lower amidst a risk-off broader market.

However, a rebound from the 50% Fibonacci could lead to a bullish pennant breakout as early as the weekend. At the time of writing, SHIB traded at $0.00003087, down by 6% over the last 24 hours.

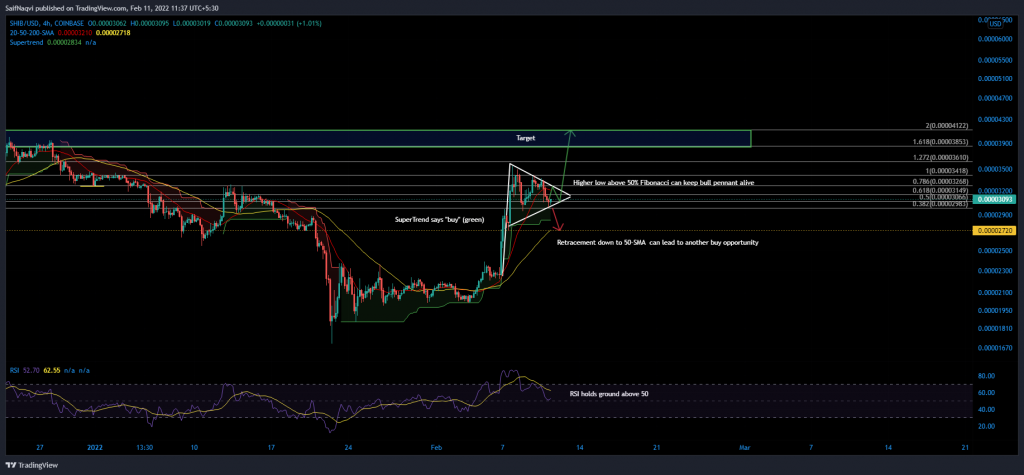

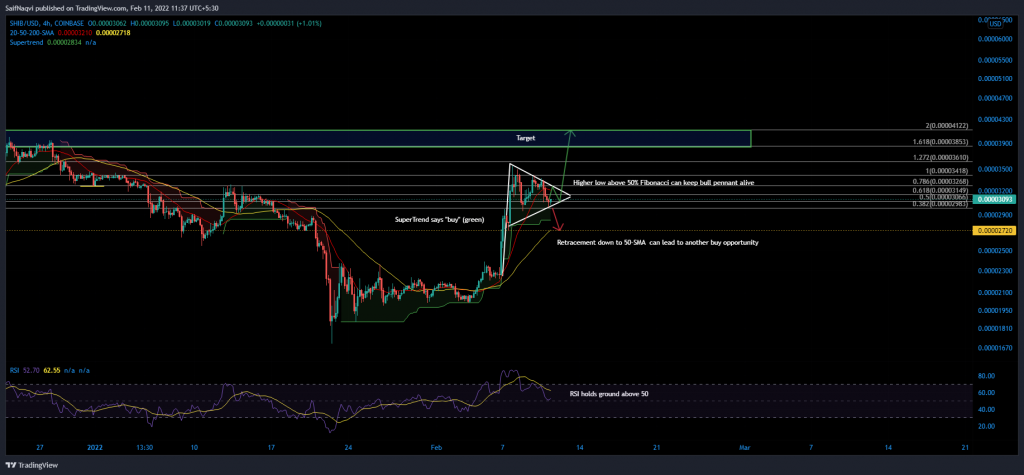

Shiba Inu 4-hour Chart

Shiba Inu’s rally was noteworthy for a couple of reasons. Not only did its price close above the daily 20 (red), 50 (yellow), and 200 (green) SMA’s, but also flipped a supply region back to demand.

With that said, a near-term correction was in play after SHIB tagged its weekly 20-SMA (not shown) at $0.00003418. Although a rebound from anywhere above $0.00002720 would maintain SHIB’s favorable outlook, a higher low at the 50% Fibonacci would be more accurate for a bullish pennant setup.

During the next upcycle, SHIB would likely target the 161.8% and 200% Fibonacci Extensions as the uptrend cuts through a pocket of weak resistance levels.

On the downside, a lower low below $0.00002770 would threaten the bullish outlook. In such a case, the market would open to a decline back to $0.0000240, offering up an additional 20% drawdown from SHIB’s press time level.

Indicators

Bulls were attempting to keep the RSI alive and kicking above 50 after the latest retracement. As long the oscillator holds above the mid-line, a bullish narrative would be active. Conversely, a move below 40 would be followed by more sell-side momentum.

The SuperTrend indicator maintained its buy signal on a 4-hour time frame but placed a stop-loss at $0.00002836, after which it would switch to “sell”.

Conclusion

A rebound from the 50% Fibonacci level would throw light on a bullish pennant setup and a breakout could trigger a large price swing over the weekend. Investors should be on the lookout for the next close above the 20-SMA (red).