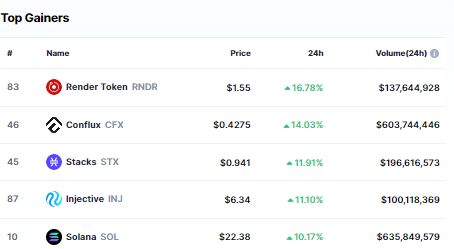

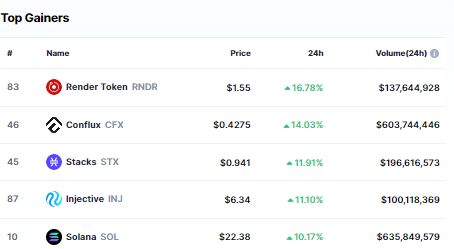

The crypto market noted a 4.49% rise in its aggregate capitalization over the past day. On Tuesday, April 11, the global crypto market cap stood at an elevated $1.24 trillion. Earlier during the day, Bitcoin went on to re-claim the $30,000 psychological benchmark. That led to a collective rally for the altcoins as well.

Solana was one such crypto. At press time, it was the fifth largest daily gainer and was seen exchanging hands at $22.38. SOL went on to register a lofty 10.17% incline over the past 24 hours to reach the said level.

Also Read: MicroStrategy’s Bitcoin Stake ‘in Profit’ Finally: Investors Add Ethereum, XRP

A recent tweet from LunarCrush revealed that Solana went on to grab the first rank out of the 4,344 coins it tracks across the market. The AltRank is basically a metric that gauges the relative combined social and market activity of an asset. Specifically, in trading volume wise Solana ranked 11th, while based on the social volume and social score, it ranked 6th.

Based on data from CMC, Solana registered a 24-hour trade volume of $635.8 million. The social mentions and engagements stood at 68.4k and 247.02 million over the past week. In fact, they were up by more than 20% each.

Also Read: Has Solana Finally Put Its FTX-Woes Behind?

State of Solana investors

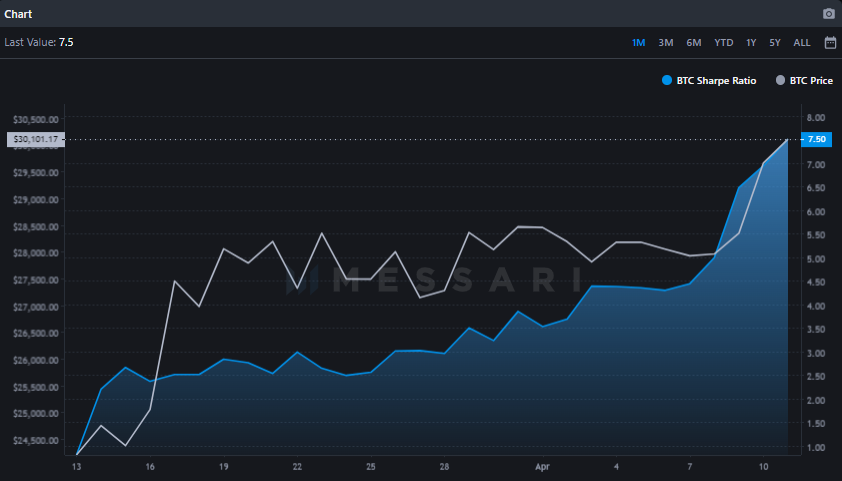

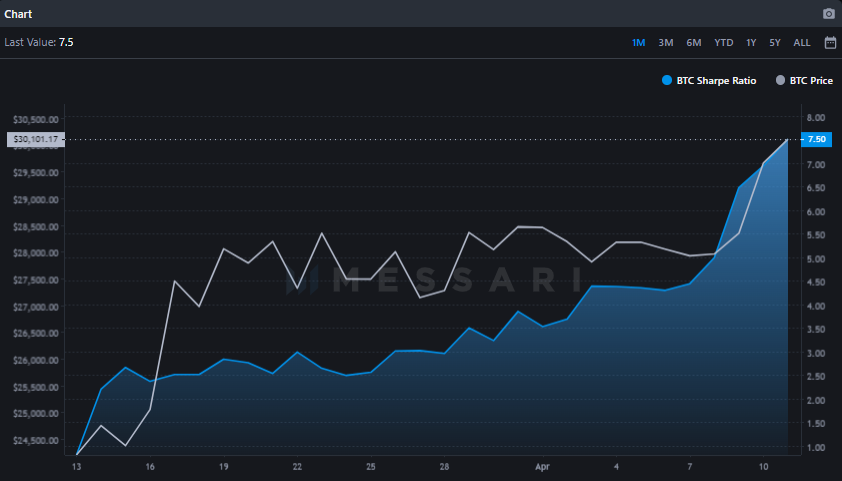

Investors have evidently been in a comfortable position of late. SOL’s Sharpe ratio is currently at a 1-month high of 7.5. This ratio basically measures the risk-adjusted returns of an asset. It reveals how much excess return investors receive in return for holding a risky and volatile asset.

At the moment, Solana is trading above its 20, 50, and 100 EMAs. However, its path above is filled with several resistances in the $24.18 to $26.6 range that has roadblocked it from inclining in 2023. Breaking beyond them and claiming a new YTD high would require some more additional momentum from the bulls.

Also Read: Blur Surpasses OpenSea as the No.1 NFT Trading Platform