The dominoes continue falling for Terraform Labs in the wake of 2022’s stablecoin collapse. The firm behind the failed TerraUSD (UST) token has now filed for Chapter 11 bankruptcy protection as liabilities stemming from the fiasco swell past $500 million.

In a Saturday court filing, Terraform Labs voluntarily initiated Chapter 11 proceedings, citing potential debts and assets totaling between $100 million and $500 million. The bankruptcy bid comes as the company faces mounting legal threats over allegations of fraud behind the UST scheme.

Also read: Shiba Inu: $1000 in SHIB Becomes $9 Million in January 2024

“We have overcome significant challenges before and…look forward to the successful resolution of the outstanding legal proceedings,” stated Terraform CEO Chris Amani.

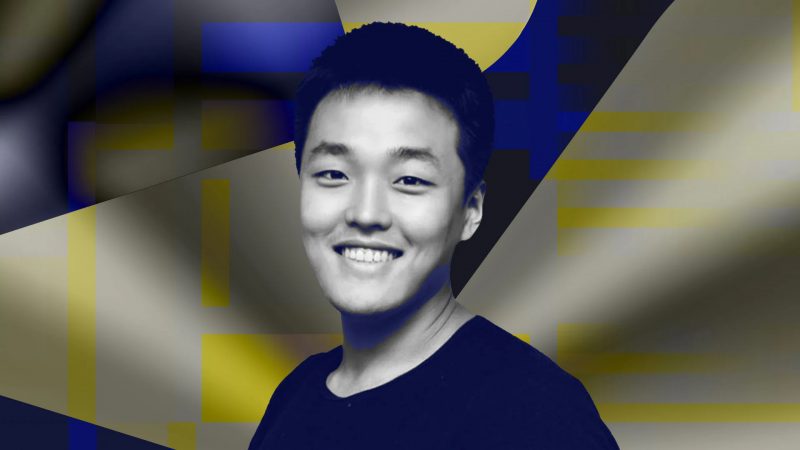

However, with Terraform Labs co-founder Do Kwon facing charges both in South Korea and the United States, the road to resolving costly lawsuits remains filled with obstacles.

Terraform Labs’ Do Kwon faces mounting pressure

The U.S. Securities and Exchange Commission recently agreed to delay civil fraud proceedings against Kwon to give his legal team more time to prepare arguments. However, the March court date looms as another peril for the Terra ecosystem founder.

South Korean authorities are pursuing a sentence of up to 40 years for Kwon, alleging his involvement in defrauding local investors during the $40 billion collapse of UST.

Also read: Cardano (ADA) Could Hit $7, But There’s a Catch

For now, Terraform Labs hopes Chapter 11 protections provide temporary relief from creditors while strengthening its position against lawsuits and claims.

Founders like Kwon drew skepticism early on for failed efforts to revive LUNA and UST following last May’s devastating depegging. However, some community developers continue building third-party projects on the original Terra chain that lives on as Terra Classic.