When Bitcoin [BTC] trades at a greater price on the South Korean exchanges than it does on other markets, it is known as the “Kimchi Premium.” A dip in South Korea’s Kimchi premium usually signifies a dip in the interest from retail investors.

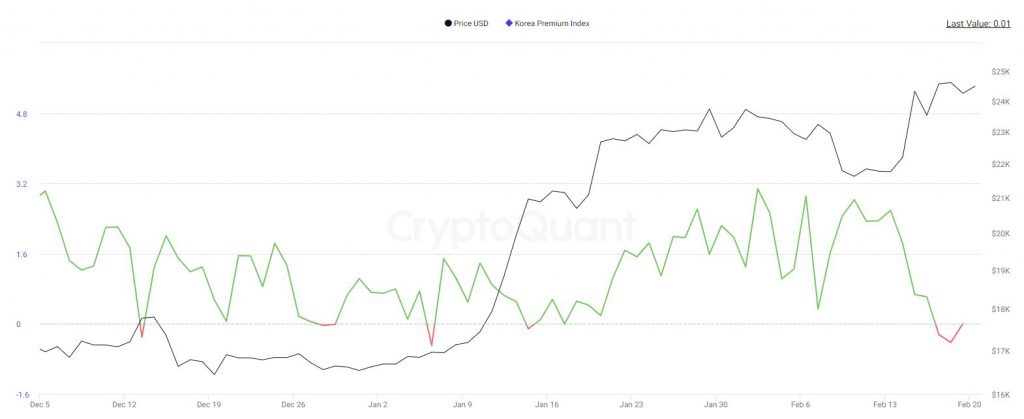

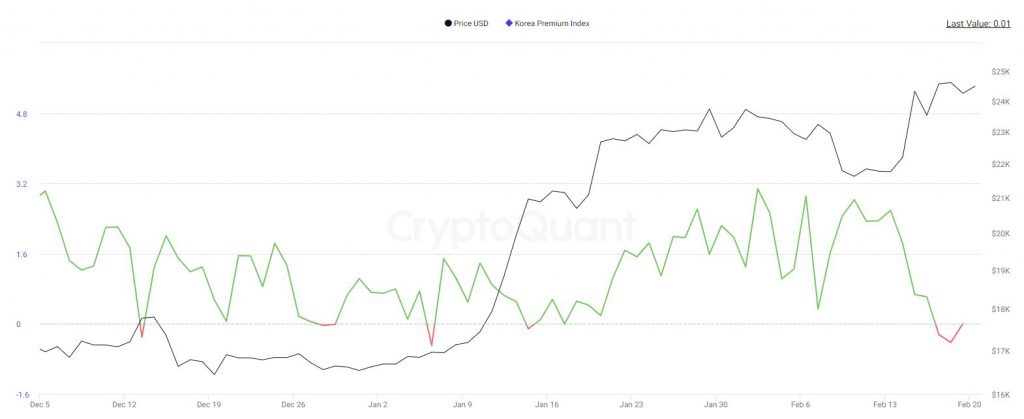

Currently, the Korea Premium Index has been lingering between the -0.24 and 0.01 range over the last two days. At press time, Bitcoin was trading for $24,944 on Binance. However, on South Korea’s prominent exchange, Bithumb BTC was priced at $24,699.

Doo Wan Nam, the COO of venture capital fund Stablenode, explained how this could benefit the market despite a fall in interest in the market.

Why is there a decline in Kimchi premium?

Over the last couple of years, a drop in the Kimchi premium has been linked to news around the Korean market. For instance, the South Korean government declared it would tighten cryptocurrency trading at the start of 2018, and the premium vanished.

Following the collapse of Terra, the regulatory climate in South Korea has been challenging. This could have lowered the interest of Koreans in the cryptocurrency industry.

Another factor that was recently brought to light was Kimchi premium’s strong link with international remittances to China. A research report by Taehee Oh of the Bank of Korea and Jangyoun Lee, an assistant professor at Incheon National University, noted that the Kimchi premium first appeared in South Korea in 2016. The year entailed high demand for Bitcoin among Korean investors but a low supply of the cryptocurrency.

The researchers explained that between Jan. 2016 and May 2021, their team examined financial data pertaining to remittances sent from outside China from around 1,211 foreign exchange enterprises. It should be noted that before Jan. 2018, the researchers claimed that the premium peaked at over 55% before declining during the 2017 Bitcoin bull run.

But how are they related? The research argues that recent developments in China were a major factor in the rise of international premiums. Additionally, although China outlawed cryptocurrency, South Korea and nations like the United States chose to regulate the sector.

This further led to Chinese arbitrageurs only withdrawing their cryptocurrency funds from outside. The report read,

“This paper shows that the Kimchi premium was positively related to the upsurge of remittances to China after controlling for the important drivers that directly impact it, such as equities, bonds, foreign exchanges, and the real economy.”