US Bitcoin ETFs have set new records, and we’re excited to see this. They gained over $1 billion in value in just three days time. BlackRock and Fidelity led this surge, marking a key moment for crypto investing.

We will explore this topic further and see which companies lead the ETF records list. Scroll down for more useful and updated information!

Also Read: Bitcoin Predicted To Hit An All-Time High Of $86,600: Here’s When

Bitcoin ETF Surge: BlackRock, Fidelity, and Market Implications

Record-Breaking Inflows

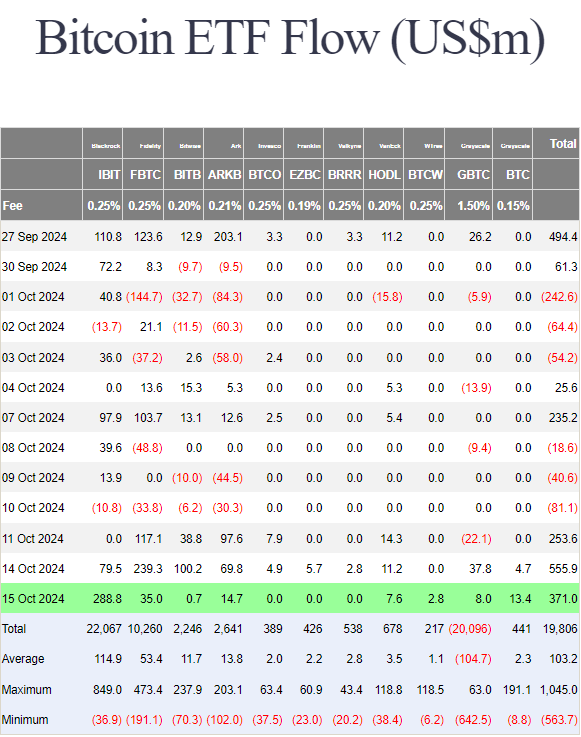

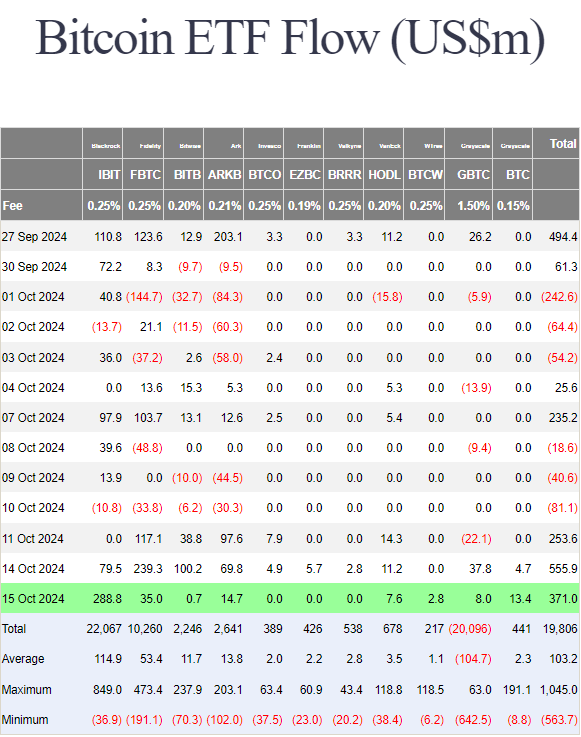

Spot Bitcoin ETFs saw some huge growth lately. Net purchases topped $1 billion in three trading days, which is an amazing amount. This shows a strong demand for Bitcoin investments, and we’re curious to see how this will evolve.

Leading Players

BlackRock’s IBIT and Fidelity’s FBTC led the pack, together drawing in about $760 million. In one day, BlackRock’s fund got over $288 million, while Fidelity’s brought in around $35 million.

Almost a month ago, this is what CoinGecko had to say on the topic:

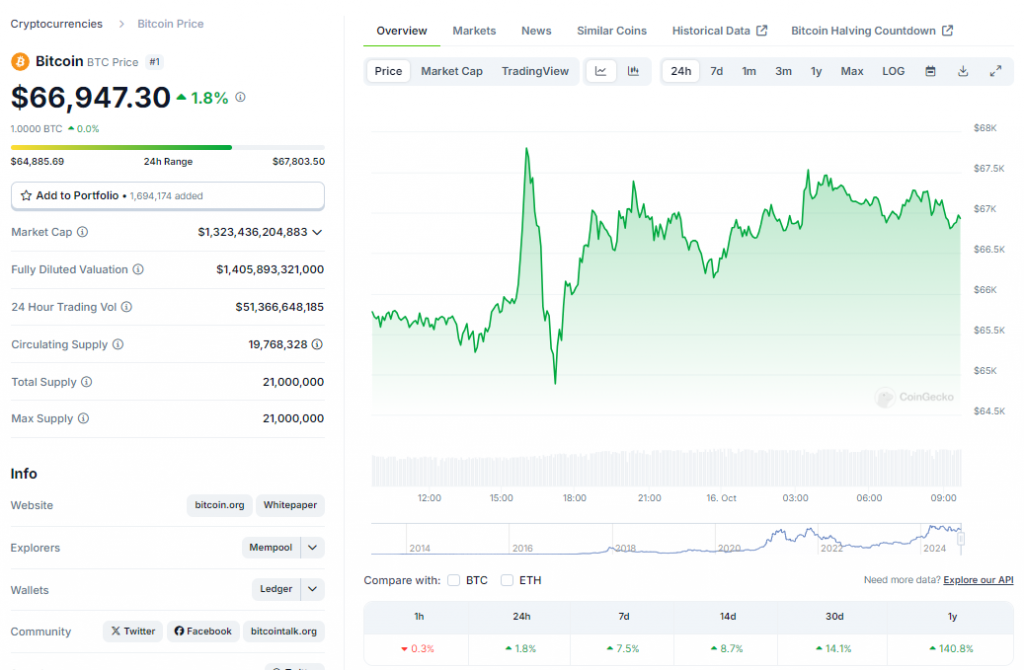

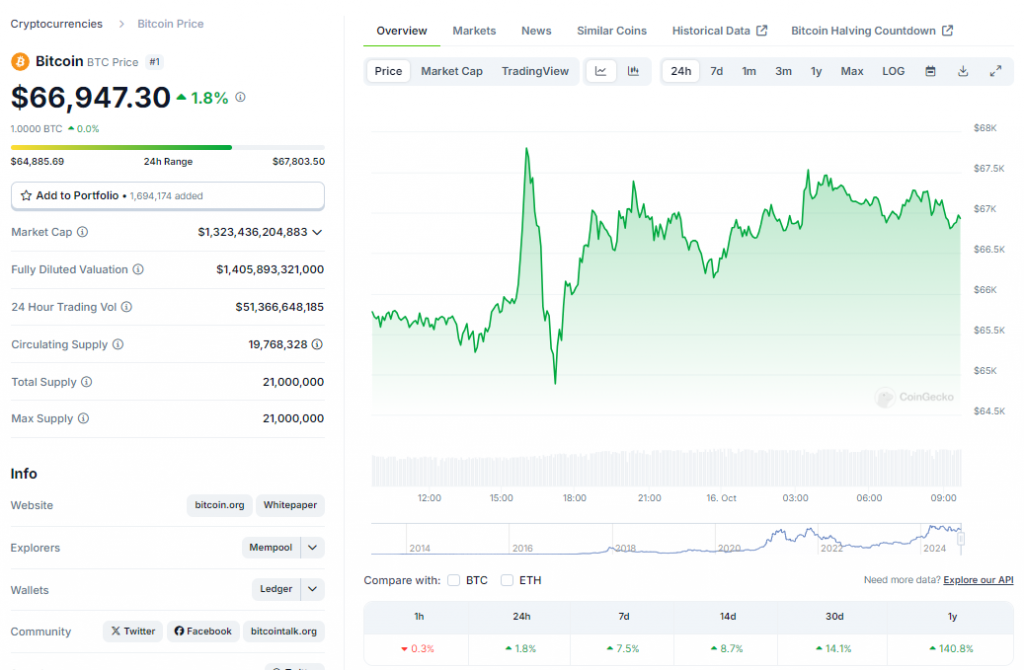

”Bitcoin surged past $62,000 following the U.S. Federal Reserve’s decision to cut interest rates by 50 basis points.”

This shows how interconnected the markets are and suggests that we can expect anything to happen in the crypto market.

Market Rally

As ETFs have grown considerably, the Bitcoin (BTC) price has risen as well. It passed the value of $65,000 on Monday and neared $68,000 by Tuesday. This rally coincided with the ETF inflows, giving it a boost in value as well.

Also Read: Traders Are Dumping Dogecoin (Doge) To Find Quick Pump Alternatives

Competitive Landscape

While BlackRock and Fidelity dominated, other funds also gained ground. Bitwise, Ark Invest/21Shares, VanEck, WisdomTree, and Grayscale all saw positive flows. Grayscale’s GBTC and BTC extended their winning streak to two days.

Future Outlook

Bitcoin is now close to its all-time high, catching the attention of market analysts. Standard Chartered predicts Bitcoin might reach its previous peak of about $73,800 before the US election. This forecast adds some more excitement around the US Bitcoin ETFs and also their potential impact on the market.

Also Read: Bitcoin Hits $67K As Tesla Moves $760 Million Bitcoin

The success of US Bitcoin ETFs indicates that cryptocurrency is becoming more mainstream, which is amazing. With major financial institutions leading the charge, the crypto market appears ready for further growth.

As investors continue investing in these new investments, the cryptocurrency landscape will likely evolve rapidly. We’ll keep you updated on the latest BTC ETF developments!