Warren Buffett, the Oracle of Omaha, has always been held in high regard in the US stock market/trading space. His portfolio is extensively tracked and followed by a majority of world investors primarily due to Buffett’s keen eye for profits and his ability to take calculated risks. Buffett has been guiding Berkshire Hathaway to new highs, all while investing in enterprises and companies that have delivered stable gains to Buffett all his life. Among all other stock preferences, Buffett’s Berkshire Hathaway has been holding onto these two stocks since 1991, showcasing the firm’s undying trust and faith in these prominent stocks. Do you own these two stocks as well?

Also Read: Apple’s Expansion in India Defies Trump: Is $250 AAPL the Next Stop?

2 Warren Buffett-Approved Stocks to Hold On To for Major Gains

1. Coca-Cola (KO)

Coca-Cola is a multinational corporation headquartered in Atlanta, Georgia, United States. The company was founded in 1892 by Asa Griggs Candler and is responsible for manufacturing and selling a variety of soft drinks, including the famous Coke. The company has recently renewed its marketing partnership with WPP Open X, amping up procedures to popularize the brand across the globe.

Coca-Cola accounts for nearly 10% of the total Berkshire Hathaway portfolio, with the firm being the largest shareholder of the beverage company.

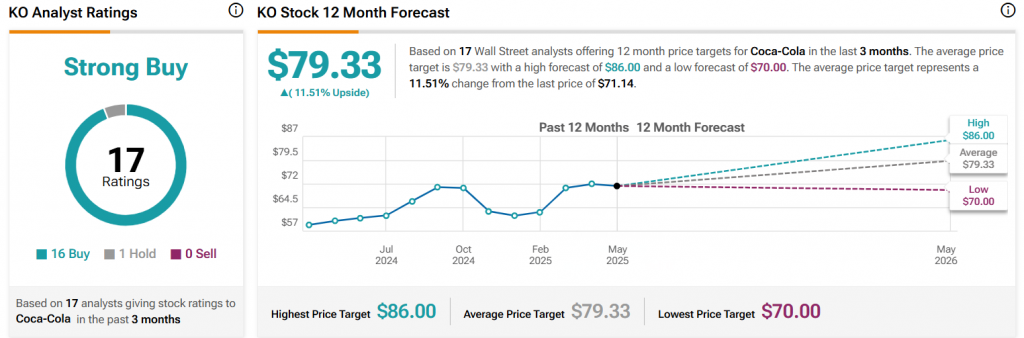

Per TipRanks, Coca-Cola is currently sitting at $71, eyeing a mild price uptick of $79 in the coming months. At the same time, the stock is also eyeing a high of $86, which it can achieve anytime in the next 12 months.

“The average price target for Coca-Cola is 79.33. This is based on 17 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $86.00, and the lowest forecast is $70.00. The average price target represents an 11.51% increase from the current price of $71.14. Coca-Cola’s analyst rating consensus is a Strong Buy. This is based on the ratings of 17 Wall Street analysts.”

Also Read: US Stock Rises 36% in a Month: It’s Not Nvidia, Microsoft, or Apple

2. American Express (AXP)

American Express is another profitable stock that Berkshire Hathaway proudly owns. The firm holds nearly a 21% stake in American Express, showcasing the undue trust that Warren Buffett has projected for more than 30 years. Buffett purchased the American stocks in 1994 in exchange for warrants from a $300 million preferred stock investment. The firm since then has been expanding its stake in the company.

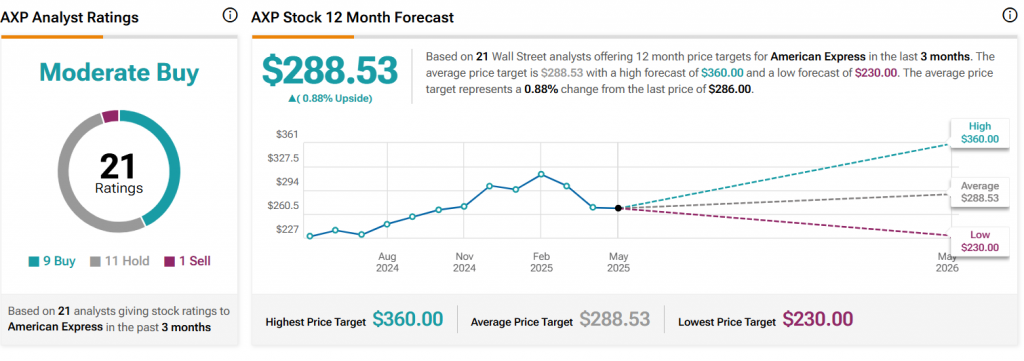

Per TipRanks, American Express stock is currently sitting at $287, eyeing the $288 short-term target. Per the portal, the stock is eyeing a new high of $360 in the next 12 months.

“The average price target for American Express Company is 288.53. This is based on 21 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $360.00, and the lowest forecast is $230.00. The average price target represents a 0.47% increase from the current price of $287.18. American Express Company’s analyst rating consensus is a Moderate Buy. This is based on the ratings of 21 Wall Street analysts.”

Also Read: US Stocks, Bonds Sink as Debt Fears Caused by Trump Persist