Trading activity on Coinbase has been noting renewed interest over the past few hours, despite the state of the market worsening. In the period from 9 to 13 June, the exchange trade volume more or less revolved around $2 billion. However, over the past day, it has slid up swiftly and was on the brink of $6 billion at press time.

The increase in Coinbase’s activity coincides with staking platform Celsius halting its withdrawals, swaps, and transfers between accounts due to “extreme market conditions.” People from the space were quick to point out how and why it’s not safe over the long run to rely on CEXes and other third parties to transact crypto. Thus, the execution of trades en masse can be speculatively attributed to the fear and uncertainty prevailing.

When zoomed out and viewed, the said rise in activity remains to be quite short of what was registered during the bull phase during the October-November period last year. So, perhaps, until winter is here, exchanges like Coinbase would find it difficult to thrive, for spikes like these ain’t essentially organic.

Bitcoin takes down Coinbase along

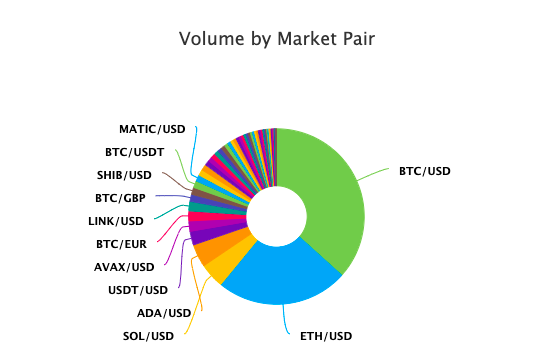

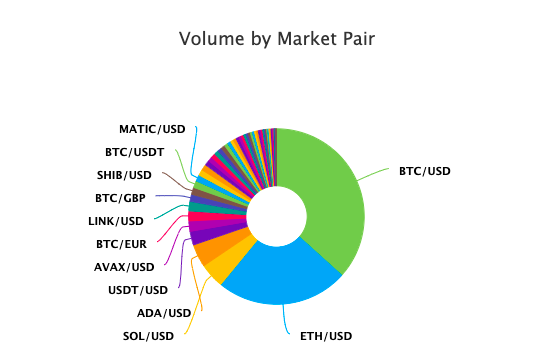

It is essential to note that Bitcoin and Ethereum account for the largest volume chunk for Coinbase [36%, and 24% respectively]. Usually, during downtrend phases, market participants tend to avoid catching the falling knife and halt their activities until the situation stabilizes.

As far as Bitcoin is concerned, there are no immediate recovery hopes and its bottom-out targets have seemingly slipped lower to the $10-$11k bracket for now. Essentially, Coinbase makes a commission when people buy and sell cryptos, and given the present state of the market and the psyche of market participants, it looks like Coinbase would continue bearing the brunt of Bitcoin’s bearishness.

Alongside, it is essential to note that the macro markets also continue to remain choppy and Coinbase shares closed 11.4% down Monday. When compared to its listing days highs, COIN is currently down by almost 90%, which ain’t a welcoming sign either.

Long-term to the rescue?

Well, bearish trends are a part and parcel of every market cycle, and more often than not, the losses incurred are made up for when the trend flips. Back last month when the exchange released its Q1 earnings, it had said,

“We believe these market conditions are not permanent and we remain focused on the long-term.”

At this stage, arguably, there’s nothing much exchanges can do other than play the long-term game, and wait for the markets to recover.