The collapse of FTX took people from the space by surprise. Given how well-established the crypto exchange was, its fall was quite unanticipated. The said event, almost single-handedly, managed to erode the trust of market participants with respect to centralized exchanges.

To rekindle hope, platforms stared publishing their proof of reserves to ensure consumers that their assets were protected. In its basic essence, PoR is a vetting technique that makes sure that crypto on exchanges has some real backing. A PoR audit confirms that custodians are holding all of the money belonging to their clients.

A plethora of exchanges including Binance, Bitfinex, Bitmex, Kraken, OKX have jumped onto the PoR bandwagon.

WazirX Joins The PoR Club

WazirX, India’s largest crypto exchange, recently made its wallet addresses and independent proof of reserves report public. The official tweet noted that the security and safety of user funds were WazirX’s “top priority.”

The thread further revealed that the exchange had sufficient reserve funds to meet users’ needs during unforeseen scenarios. In other words, it has more than a 1:1 Reserves to Liabilities ratio.

WazirX additionally pointed out,

“With this, we are not only India’s largest Crypto Exchange by Volume but also India’s largest Crypto Exchange by Reserves.“

Also Read – Crypto: These are the Biggest Proof-of-Reserve Wallets

Holdings Break Up

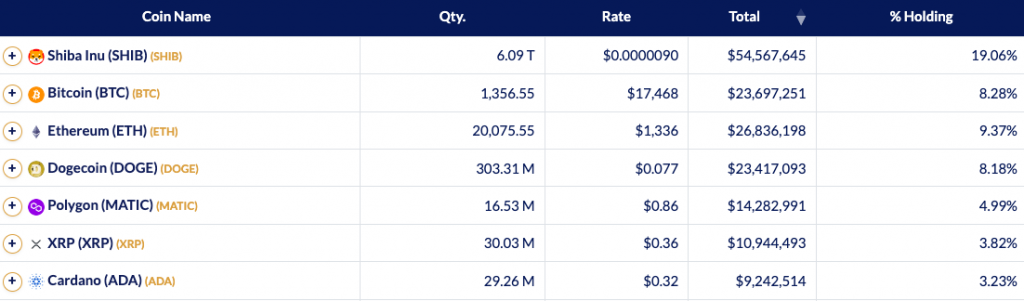

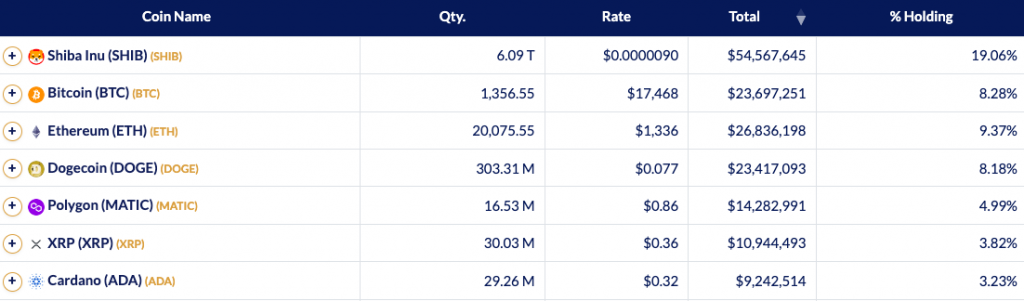

The exchange provided Coin Gabbar, a platform that tracks crypto assets, necessary information and details required to publish the report. According to the same, WazirX’s reserves are totally worth $286.27 million.

Shiba Inu accounted for the lion’s share of its holdings [19.06%]. The PoR report showed that WazirX had a total of 6.09 trillion Shiba Inu tokens worth $54.5 million. That was followed by Bitcoin and Ethereum. WazirX had 1,356 BTC and 20,075 ETH valued at $23.6 million and $26.8 million respectively.

The exchange’s holdings additionally comprised of DOGE, MATIC, XRP, and ADA among other tokens. Their proportion varied between 3% to 8%.

Also Read: Cardano’s Market Cap Surpasses $11B To Flip Dogecoin