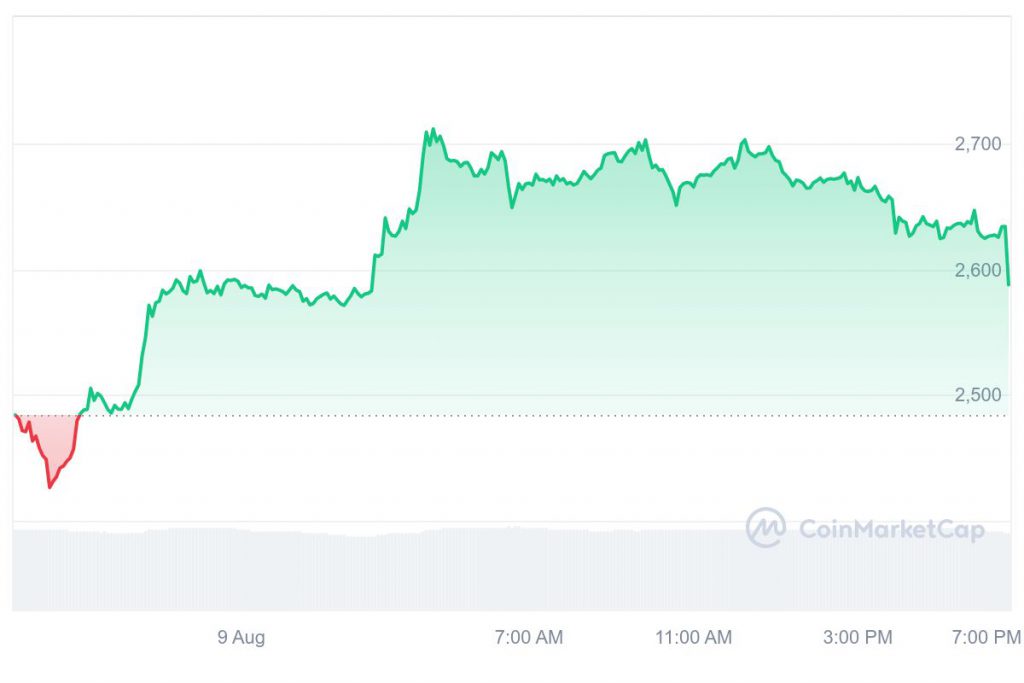

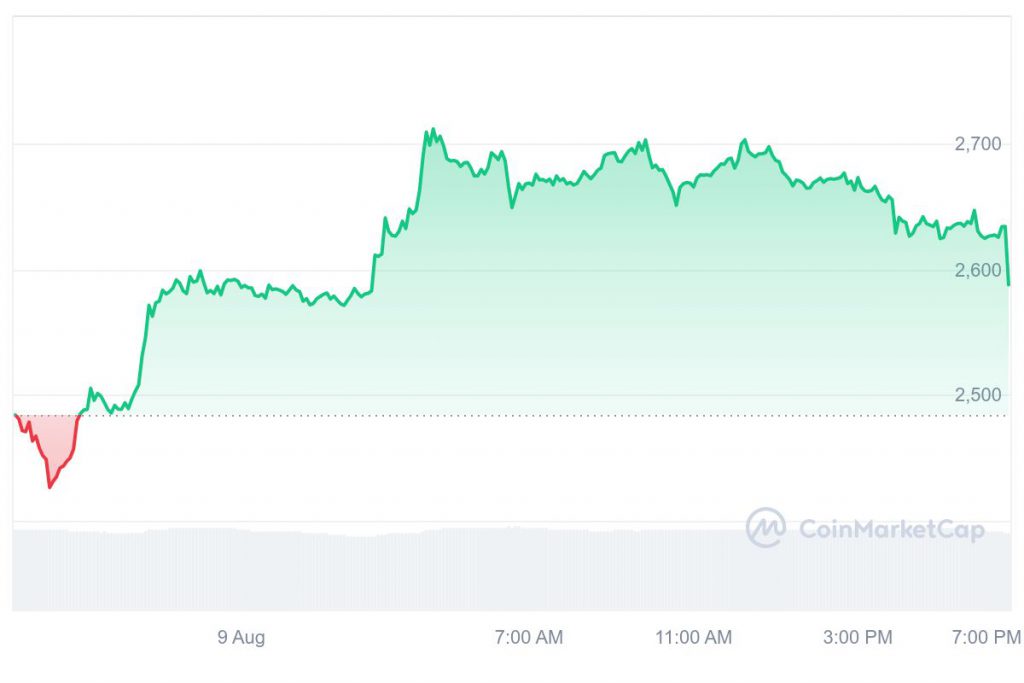

The entire cryptocurrency market was slowly recovering. But, Ethereum (ETH) was seen outshining its counterparts. Earlier today, ETH was trading at $2,426 but it went on to rise to a high of $2,711. The asset added 10% gains over the past 24 hours. At press time, the altcoin was trading at $2,630 with a 6% surge throughout the last couple of hours.

According to Coinglass data, open interest has increased by 15%. Meanwhile, volume has increased by 5% over the past 24 hours. This shows that investors are becoming more optimistic about Ethereum’s future. The latest spike in price and investor confidence comes after several analysts pointed out how ETH wasn’t living up to expectations in the current market.

Also Read: Solana: ETF Approval Drives SOL to $160 as it Outperforms Ethereum

Ethereum Turns Inflationary

In 2024, the Ethereum network experienced inflation for the first time since 2022. Despite burning 465,657 ETH since the year began, the network has increased its supply by a net total of 75,301 ETH. Q2 2024 saw the change from a deflationary to an inflationary environment due to a decrease in network activity. This quarter, 120,818 ETH were added to the blockchain as a result of 228,543 ETH being emitted compared to 107,725 ETH burned.

This came as a shock to many considering the hype around Ethereum exchange-traded funds (ETF). According to data from Farside Investors, net outflows from Ethereum ETFs on Aug. 8 amounted to just $2.9 million. While Fidelity’s FETH experienced its first day of outflows since launch, Grayscale’s Ethereum Trust (ETHE) saw a slowdown in outflows to $19.8 million. Speaking about the same, Crypto Kaleo, an analyst said,

“There was too much hype about the potential for what this ETF would immediately do for the price—now, there’s too much FUD.”

Also Read: BlackRock’s Ethereum ETF Witnesses $900 Million Inflows