Back in Q4 last year, the world’s largest digital asset manager, Grayscale, filed to convert its flagship Bitcoin Trust [GBTC] into an ETF. Back then, the news came at a time when the SEC had given a green flag to the first-ever US-based Bitcoin Futures ETF [ProShares’ BITO].

Earlier this year, the regulatory agency opened its doors for community comments and feedback on the same. Unsurprisingly, a majority of them [close to 95%] were in favor of Grayscale’s proposal.

Since then, there has hardly been any progress made by the SEC on this front. In what is the latest development, Grayscale’s CEO, Michael Sonnenshein, said the firm is gearing up for a legal fight if Grayscale’s Bitcoin Spot ETF product is denied by the SEC.

All options on the table

In a recent Bloomberg interview, Sonnenshein was asked if he would consider the Administrative Procedure Act (APA) lawsuit option if the application for its Bitcoin Spot ETF was denied by the financial regulator. Asserting the importance of continuing to advocate for investors, he responded,

“I think all options are on the table come July.”

Notably, the next decision date for the approval or denial of the investment product on 6 July this year. The SEC’s decision was previously delayed in February.

“The Grayscale team has been putting the full resources of our firm behind converting GBTC, our flagship fund, into an ETF. It’s really important that investors know that we have and will continue to advocate for them.”

Sonnenshein also stressed on the fact that GBTC is owned by investors in all 50 states, and over 800,000 accounts in the US are all “waiting patiently” to have it converted into an ETF. He went on to add,

“GBTC today has been traded since 2015 and it’s been an SEC-reporting company since January of 2020, so every single day that it is trading and being bought and sold by investors and is not being folded into the familiarity and the protections of an ETF wrapper, we really don’t feel that the SEC is doing everything they can to actually protect investors.”

State of Grayscale’s Bitcoin Trust

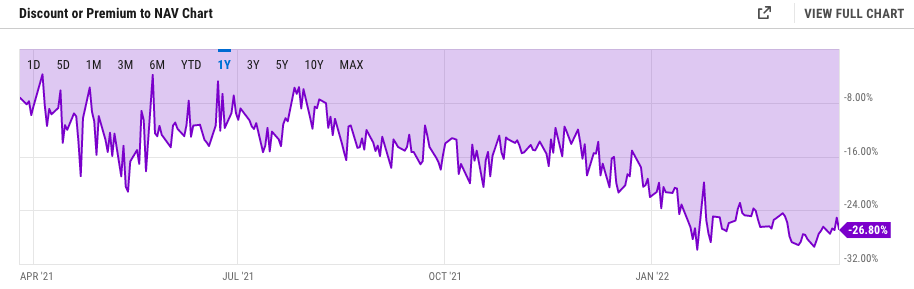

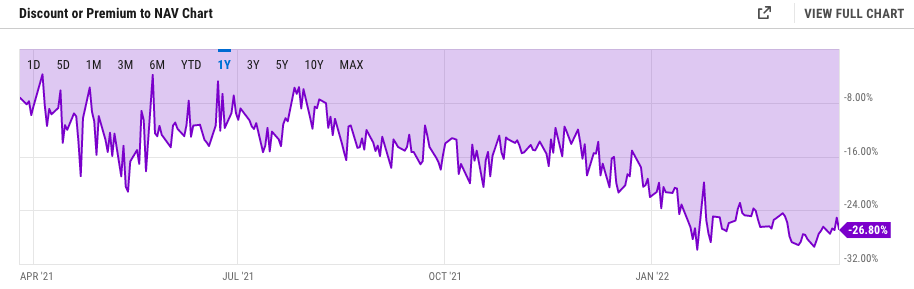

Despite Bitcoin rallying over the last few days, GBTC shares haven’t been able to catch up. They continue to trade at a discount. In fact, at press time, the gap was as wide as 27%.

In an op-ed piece written towards the end of February, it was highlighted how the conversion could actually reverse the tides back in Grayscale’s favor. Reflecting the same thought, Sonnenshein said that the NAV and price of the fund should converge when the fund is eventually converted.

In fact, per community reactions on Twitter, the SEC not being on its heels and the fund not performing, in conjunction with the community interest, have all together propelled Grayscale’s ‘lawsuit’ thought.

Sonnenshein concluded,

“It’s a matter of when, not a matter of if, a spot Bitcoin ETF is approved.”