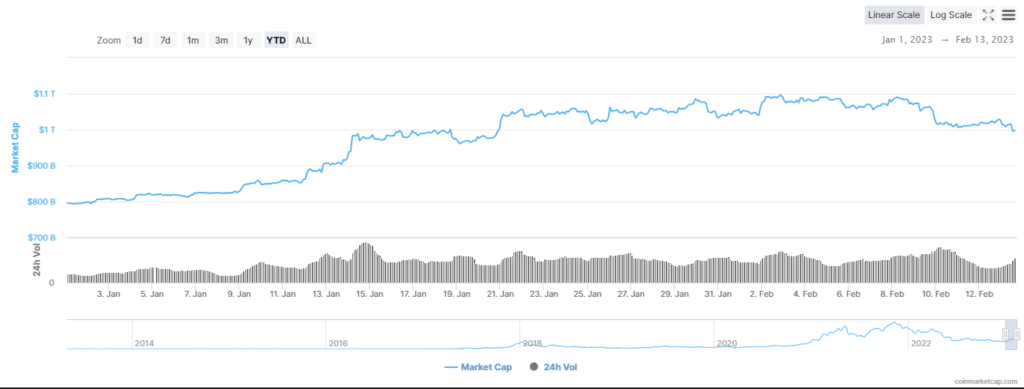

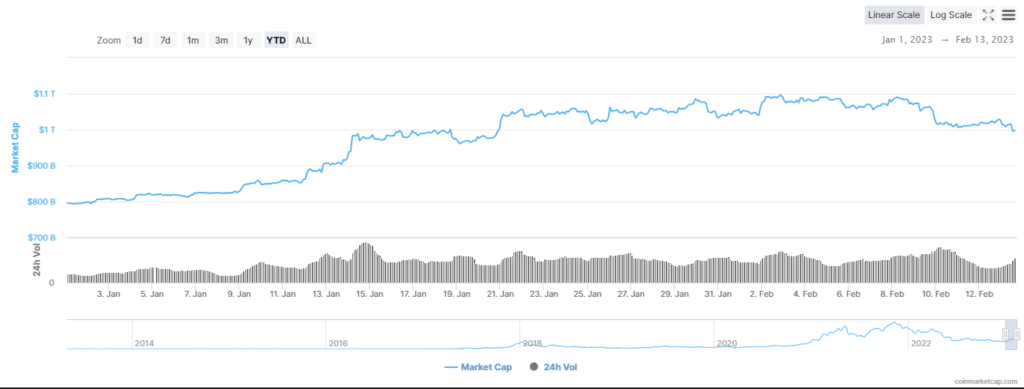

The year started with an abundance of positivity, with cryptos across the board bouncing back from a horrendous 2022. Now, as companies face the uncertainties of regulation and a plummeting market cap, will institutions still enter crypto with a global value falling below $1 trillion?

The past two weeks have seen a plethora of crypto companies come under regulatory fire. Agencies are seeking to tighten the ship. This is not surprising considering the controversy that abounded last year. Yet, that development has impacted the industry’s market cap, and that could have an important effect in the coming years.

What Happened?

The year 2022 will forever be remembered as one of the worse years the crypto industry had ever seen. Plummeting prices and bankruptcies abounding, it seemed to be the year-long “crypto winter” that wouldn’t cease.

Yet, when January arrived, the new year brought forth new optimism. Prices bounced back, and Bitcoin reached the illustrious $23,000 that seemed so impossible just months prior. Moreover, the entire industry seemed to be back on track, with a clear direction toward more prosperous times.

Although that positivity is certainly still warranted, the crypto global value has fallen below $1 trillion. Specifically, the market cap for the industry has reached $99.7.98 billion, following a peak of $1.028 trillion in just 24 hours.

The reason for the fall was undoubtedly regulatory concerns. As seems par for the course, the industry’s progression is nearly always halted by certain regulatory actions. In recent weeks, as Kraken ends its staking service following the SEC settlement, and stablecoin issuer Paxos is in the midst of a lawsuit involving Binance, the industry is in a state of worry.

The impact is already seen in the response to SEC action. PayPal has paused its stablecoin development due to regulatory concerns. Collaborating with Paxos, the company has now unintentionally been embroiled in a regulatory battle that has seen it reassess the direction of the industry as a whole.

SEC head Gary Gensler has issued a clear warning to the industry of his incoming action, having affected its overall value. Not to mention — the war on staking and crypto lawsuits arriving amidst microeconomic factors, like inflation, is undoubtedly affecting every industry across the board.

Why it Matters

The global crypto market cap is undeniably an important facet of the industry. More than anything, it is vital in what it means for the industry’s future. Specifically, in the kinds of investing that enters into the space.

Finbold notes that the $1 trillion mark has always been considered a “critical psychological level,” for investors. More importantly, for the ability to attract institutional investors, who thus pump the industry with more capital, to create more technological innovation in Web3 and blockchain services.

Falling below that $1 trillion mark starts to scare off those potential institution players. Thus, it limits the kind of funding the industry sees throughout the year. Thereafter, this could have an impact on the potential progression of the industry in the coming years.

It has been previously reported that a massive 92% of “high net worth investors,” seek to enter the digital asset space. Conversely, the question becomes, how do they feel as the crypto global value continues to fall, and plummets below $1 trillion? As the market moves, whether or not institutional investment continues upward is a narrative worth observing.