The entire community had high hopes for Bitcoin [BTC]. The world’s largest cryptocurrency was finally on its way to recovery. As the asset was trying to reach towards $25K, it encountered major hurdles. Earlier today, BTC dipped to a low of $21,539.39 after its recent rally to a 90-day high of $24,167.21. Several believe that the king coin could prolong this notion and have a bloody Valentine’s day. But here’s how artificial intelligence networks expect BTC to move on Tuesday.

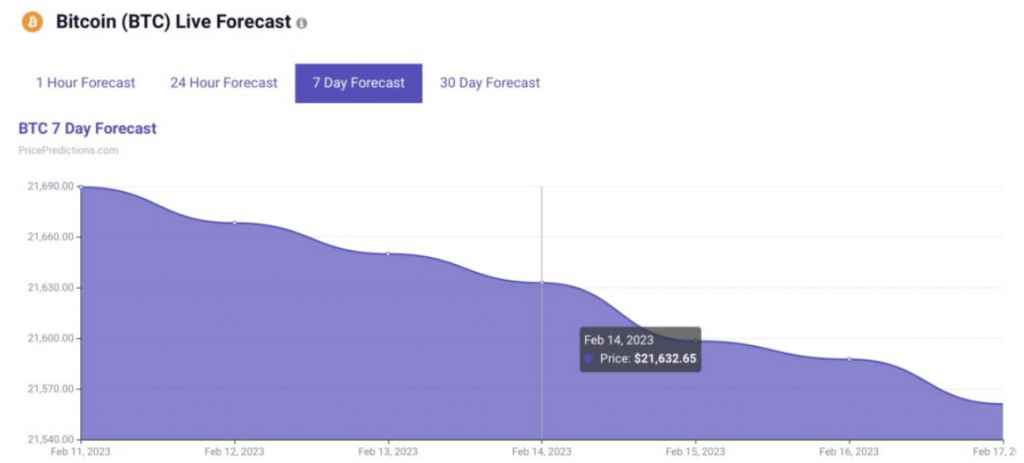

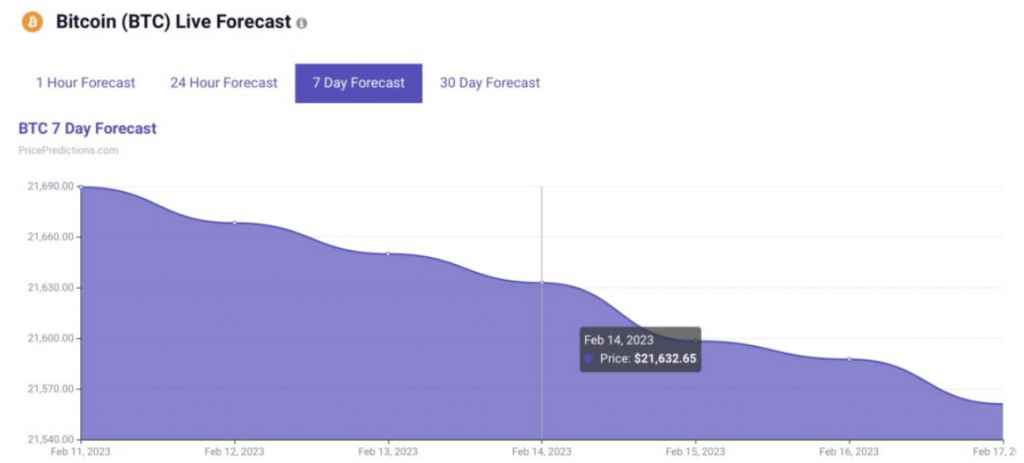

According to PricePredictions, a prominent crypto monitoring firm that employs machine learning algorithms, BTC will linger around its current zone. The platform believes that Bitcoin will trade for $21,632 on Feb.14.

It should be noted that PricePredictions employs an array of indicators to predict the price of Bitcoin. The platform uses indicators like MACD, moving averages, Bollinger Bands, Relative Strength Index, and others.

In addition to this, the machine-learning algorithm believes that it is going to be a bearish week for Bitcoin. The firm wrote,

“Based on our Bitcoin technical analysis, we are noticing a bearish trend in the long term, as such, we predict that the price of Bitcoin will decrease by $33.58 over the next 7 days, reaching $21,661.40 by 20th February 2023.”

Amidst its latest price change, Bitcoin remains 68.33% below its all-time high of $68,789.63. This high was achieved back in Nov. 2021.

Bitcoin holders continue to bag profits despite plummet

Fear was instilled in the cryptocurrency community as Bitcoin sunk. Even though the asset encountered a drop, the percentage of holders making money at the moment remained high. According to Into the Block, a whopping 63% of BTC holders were pocketing profits. A dainty 34% were enduring losses.

If Bitcoin manages to move upwards from its current price level, BTC holders might garner more gains. If it prolongs its corrective phase the asset’s holders might be in trouble.