The Federal Reserve of the United States has been prepping for the Federal Open Market Committee or the FOMC meeting for quite some time now. The meeting is scheduled to be held later today. During this meeting, analysts expect to witness an interest rate hike of 75 basis points [BPS] or 0.75 percent. The chances of a lower hike than 75bps were highly unlikely.

According to Arcane Research, only 14% of the probability was leaning toward a 50bps hike while 86 percent predicted a 75bps hike. With 75bps as the most likely outcome of the FOMC meeting, volatility was bound to follow.

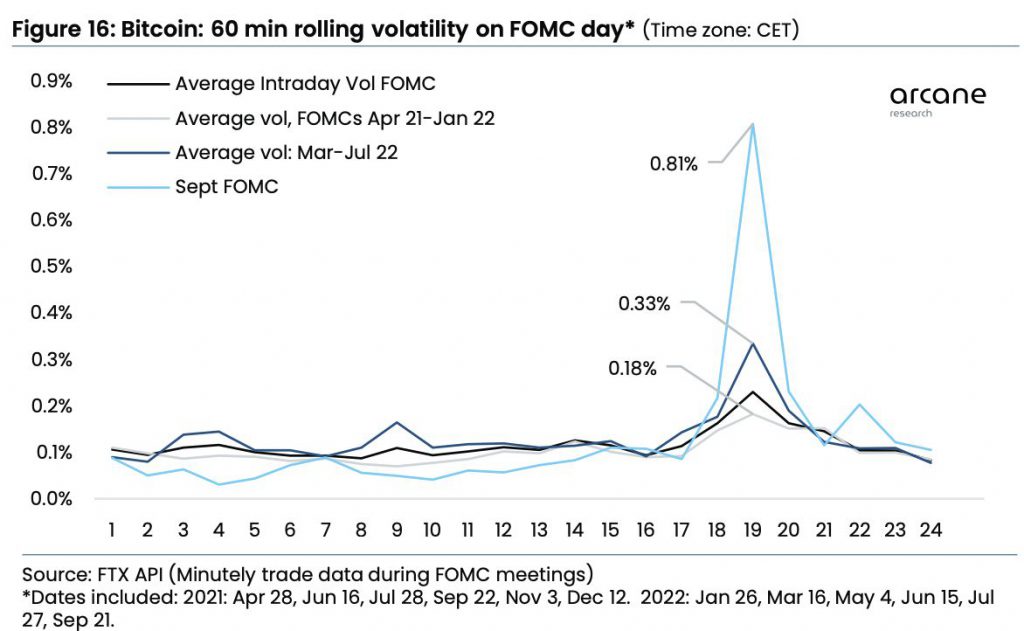

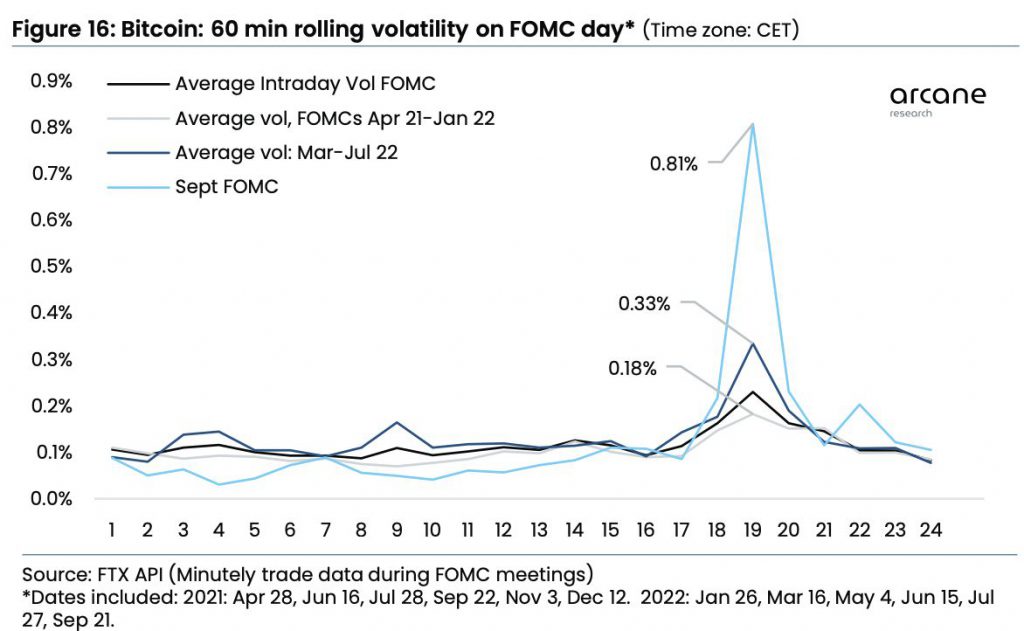

Volatility has witnessed a spike amidst FOMC meetings. Veering back to September, during the meeting, Bitcoin [BTC] witnessed price changes of around 0.81 percent. But previous changes in price during the FOMC meetings were limited to 0.18 percent. Therefore, speculations about possible fluctuations in the price of Bitcoin were foreseen.

Here’s what happened post-FOMC in September

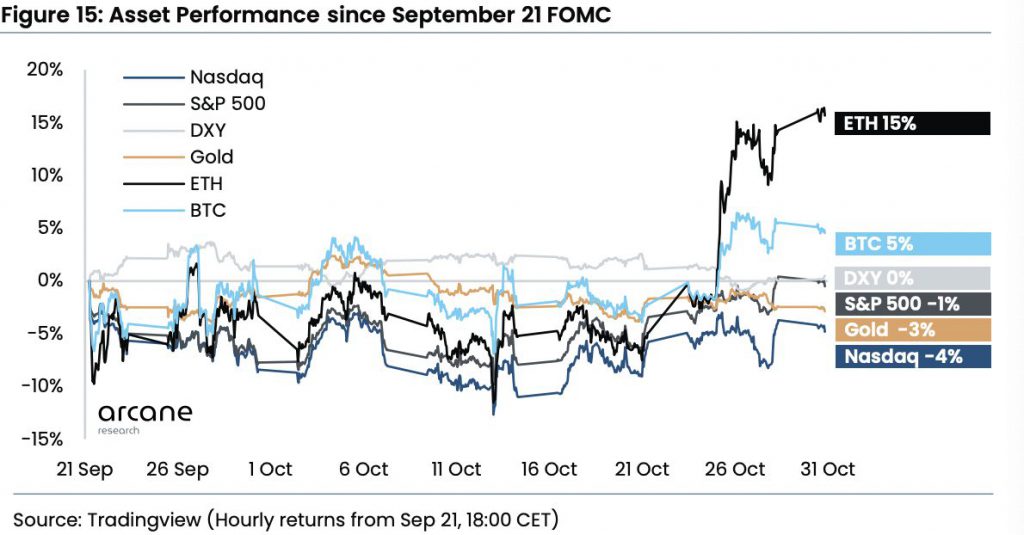

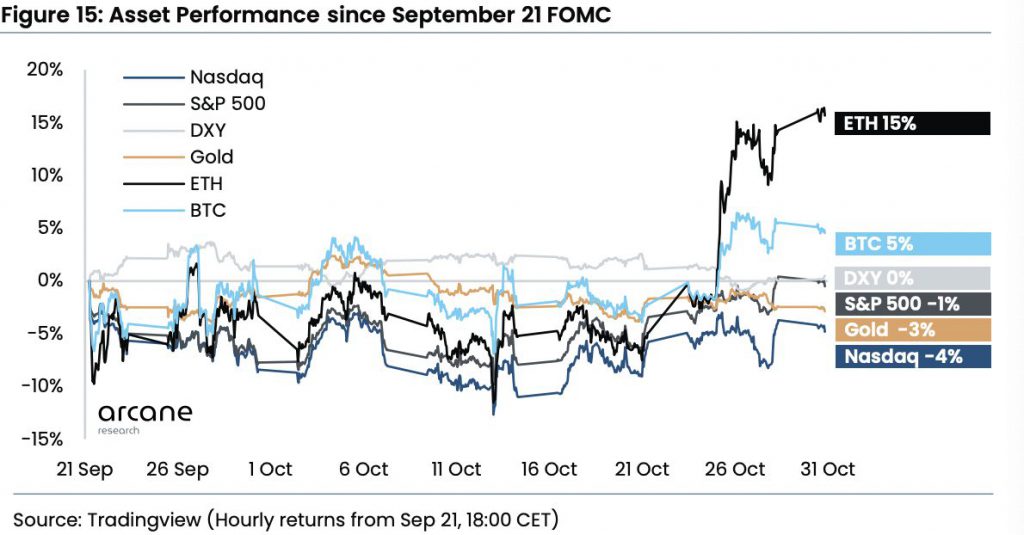

As per the recent report, right after the previous FOMC meeting that took place in September, crypto has outperformed traditional financial markets. Two of the biggest cryptocurrencies Bitcoin as well as Ethereum [ETH] witnessed immense selling pressure right after the FOMC. This, however, was short-lived. In addition to this, the markets reportedly recovered.

As seen in the above image, gold, as well as equity indexes, were recording a drop. Crypto, however, has witnessed a surge ever since. Bitcoin rose by 5 percent while Ethereum jumped by nearly 15 percent following the previous FOMC meeting.

Ahead of the meeting, Bitcoin was trading for $20,400 with a 1.13 percent daily drop. Ethereum, on the other hand, was more volatile as it was dipping by 3.61 percent and was trading for $1,546.73.

While the volatility had started to kick in, the FOMC meeting could instigate more fluctuations in price.